With digital transactions and online interactions becoming increasingly common, traditional processes face the challenge of keeping pace with the speed and convenience that consumers demand. One such area undergoing a transformative shift is the Know Your Customer (KYC) process, with Electronic KYC (eKYC) bringing a new era of efficiency and security.

What Is eKYC?

eKYC, or electronic Know Your Customer, is a fully digital approach to online identity verification. It replaces the traditional, paper-based KYC process with a faster, more secure, and more user-friendly alternative that eliminates the need for physical documents, in-person visits, and manual checks.

Designed to streamline digital onboarding, eKYC enables businesses, particularly in finance, telecom, and other regulated industries, to validate customer identities remotely using technologies like biometric recognition, real-time scanning of identity documents using optical character recognition technology, and data cross-checking with official sources. Beyond improving speed and convenience, eKYC enhances security, reduces human error, and ensures compliance with global regulatory standards such as AML and GDPR.

How does eKYC Work?

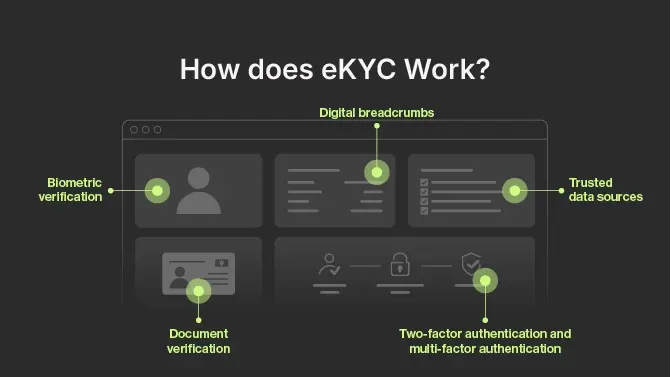

The implementation of eKYC encompasses various methods and technologies, including:

Biometric verification: Utilising biometric data such as facial recognition or voice recognition offers convenience to customers and the most accurate verification results. Most smartphones, equipped with high-quality cameras, eliminate the necessity for additional equipment.

Document verification: Digital submission of official documents like passports, birth certificates, and proof of address can be achieved through a smartphone camera. Facial recognition software can then verify that the customer’s selfie aligns with their photo ID.

Two-factor authentication and multi-factor authentication: This security layer requires customers to verify transactions using a second hardware token or across multiple accessible channels, reducing the risk of identity fraud.

Digital breadcrumbs: Characteristic identifiers, known as digital breadcrumbs, arise from an individual’s online meta-information, including IP address, browser settings, email address, and typing speed. These can aid in fraud prevention during online identity verification.

Trusted data sources: eKYC identity verification can automatically cross-check individuals or entities against government registries, databases, whitelists, and official sanction lists.

eKYC vs Traditional KYC

While both electronic Know Your Customer (eKYC) and traditional KYC processes focus on customer verification to ensure compliance with legal and regulatory standards, the methods they use are fundamentally different, especially in terms of speed, user experience, and scalability.

Traditional KYC: Manual, Slow, and Resource-Heavy

Traditional KYC relies heavily on manual workflows. Customers are typically required to visit a physical branch, bring paper documents like passports or utility bills, and wait for human agents to verify their details. This can involve multiple appointments, photocopying, physical signatures, and days — sometimes weeks — of waiting for approval.

Example:

A customer opening a bank account might have to schedule a visit to the branch, bring a printed ID and proof of address, fill out forms, and then wait for the back-office team to validate their information before the account is activated.

This process is not only time-consuming and prone to human error, but also costly for businesses. It requires administrative staff, physical storage for paperwork, and face-to-face infrastructure — all of which limit scalability and operational agility.

eKYC: Fast, Digital, and Scalable

eKYC digitizes the entire verification process, allowing customers to complete onboarding anytime, anywhere — usually through a smartphone or computer. Instead of handing over paper documents, users upload scans or photos of their ID, which are then validated in real time using biometric verification (e.g., facial recognition or liveness checks), trusted data sources, and automated validation algorithms.

Example:

A fintech app user can complete onboarding in under two minutes by taking a selfie, scanning their passport, and confirming a code sent to their email. The system automatically checks the identity data against government databases and confirms a match — all without human intervention.

This modern approach drastically reduces turnaround times, enhances the accuracy of checks, and minimizes the risk of fraud by using biometric data and digital signals like IP address or typing patterns. It also supports large-scale remote onboarding, making it ideal for digital-first financial institutions, online marketplaces, and global service providers.

Key Differences at a Glance

| Feature | Traditional KYC | eKYC |

| Process Type | Manual & paper-based | Fully digital & automated |

| Verification Time | Days or weeks | Minutes (or under 30 seconds with Ondato) |

| Customer Experience | Inconvenient & time-consuming | Remote, seamless, and fast |

| Risk of Human Error | High | Low (AI-driven validation) |

| Fraud Prevention | Limited tools | Biometric verification, real-time validation |

| Scalability | Resource-heavy | Easily scalable across regions |

| Compliance | Manual record-keeping | Built-in regulatory checks and reporting |

By comparing the two approaches, it’s clear that eKYC is the future of identity verification. As customers increasingly demand fast, secure, and mobile-friendly services, and as regulatory pressures intensify globally, businesses must move toward digital verification tools. eKYC not only helps organizations comply with AML, GDPR, and KYC rules but also delivers a smoother experience that builds trust and drives growth.

Where Is eKYC Used?

eKYC is increasingly adopted across a wide range of industries where secure and efficient identity verification is essential. While its roots lie in financial services, its applications now extend far beyond banking.

Key industries using eKYC include:

Banking and Fintech: To onboard new customers, verify account holders, and comply with anti-money laundering (AML) regulations.

Telecommunications: For SIM card registration and user authentication, often mandated by government regulations.

Insurance: To streamline policy issuance, claims processing, as well as identity theft and fraud prevention.

Healthcare: For verifying patients’ identities during telemedicine sessions or while accessing digital health records.

E-commerce and Online Marketplaces: To ensure seller and buyer legitimacy and reduce the risk of fraudulent transactions.

Real Estate and Property Rentals: For tenant verification and digital contract signing processes.

Government and Public Sector: In national ID programs, voter registration, and digital service portals.

As digital transformation accelerates, eKYC continues to become a critical component in any sector that requires trust, security, and compliance in remote interactions.

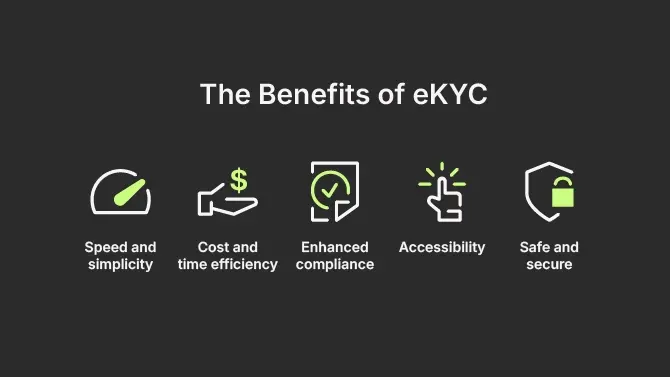

The Benefits of eKYC

Traditional KYC processes often involve friction-heavy steps like physical document collection, in-person verification, and manual data entry. These outdated methods are not only time-consuming but also prone to delays, errors, and compliance risks — all of which create barriers for both businesses and customers in an increasingly digital world.

eKYC addresses these pain points with a fully digital, secure, and scalable approach to identity verification. Its advantages span operational efficiency, user experience, fraud prevention, and compliance.

Speed and Simplicity

eKYC dramatically accelerates the identity verification process. Instead of waiting days or even weeks for manual checks, customers can complete verification in a matter of minutes (or under 30 seconds with Ondato’s system). This speed improves onboarding conversion rates and reduces drop-offs, helping businesses retain more users at the crucial first interaction.

Cost and Time Efficiency

Automating KYC processes means fewer manual tasks, less reliance on physical infrastructure, and a lower administrative burden. Businesses save money by reducing document handling, physical storage, and staffing needs — while customers enjoy a smoother, low-effort experience that respects their time.

Enhanced Compliance

eKYC isn’t just faster — it’s smarter. Businesses can meet and often exceed global compliance requirements like AML (Anti-Money Laundering), GDPR, and evolving KYC regulations. Real-time checks against government registries, watchlists, and databases, along with ongoing monitoring, ensure that businesses stay compliant across jurisdictions and reduce regulatory risk.

Prevention of Identity Fraud

By combining biometric authentication (like facial recognition), liveness detection, and real-time data validation, eKYC minimizes exposure to fraud. It detects spoofing attempts, altered documents, and identity theft with high accuracy, protecting both businesses and their customers from costly fraud incidents.

24/7 Accessibility

Unlike traditional KYC workflows that depend on physical offices and working hours, eKYC systems operate continuously. Customers can complete identity verification at any time, from any location, using just a smartphone — making onboarding truly global and on-demand.

Large-Scale Remote Onboarding

Whether you’re onboarding 100 users or 100,000, eKYC scales effortlessly. This is especially valuable for rapidly growing companies, multinational businesses, or digital platforms with high user volumes. It ensures consistent verification quality while maintaining speed and compliance.

Security and Privacy

eKYC systems employ strong encryption, secure storage, and access control mechanisms to protect sensitive data. Unlike paper-based systems that are vulnerable to loss, theft, or mishandling, digital records offer enhanced integrity, traceability, and auditability — reducing the risk of data breaches and compliance violations.

Reduced Paperwork and Admin Burden

Shifting to digital verification removes the need for physical forms, manual filing, and time-intensive reviews. This not only lowers costs but also simplifies internal workflows, improves audit readiness, and enhances data management practices across the organization.

Seamless Integration

Modern eKYC platforms can be easily integrated via API with CRMs, customer portals, banking systems, and more. This flexibility ensures that identity verification becomes part of a larger automated workflow, enabling real-time decision-making and unified customer experiences without disrupting existing infrastructure.

By eliminating inefficiencies and replacing legacy systems with automated, intelligent verification tools, eKYC empowers businesses to onboard faster, operate smarter, and grow securely. It’s not just a compliance tool — it’s a competitive advantage in the digital era.

Last Thoughts

As digital demands rise, eKYC offers a faster, safer, and more compliant alternative to outdated manual processes. It enables real-time verification, prevents fraud, ensures global regulatory compliance, and scales effortlessly for remote onboarding. For businesses aiming to grow and stay secure in the digital age, eKYC is no longer optional — it’s essential.