Customer Data Platform

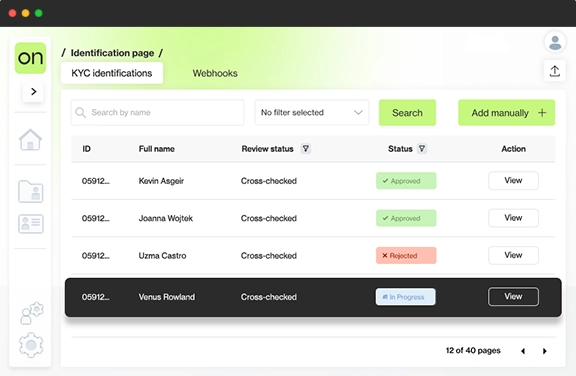

Easily manage your user base from a centralized hub no matter whether you’re dealing with natural or legal entities. An all-inclusive dashboard covers all the areas from monitoring to tools for external communication.

Comprehensive

Management Suite

Data-Driven Analytics

Orchestrate your entire client database. Evaluate their risk profiles, monitor registry changes, and get various business insights delivered straight from the main dashboard. Supervise the complete lifecycle of your customer's journey with one tool.

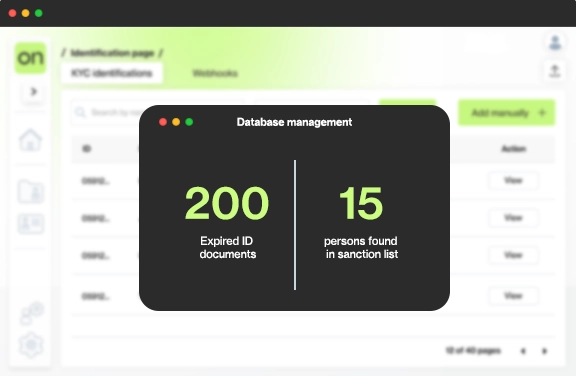

Integrated Database Management Tools

Stay one step ahead of data expirations and stay informed on time. Customize every step of your workflow, including direct contact with your users. Reach out to give reminders or update your data sets with up-to-date information. If there's a precedent, have quick access to reporting toolkit with full action logs.

Monitoring & management tools

Monitoring

Customer Risk Scoring

Registry Monitoring

PEP Monitoring

Adverse Media Monitoring

Sanctions Monitoring

Userbase Analytics

Document Verification

External Communication Tools

Reporting

Case Management Platform

Why Clients Trust Ondato

FAQ

A customer data platform (CDP) allows companies to manage and securely store the data of their customers. As the storing of data is required by AML regulations, this is especially useful for financial institutions.

When it comes to CDP versus CRM, there’s one major difference: CRM focuses on organising and managing customer-facing interactions with your business, while CDP manages data needed for money laundering prevention.

No. Although both customer data platforms and data management platforms collect the same type of data, their targets differ. DMPs primarily pursue third-party data while CDPs focus on structured, semistructured, and unstructured PII first-party data.