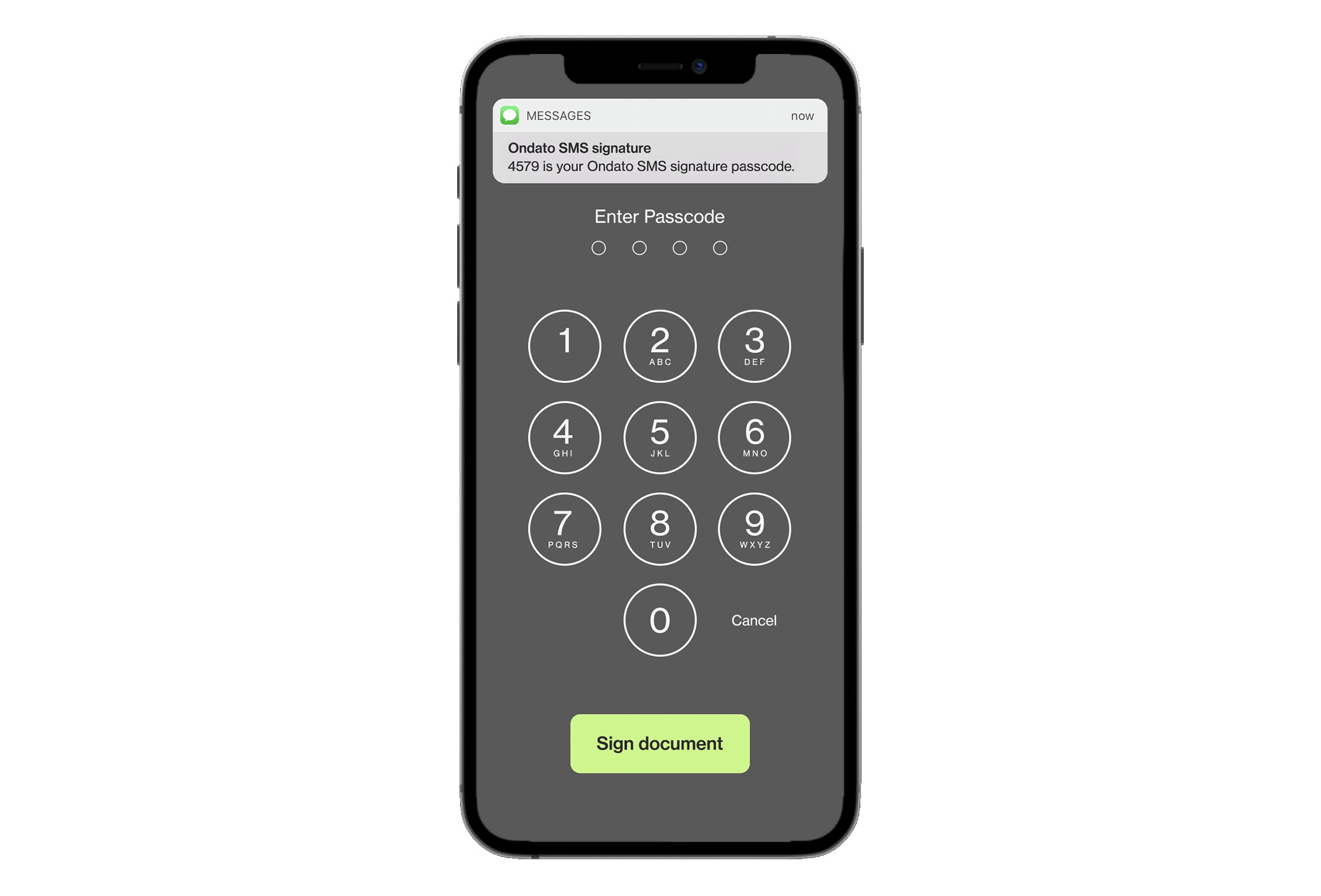

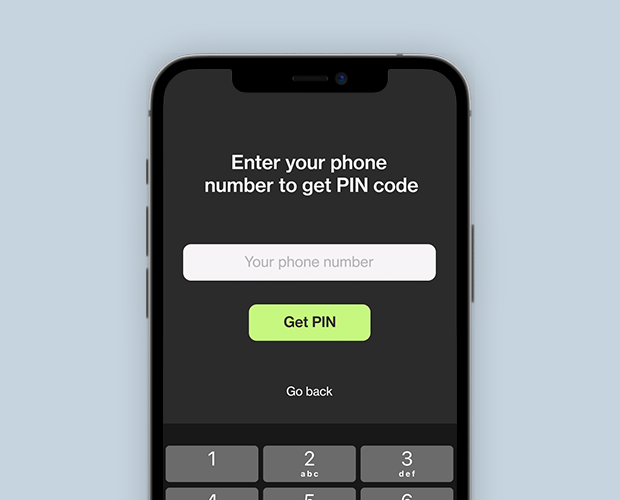

SMS Signature

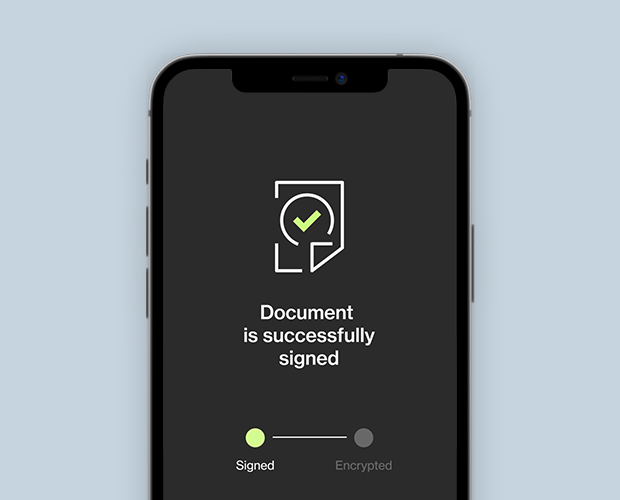

Signing documents remotely have never been easier. Effortlessly sign legally binding documents with a simple SMS message.

Sign Any Document Online

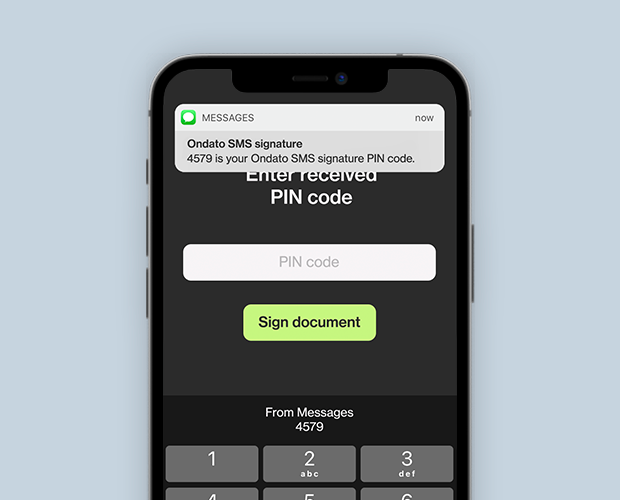

Users that are signed up and passed identity authentication can be offered to sign documents accept services or plans via SMS. Users can provide a phone number to receive a six-digit PIN code and enter it on the requested field, signing a document. It's a simple but secure method to digitally sign documents without installing proprietary applications or extensive knowledge of cryptography.