Manual Identity Verification

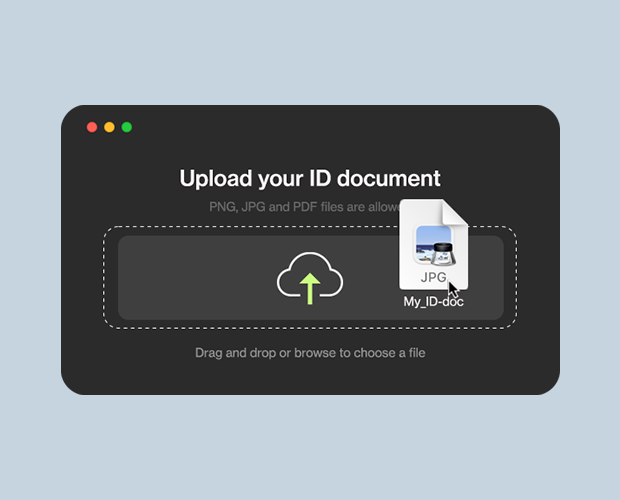

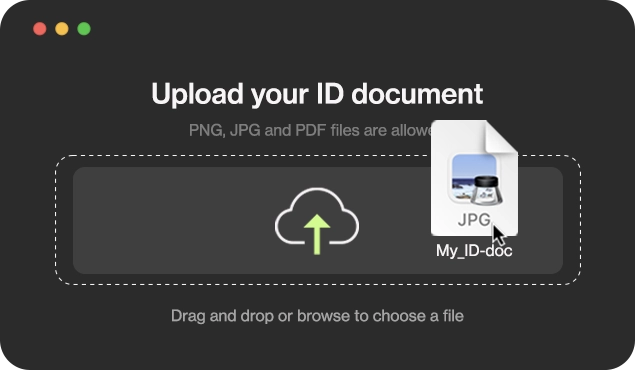

Fully adapt to your customers and allow manual submissions of the necessary documents to be checked later. Ensure that the used documents are valid and reach the higher compliance status for your user base.

Jurisdiction-Adjusted

KYC Compliance

Upload the necessary data and have your client confirm its identity without the need to be present. Make use of additional channels for secure document verification while handling branch, offline or other operations to avoid fines and ensure regulatory compliance status.

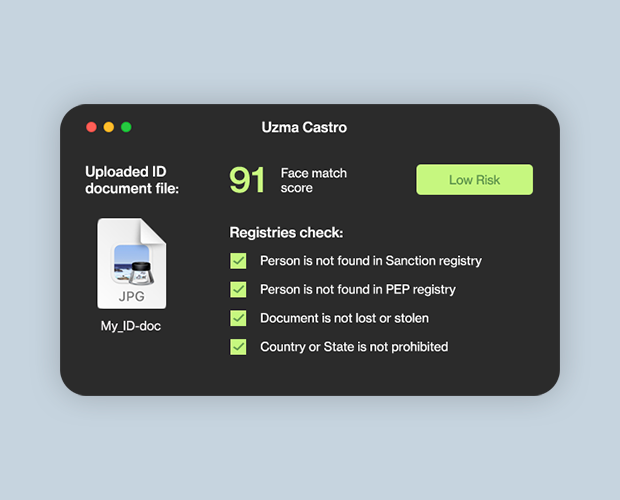

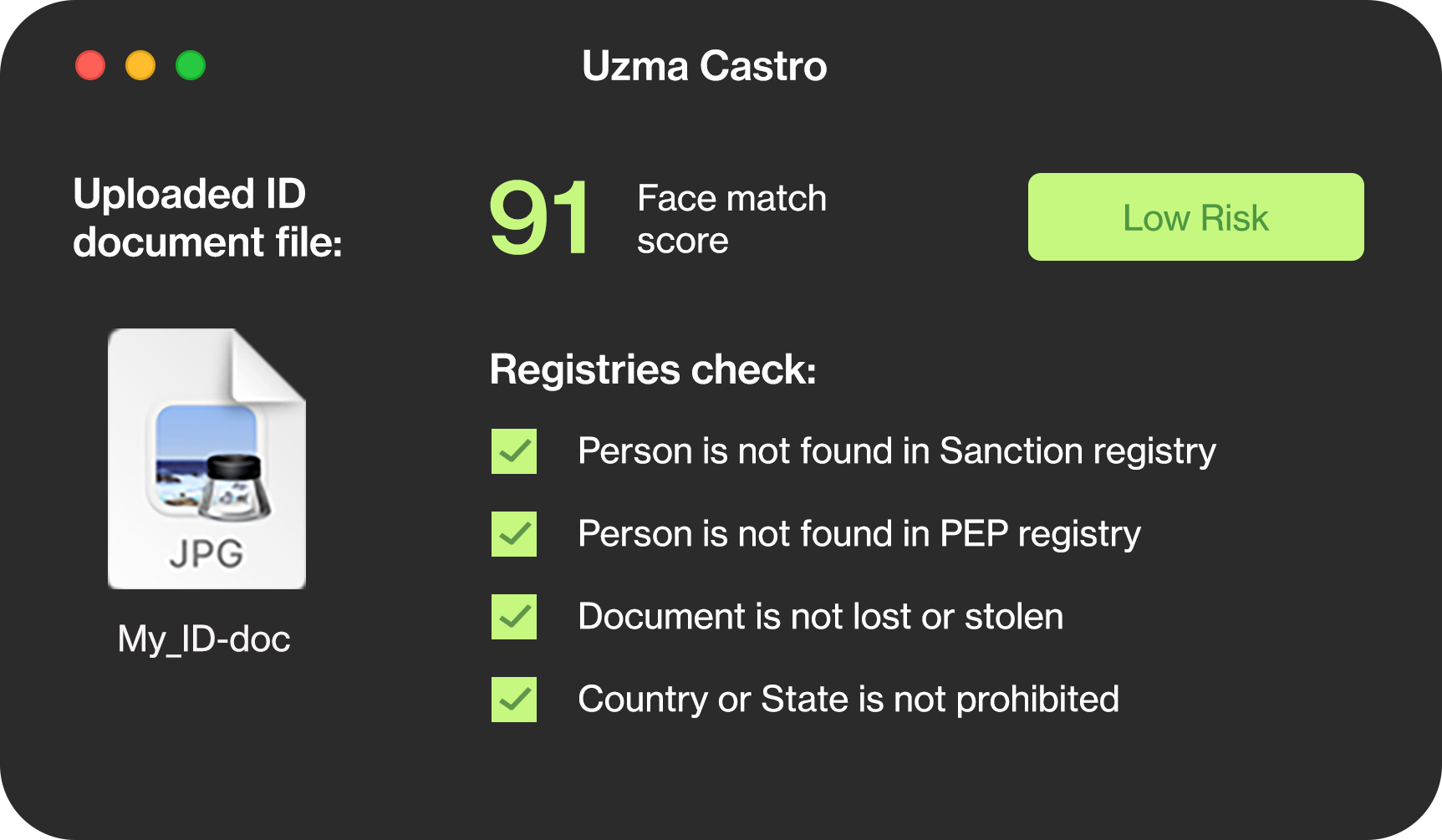

ID Spoofing Checks

Fake IDs aren't going to work. Each is checked through numerous alteration filters cross-referencing registries.

Registry Confirmations

Quickly find out whether the document is valid and isn't altered in any way with local and international registry checks.

Easier for You Client,

Not the Fraudsters

All the provided data is still run through numerous spoofing checks to verify its legitimacy. There won't be a ticked box under the approved tab if anything raises suspicion that it may be a fraud attempt. It's the same no half-measures approach but more flexibly adapted to your client.

Biometric Security

Trust biometric data with passive liveness analysis for digital images and videos. Ensure identification without requiring active user participation.

Biometric Face Comparison

We have the tech that accurately compares ID documents with the provided face, filtering out identical twins and lookalikes to ensure the highest degree of accuracy.

Benefits

Next-Gen KYC Compliance

Management

Build Your Own Process

Mix and match our modules to create the perfect solution for your problems. Adapt the software to your unique business case, not the other way around.

Integrate with Customer Data Platforms

All our modules can be seamlessly integrated into customer data platforms. There you can manage cases and monitor customer actions after they've onboarded.