Anti-Money Laundering (AML) processes are essential to conducting any business. Although regulated industries do not encompass every company out there, AML procedures should be standard practice in today’s market. As regulatory bodies require companies to perform extensive data analysis of potential clients, it’s best to look at them separately to understand the significance and impact of each step. Among many others, one of the measures for combating financial fraud is adverse media screening which we will be taking a closer look at today.

What Is Adverse Media Screening?

Adverse media screening, also known as media monitoring or negative news screening, involves looking for negative news about a natural or legal person in news sources. This check is incredibly significant in the Customer Due Diligence (CDD) process, which is an essential aspect of KYC, KYB, and AML procedures. It allows companies to identify risks, find out about financial crimes a potential client may be involved with and recognize high-risk clients.

Adverse media can come from a variety of different sources. Traditional media, such as newspapers and magazines (both print and online), as well as television and radio, are the most common sources. However, negative media can also emerge from a variety of other sources. Online blogs and social media platforms, for example, include plenty of essential information.

Why Should Companies Implement Adverse Media Screening?

An effective adverse media screening is one of the most important components of a strong AML strategy required by regulators. A check can determine your client’s or business partner’s reputation and easily identify potential risks.

The media is one of the fastest ways to acquire information about financial crime. Law enforcement and journalists conduct investigations to determine the criminal activities of individuals and organizations, concluding their findings with press releases or news articles. That is why, before beginning relationships with new clients, you should perform adverse media checks to determine whether they are involved in money laundering, terror funding, financial crime, or other criminal behavior.

Since most regulators demand a risk-based approach to compliance, the adverse media screening process can help implement a robust risk management strategy. If a check yields no findings, the client should be assigned a low-risk score. However, if a negative news piece surfaces, a client should be flagged as high-risk. In this instance, an obligated organization should either initiate an enhanced due diligence process that involves ongoing monitoring or completely cut ties with the individual.

It is apparent that adverse media checks can be beneficial to any organization that wants to know who they can trust. However, regulated industries, such as financial institutions, are obliged to perform these checks routinely.

While negative news screening may be useful to any company that wants to know who they can trust, screening is a must for regulated industries. Failing to establish a client’s risk factors correctly may have legal consequences. On average, financial institutions spend $14.82 million annually on AML violations. While the staggering financial loss is penalty enough, institutions also face reputational risks, often leading to lost clients.

The Most Common Negative Media Challenges

Like any other AML-related process, adverse media screening doesn’t come without challenges. Due to its complexity, many regulated organizations struggle to make screening efficient.

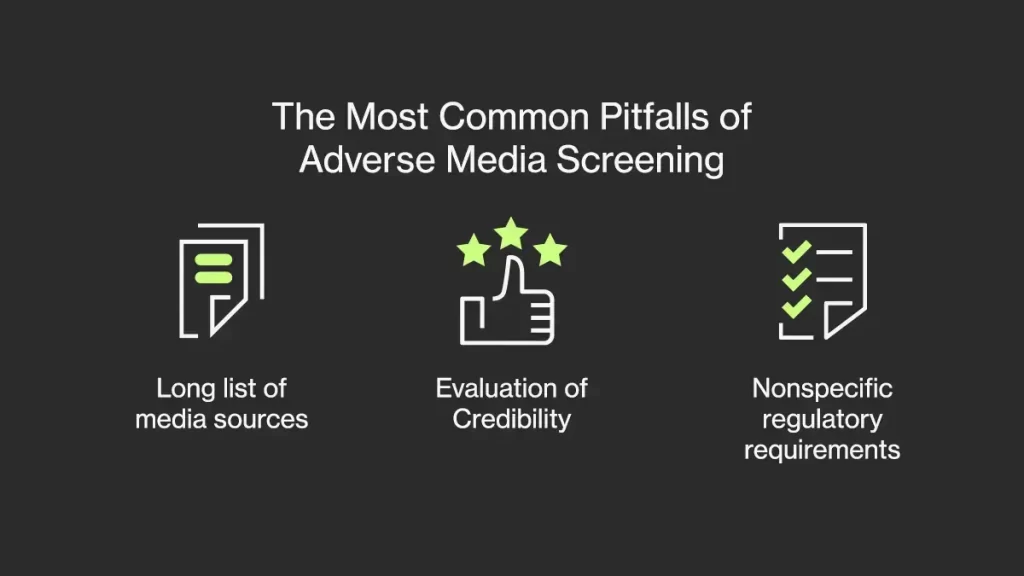

These are the most common pitfalls of adverse media screening:

Long list of media sources

A large variety of news sources need to be checked for the most reliable and accurate information. From press releases published by law enforcement agencies to daily news sites – the number of relevant sources can be overwhelming. Many of them are also in different languages, which makes going through all of them, even with good translators, extremely time-consuming.

Evaluation of credibility

A large number of media channels poses another challenge – assessing credibility. Ensuring that a source is credible and doesn’t include fake news adds more weight to an already heavily tasked process.

Nonspecific regulatory requirements

While adverse media searches are compulsory in many regulatory environments, such as the European Union, they are not well specified. The lack of requirements leaves obligated industries puzzled about how to implement adverse media screening correctly and ensure its effectiveness.

Why Should You Automate Adverse Media Screening?

In the digital age, manual data gathering and analysis are simply ineffective. Organizations that still analyze adverse media information by hand are losing many resources that can be saved by adopting automation.

Compliance solutions that include adverse media screening, such as Ondato, can reduce the time and expense required to assess a client’s reputation. With our AI-powered system, all information is easily accessible. Every day, Ondato’s adverse media screening tool checks approximately 6.5 million news articles. It delivers accurate, trustworthy, and up-to-date information.