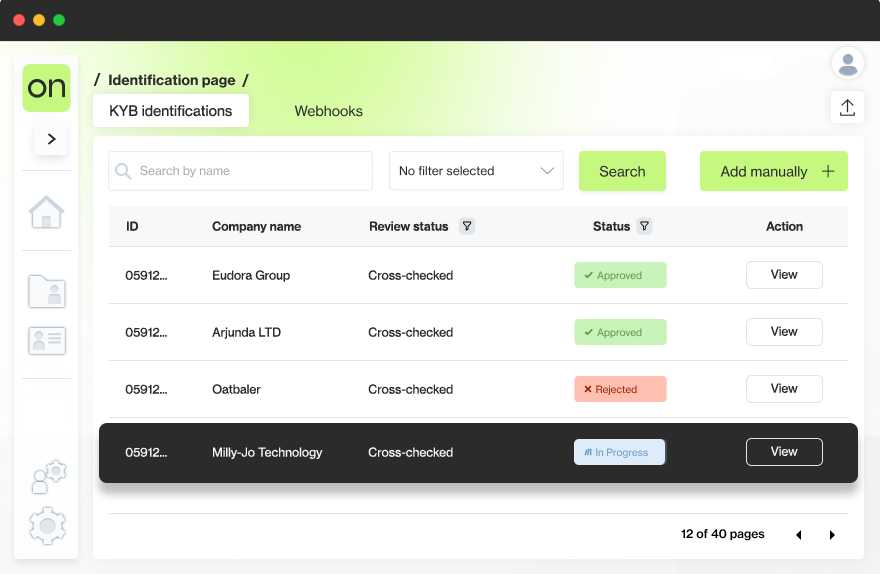

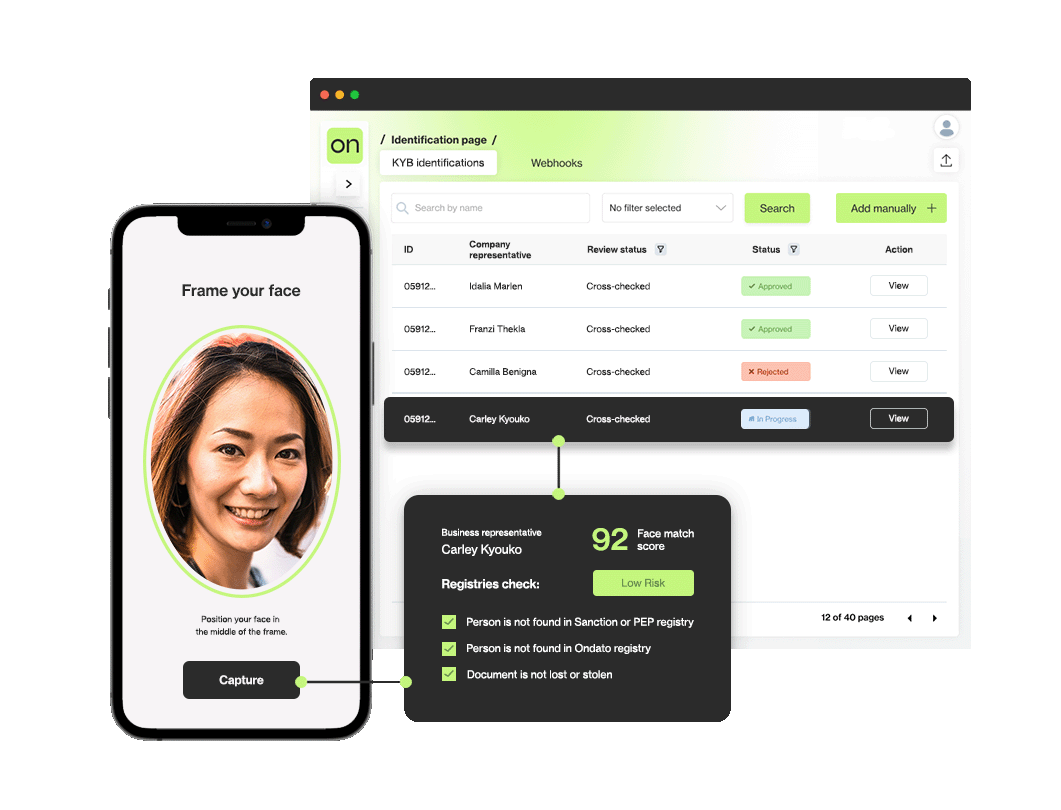

Automated Business Onboarding

Fully automated business representative document verification that saves everyone’s time. Confirm your identity, provide the business code, and our solution will go through all the related data grabbing the rest from various registries and other sources. It’s a one-stop solution for all your legal entity onboarding needs.

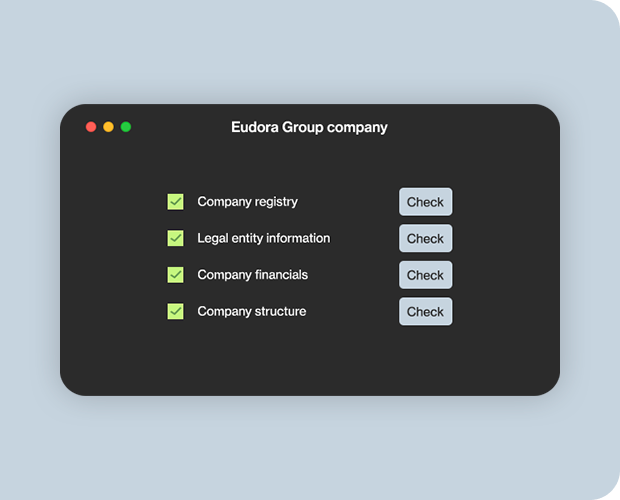

Universal Data Coverage

Our intelligent solutions enquire numerous registries about all the necessary legal information. The tool quickly retrieves company registry statements, financial information, ultimate beneficiary owner, and other relevant data. This gives you a complete picture of the legal entity you're dealing with.

Automated Shareholders Checks

Instantly evaluate the company's ownership structure and reveal its ultimate beneficial owners. Collect the important pieces of information and ensure regulatory compliance and transparency.

Pre-fills KYB Forms

Quickly put the gathered data to use, automatically filling out KYB forms, making a template for a contract that can be signed in one of the officially recognized methods.

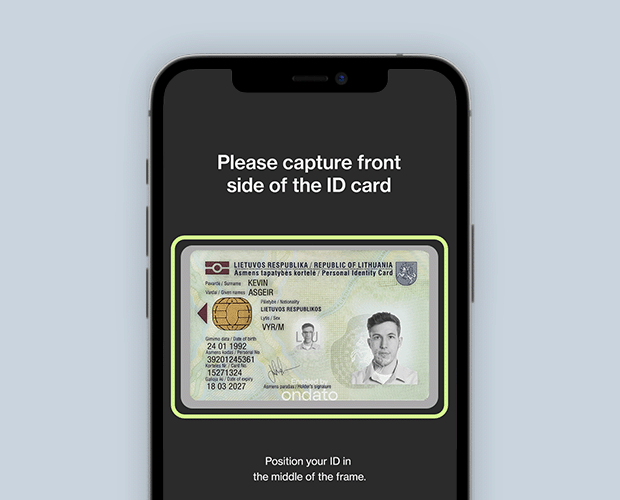

Business Representatives Checks

Business representatives can provide the required documents and ID with our system, simultaneously picking up the data. From the rights to represent to spoofing checks, the process ensures that all the provided data is genuine before giving any confirmations.

ID Spoofing Checks

Fake IDs aren't going to work. Each is checked through numerous alteration filters cross-referencing registries.

Registry Confirmations

Quickly find out whether the document is valid and isn't altered in any way with local and international registry checks.

Benefits

Next-Gen KYC Compliance

Management

Build Your Own Process

Mix and match our modules to create the perfect solution for your problems. Adapt the software to your unique business case, not the other way around.

Integrate with Customer Data Platforms

All our modules can be seamlessly integrated into customer data platforms. There you can manage cases and monitor customer actions after they've onboarded.