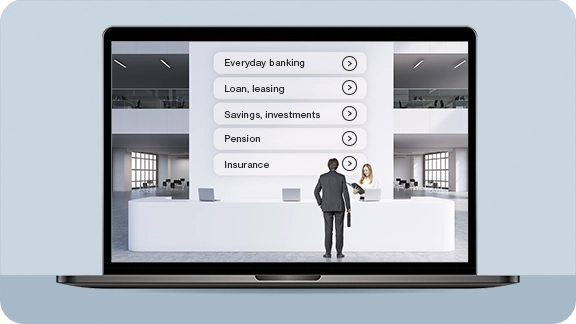

Virtual Branch

The virtual branch is a feature that allows remote services while preserving personal interaction with your clients and mitigating security and compliance risks. Virtual branches contain all of the communication tools housed in an app or other digital platform. They allow you to elevate your remote services experience while avoiding security and compliance risks.

The benefits of providing

remote services

Real-time video conversations

Connect with your customers in real-time through video calls. Ensure satisfactory customer service while maintaining an excellent user experience.

Streamlined and efficient

use of resources

Reduce waiting lines at physical branches by virtually migrating available agents. Our technology combines digital and physical services to balance the workload and eliminate the need to relocate team members.

The only solution you will need

A virtual branch can fully integrate your internal processes while also offering online customer service. It can be powered by identity verification, authentication, document signing, and other solutions.