Customer Due Diligence (CDD)

Analyse your user base not only during onboarding but long after they have become your existing clients to ensure due diligence is performed. No matter whether they are natural or business entities. Accurately evaluate their risk level and its developments. With our tools, we’re making sure that nothing slips by you.

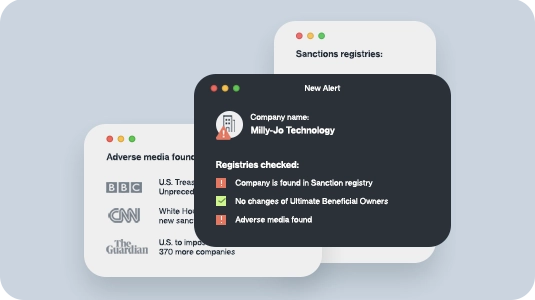

Tools for Your Perpetual KYC

Sanctions Screening

Adverse Media Screening

Politically Exposed Person Screening

Ultimate Beneficiary Owner Detection and Screening

Proof of Address Screening

Business Registry Screening

People Registry Screening

IP and Email Risk Screening

A Holistic Approach To

Regulatory Compliance

The Customer Due Diligence Process

CDD is an essential step in preventing money laundering. Financial institutions and other companies can use it to confirm any customer’s identity, inspect their financial transactions, and evaluate the customer’s risk profile. AML regulations require due diligence to be performed for all new and existing clients.

Continuous Background Screening

Perform repeated checks of sanctions, people registry, address, lost/stolen and other customer data changes. Enable AI to take care of reminders and tracking, never letting your customer data go out of date.

Why Clients Trust Ondato

FAQ

The customer due diligence process is used by financial institutions and other companies to collect and evaluate relevant information about a current or potential customer.

Due diligence deals with risk assessment. For example, financial institutions that want to onboard a new client or enter into a business relationship with a different company perform due diligence to be aware of the risks, the reputation and any hidden information.

KYC is the broad term for the entire process. CDD is one of the steps that focus on financial profiles and risk levels, and CDD is the key to this process. Customer due diligence deals with collecting and evaluating the customers' information and determining their risk for illegal financial transactions. Both KYC and CDD fall under anti-money laundering (AML) regulations.

There are three levels of customer due diligence: standard, simplified, and enhanced.

Whether you are required to perform EDD or CDD depends on your customer’s risk level. If a customer is judged to be low risk, they might only be subject to simplified customer due diligence, where the only requirement is to identify the customer but not verify their identity. For high-risk customers, EDD is required to ensure they are continuously monitored to prevent money laundering.

Yes. The customer due diligence rule is a legal requirement under anti-money laundering regulations.

Customer due diligence has four main requirements: Verify customer identities. Ensure that your clients and business partners are who they say they are. This includes analysing the customer's risk profile.

Assess third-party information sources. As due diligence requires third-party information, it is important to understand which sources are reliable.

Secure your information. Any data you gather and store needs to be secure, as this data getting leaked can have grave consequences for your business relationships.

Use ongoing monitoring when necessary. The correct CDD measures will require that any high-risk customers be continuously monitored after onboarding.