Global Leader in Age Verification

Ondato stands out as a leader in age verification, offering years of expertise in delivering comprehensive and reliable solutions. Our extensive experience with global companies ensures full compliance with even the strictest legal and regulatory requirements worldwide. This proficiency allows us to provide seamless and secure age verification methods that prioritise both privacy and convenience for your customers while keeping you compliant with global regulation standards such as NIST, KJM, CAADCA, DSA, GDPR, COPPA, PIPEDA and others.

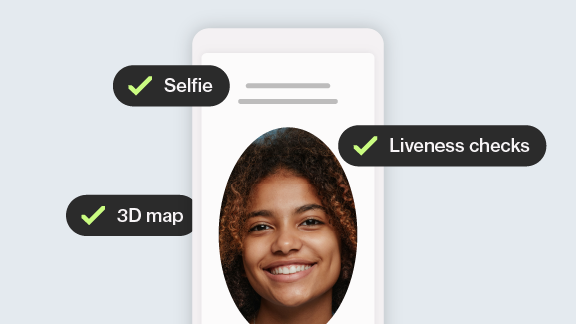

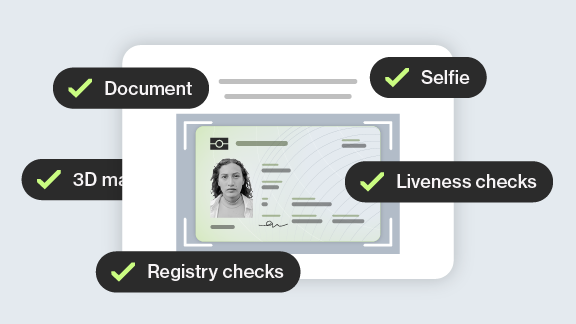

Three Age Verification Methods

Choose a reliable method that fits your needs and regulatory requirements wherever you operate.

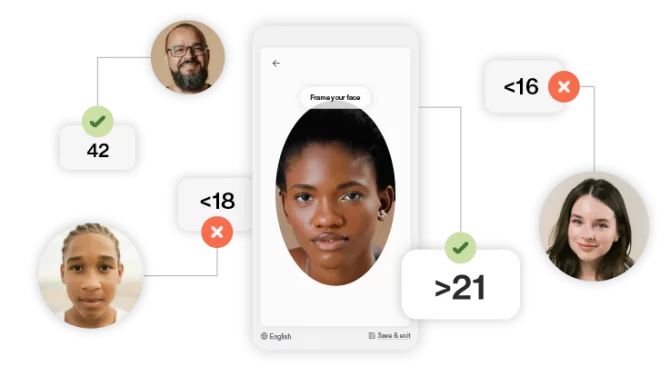

Age Verification without Processing Customer Data

Quick and Convenient Verification

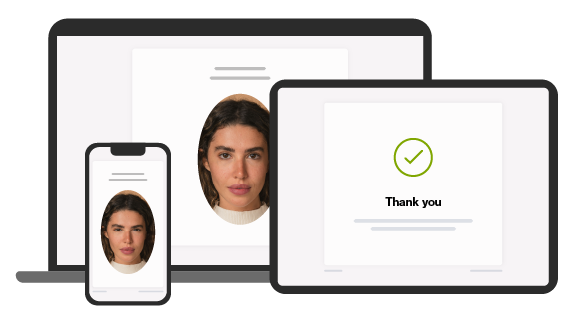

Ready-Made and Fast IT Integration

Age Verification Benefits

International compliance authorities certificates

Learn more about securityWhy Clients Trust Ondato

Use Cases

See how our solutions work and get expert advice on which methods would be best for your business from qualified professionals.