Identity Verification Service

Effortlessly onboard customers globally with cutting-edge AI-powered identity verification solutions. Achieve top pass rates, ensuring seamless compliance with the latest KYC, AML, and GDPR guidelines. Ondato guarantees easy integration, high conversion rates, data protection, fraud mitigation, and operational efficiency.

Trusted by Companies Worldwide

A Holistic Approach to Regulatory Compliance

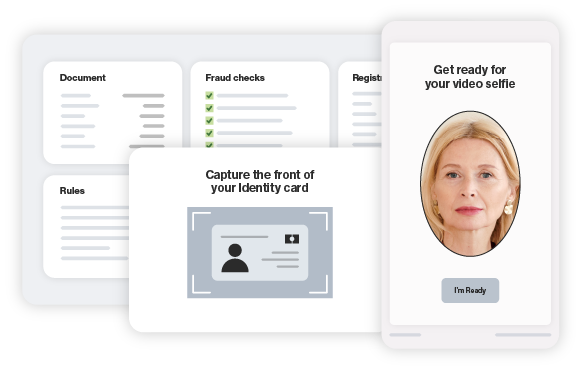

Digital ID Verification Options for Your Needs

Scale and Verify Users Globally

We understand how much regulations and requirements can differ from jurisdiction to jurisdiction. With our identity verification service, you can easily adapt to any differences in regulations for any clients, choosing different identification methods for different countries, switching document requirements, and requiring the exact data you need to stay compliant. Tell us the jurisdictions you want to work with, and Ondato’s flexible solutions will take care of the rest.

360 Degree Overview of Your Customers

During the initial ID checks, your potential client's background and identity documents are analysed. This includes sanctions, politically exposed persons, and reputational risk media checks. Additionally, AI runs through the user’s IP address and where the email was used previously. All of this paints a complete picture of your potential client, allowing you to evaluate any suspicious activity and minimise the risk of identity fraud.

Improve Your Pass Rates

With our comfortable and easy-to-use UX, your clients will get the best user experience, minimising the number of drop-offs. Our online identity verification service ensures some of the highest pass rates for our customers, creating a quick and efficient process to verify identities that will leave your clients happy.

International compliance authorities certificates

Learn more about securityWhy Clients Trust Ondato

Streamline Your Compliance Management with Ondato

FAQ

The costs of identity verification services can differ based on provider, jurisdiction, and volume. Ondato offers prices from €0.80 to €1 based on volumes or any additional checks you require. It’s also worth noting that manual identity verification is generally much higher than automated processes.

Ondato’s identity verification takes less than 60 seconds on average. However, this all depends on the process and system your IDV provider uses. Where automated processes can usually be done in a few minutes or hours, manual processes might take a few days or even weeks.

The accuracy of IDV, of course, depends on the methods used. Ondato’s software can currently provide 99.8% accuracy. With additional tools such as population registry checks, this can be even higher.

This all depends on regulations and your business needs, but the most common requirements include a government-issued document and a selfie picture captured at the time of the verification process.

Identity verification is a legal requirement for money laundering prevention and combating terrorist financing. This is needed to prevent financial crime as well as protect the company’s reputation and avoid anti-money laundering fines. However, any business that wishes to know its customers should invest in IDV processes.

Identity verification is the process of confirming or denying that a claimed identity is correct by comparing credentials such as biometric data, ID documents and more of a person.