NFC Identity Verification

A new identity verification method that’s making the process much smoother for customers. Simple, quick and considered to be one of the safest IDV processes out there.

The modern method of KYC compliance

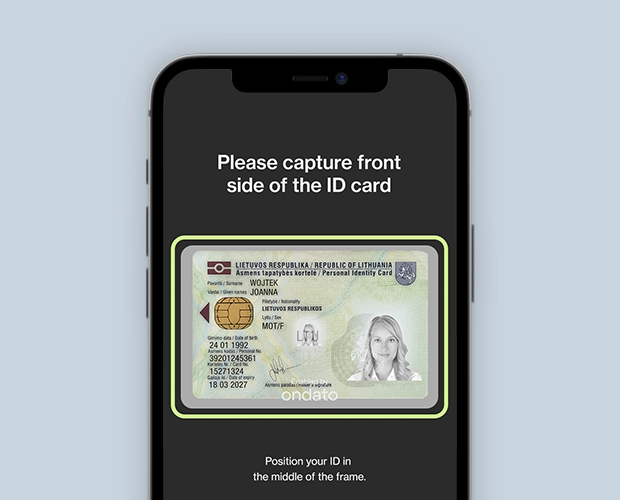

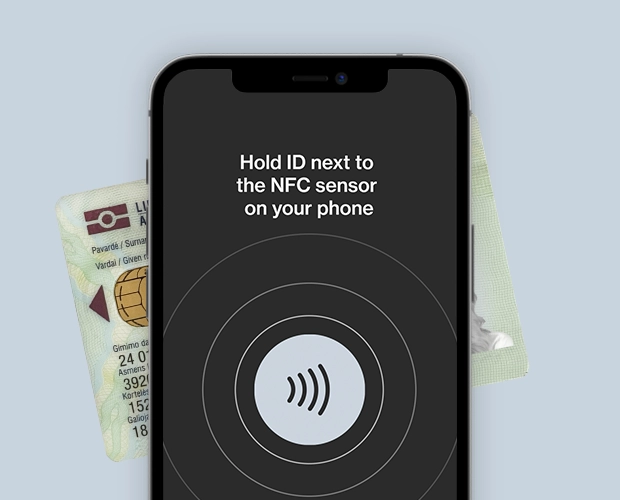

NFC technology isn’t as rare as some might believe. NFC readers can be found on most modern phones. One press of the passport or ID card to the customer’s phone, and our system has all the necessary information to confirm the legitimacy of the identity documents. This makes NFC verification accessible, efficient and quick for most potential customers.

ID verification anywhere

All your customers need is a phone and their documents. The KYC procedure can be performed anywhere at their convenience.

Registry checks

As with all of our IDV methods, the document is immediately checked against international registries to ensure it is valid.

Security at the forefront

As NFC technology is still relatively new, there are currently no known ways to tamper with it. Additionally, Ondato has compiled numerous ID registries and offers KYC agents for additional confirmation. This means the identity documents overgo three distinct and secure checks before confirmation. False positives are much lower, and scammers cannot get through the system.

Easy falsification checks

NFC chips cannot be tampered with. Therefore any documents with fake information will immediately be recognized.

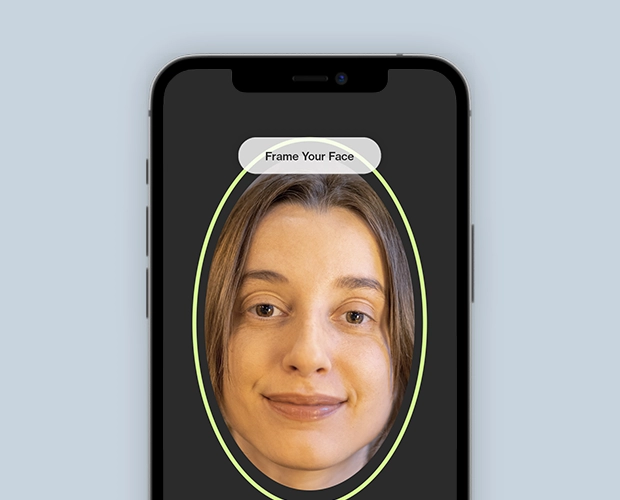

Biometrics and NFC

Facial recognition combined with NFC ensures the process is as accurate as possible, minimizing false negatives.

Benefits

Next-Gen KYC Compliance

Management

Build Your Own Process

Mix and match our modules to create the perfect solution for your problems. Adapt the software to your unique business case, not the other way around.

Integrate with Customer Data Platforms

All our modules can be seamlessly integrated into customer data platforms. There you can manage cases and monitor customer actions after they've onboarded.