Enhanced due diligence (EDD) is a risk-based approach to customer identification. EDD is an element of the Know Your Customer (KYC) process, which ensures that customers are not involved in money laundering, terrorist financing, or other forms of financial crime.

Types of Due Diligence Procedures

Typically, enhanced due diligence is performed after the customer due diligence process (CDD) and simplified due diligence (SDD). While the procedures have several similarities, each regulatory procedure has a different customer risk profile.

Let’s look through all the due diligence processes and compare their risk categories.

Low-Risk Category: Simplified Due Diligence

As defined by anti-money laundering (AML) laws, SDD is the minimum level of examination required to be performed on a new customer. It can be implemented when there are lesser known risk factors for financial crime, such as money laundering.

The SDD procedure is much quicker and easier than other risk management procedures. However, it doesn’t skip the most common parts of due diligence; instead, it only applies them to a lesser extent.

Medium Risk Category: Customer Due Diligence

CDD is the standard and most common AML compliance procedure. Financial institutions and other regulated industries are required by law to complete a customer due diligence process. It involves gathering and analyzing identifying information about the customer to assess their risk score.

High Risk Category: Enhanced Due Diligence

Even though some companies choose to forgo other diligence processes and implement the EDD from the start, it is typically applied when dealing with a high risk customer. Enhanced due diligence is a much more extensive and complex process that can efficiently uncover and stop financial crimes in their tracks.

Ongoing Monitoring

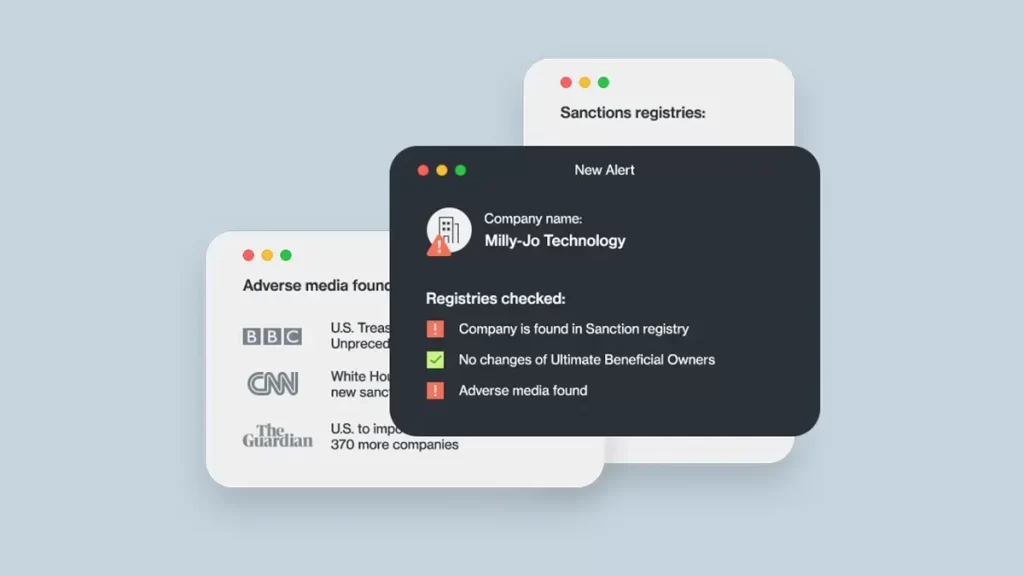

AML compliance requires all of the due diligence processes to include ongoing monitoring. Ongoing monitoring is an efficient, risk-based strategy that ensures AML compliance throughout the client lifecycle. Some of the important changes that must be monitored are the document’s expiration, new address, surname, sanctions, or PEP status alerts.

Why Is Enhanced Due Diligence Important?

Enhanced due diligence is a way of ensuring AML compliance, which is particularly important when it comes to the financial services industry. EDD will help an organization avoid fines and other penalties associated with non-compliance. It will also help avoid reputational damage as well as being held liable for any problems that arise from your customers’ behavior.

The best way to ensure that you have effective enhanced due diligence procedures in place is by creating policies, procedures, and controls for conducting enhanced due diligence on your customers. You should also provide training so that staff who are responsible for conducting enhanced due diligence understand what they need to look out for.

When to Perform the EDD Process?

Enhanced due diligence is a more rigorous version of standard due diligence, which is performed for all higher-risk customers and partners. Enhanced due diligence focuses on the specific risks associated with the relationship, such as reputational risk, operational risk, compliance risk, and financial risk.

EDD is essential in onboarding high-risk customers. However, the process is also used to minimize the risk of an existing relationship. For example, it’s important to know if a person or their family member has become a politically exposed person after onboarding.

Additionally, EDD can be triggered by geographical risk factors such as connections with high-risk countries. Relationships with greater risk industries, such as gambling services, may also require an EDD process.

To effectively handle high-risk customers, EDD must also be carried out when a customer provides altered or stolen documents during onboarding.

How to Perform EDD Processes

Enhanced due diligence shares some parts of the process with customer due diligence. These processes are:

- Identity verification. Organizations must verify the customer’s identity during onboarding and assess their behavior and intended service use. They collect customer details about a natural person or legal entity, such as names, ID documents, etc.

- Risk assessment. Organizations must check sanctions, adverse media, and PEP lists, validate ultimate beneficial ownership, shareholding structure, and perform other processes to assess the risk score of a customer.

- Ongoing monitoring. Automated checks help to ensure that no changes in client information are missed.

If this process results in a greater risk score, additional EDD procedures apply:

- Collecting additional information. This step includes retrieving information such as proof of address, identifying a legal entity’s management, business sector, or anything that helps to get a full view of the client.

- Implementing more checks. Organizations should carry out robust and comprehensive checks. For instance, adverse media screening can help to quickly assess a client’s reputation and involvement in criminal activities.

- Transaction tracking. Analyzing transaction history and checking ongoing transactions can help establish a client’s business relationship and detect suspicious activity.

Conclusion

Enhanced due diligence is an important AML compliance procedure that helps onboard high-risk customers. EDD aims to prevent financial crimes and protect financial institutions and other organizations from criminal exploitation.