Identity Verification Service

Ondato’s AI-powered identity verification solutions are built to make KYC faster, safer, and globally compliant, no matter your industry or customer base.

Trusted by Companies Worldwide

Digital Identity Verification Solutions for Your Needs

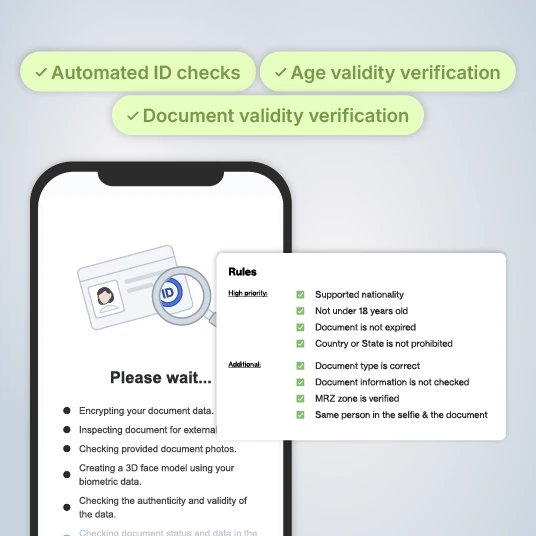

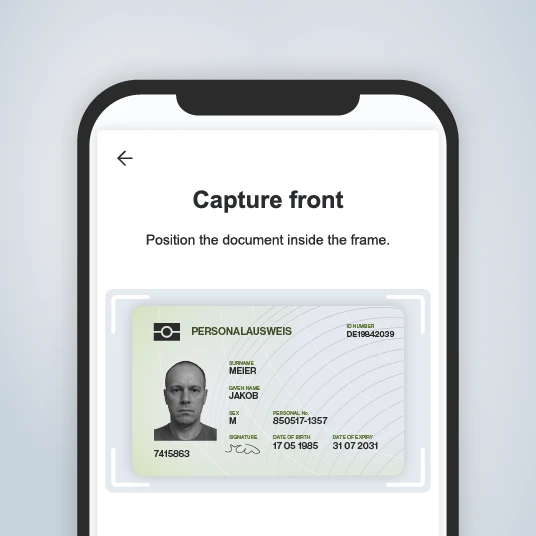

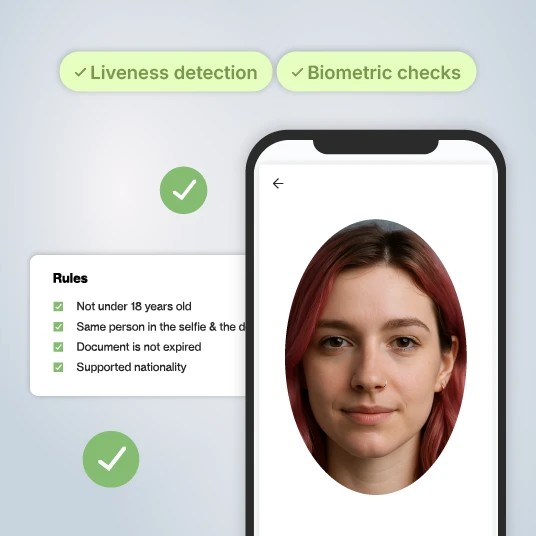

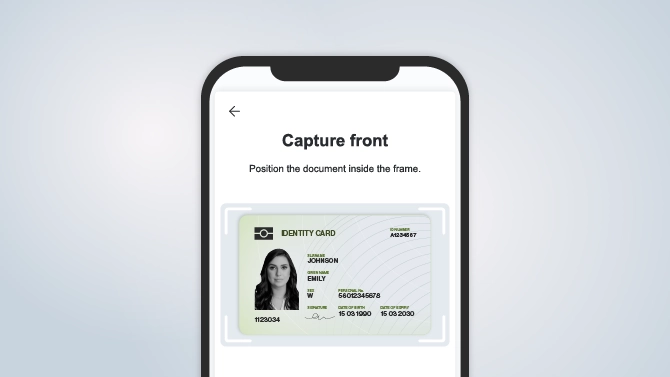

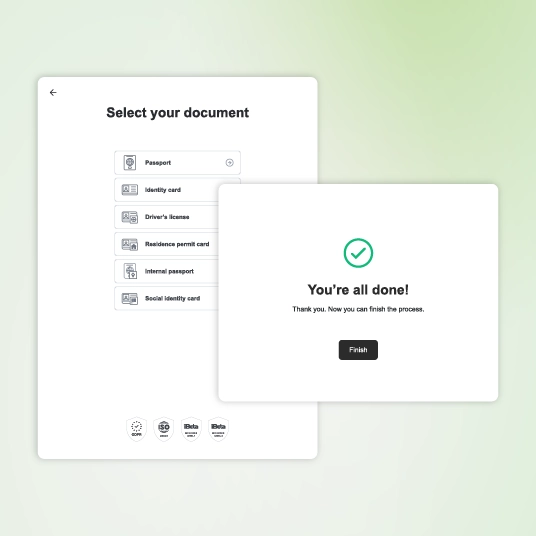

Photo-Based ID Verification

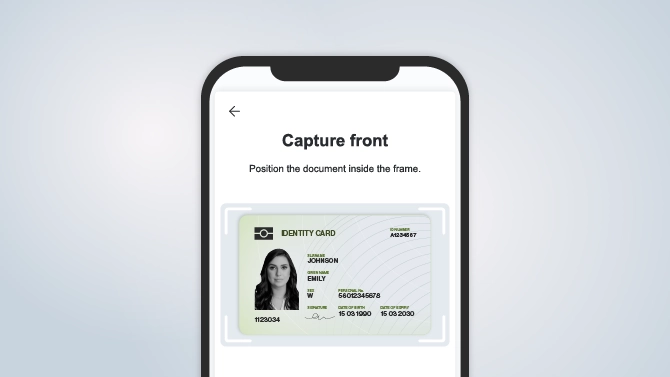

Our most widely used method combines speed, accessibility, and security. Users snap a photo of their identity document, and our AI-powered system instantly extracts and validates the data. Using advanced OCR and document authenticity checks, as well as biometric liveness detection, Ondato verifies identity with 99,8% accuracy.

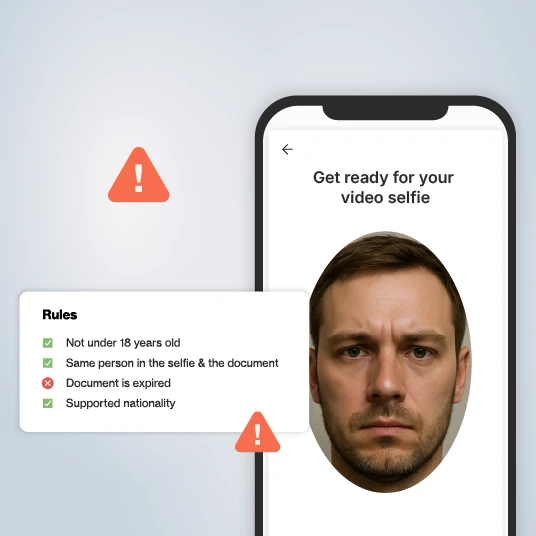

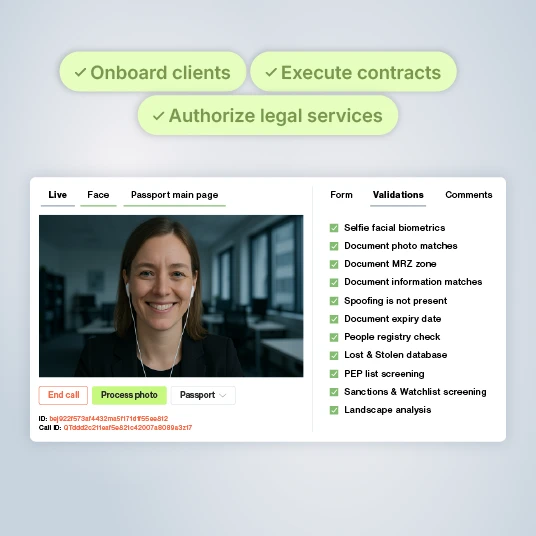

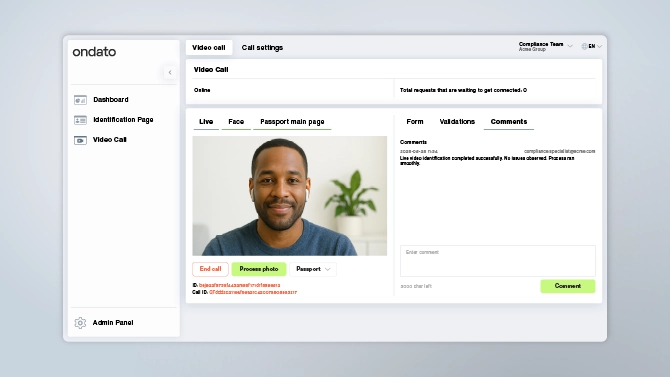

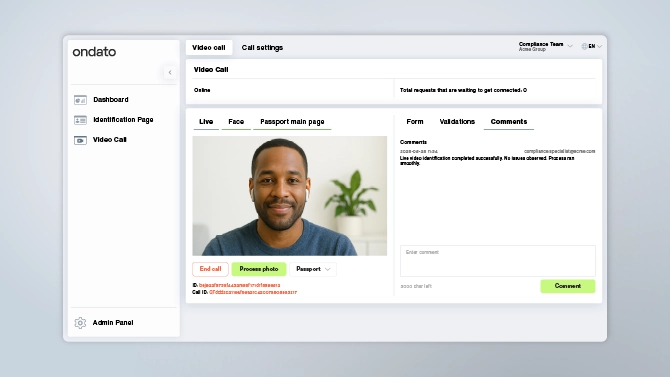

Video-Based ID Verification

For scenarios that demand a higher level of assurance or are subject to strict regulatory scrutiny, video-based verification offers the most secure verification. Users can be guided through a live video call with an agent during which Ondato’s system analyzes the video for liveness, document presence, and behavioral cues in real time.

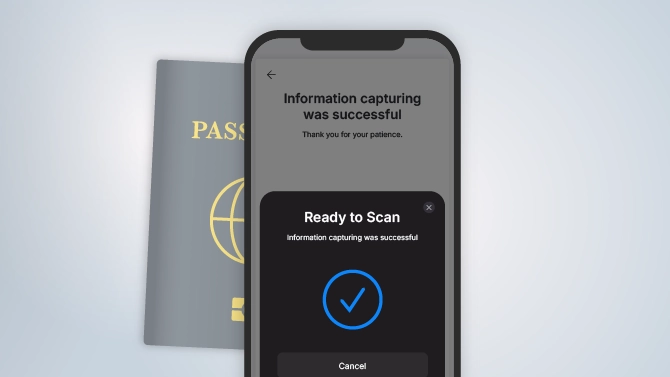

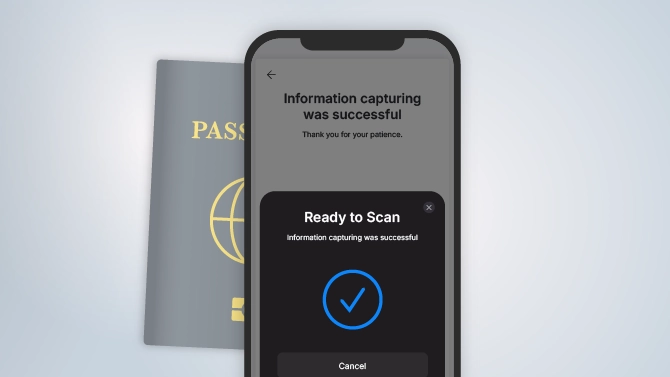

NFC-Based ID Verification

NFC (Near Field Communication) verification is available on most modern passports, ID cards, and smartphones. Ondato securely reads the encrypted NFC chip data, which includes a high-resolution facial image and tamper-proof identity information. This method offers the highest level of document authenticity, with no reliance on visual elements that can be forged or manipulated.

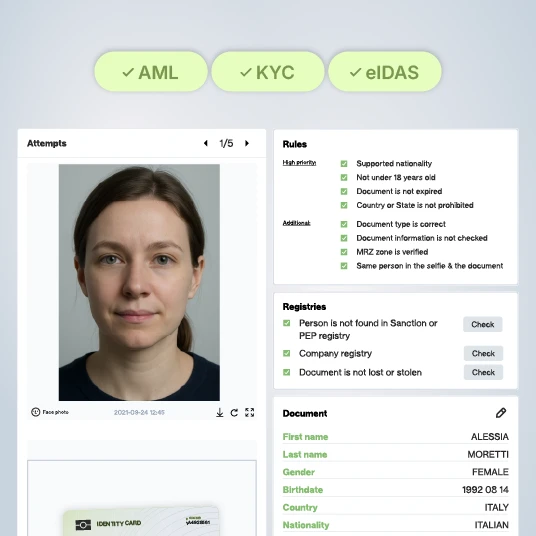

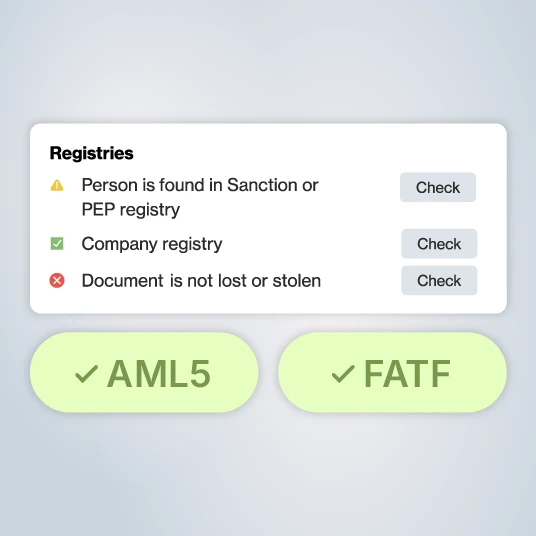

Regulatory Peace of Mind

Ondato’s identity verification solutions are built with compliance at their core, aligning with AML directives, GDPR, FATF guidance, NIST and eIDAS standards, and sector-specific requirements across 190+ countries. Ondato enables full compliance while automating your workflows and keeps up to date with new laws and updates so you don’t have to.

Frictionless User Experience

Ondato's identity verification flows are designed with both speed and simplicity in mind without compromising security. The entire process from document capture to approval is smooth, guided, and free of friction. Intelligent prompts help users complete verification in 30 seconds on the first try, reducing drop-offs and frustration.

Scalable and Secure

Ondato grows with you. Our infrastructure is cloud-native, built on globally distributed servers. Security is non-negotiable: all data is encrypted at rest and in transit, with role-based access, penetration-tested architecture, and continuous monitoring by our security operations team. With flexible modules and API-first architecture, you can adapt quickly to new markets, user segments, or compliance regimes.

Full Customer Lifecycle Strategy

Identity Verification

KYC Form

Customer Due Diligence

Registry Checks

Age Verification

Biometric Authentication

E-Signatures

Client Base Analysis

Reporting to Regulator

Adverse Media Screening

PEP Screening

Sanctions Screening

Tailored to Your Industry

Why Clients Trust Ondato

Integration That Works Your Way

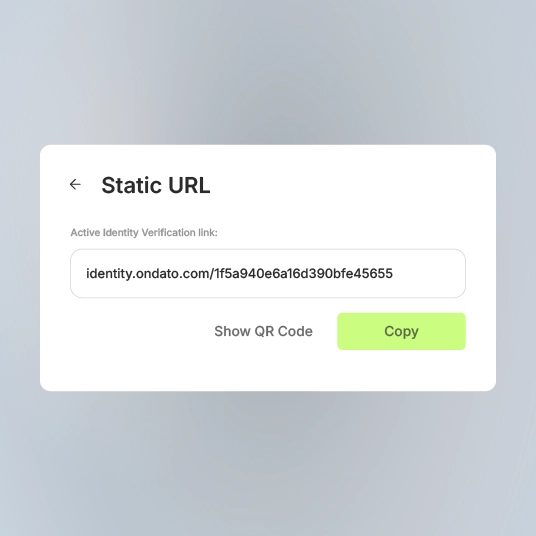

Static URL

Kick off identity verification with a simple, secure link, no code needed. Share it via email, SMS, or chat to capture documents, run liveness checks, and verify users instantly.

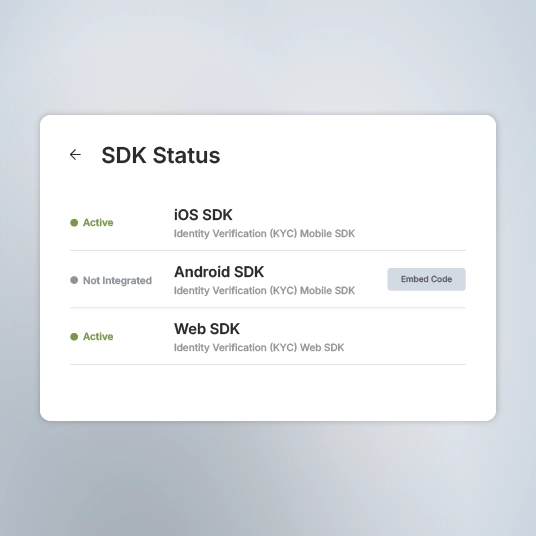

Web & Mobile SDK

Our SDKs are designed to embed directly into your application, complete with pre-configured flows that handle document capture, biometric checks, and liveness detection.

API

Ideal for businesses that want to manage every touchpoint of the verification process, our API allows for full customization and backend control.

Don't Just Trust Our Word, Try Ondato Today

FAQ

We support passports, national IDs, driver’s licenses, and residence permits from 190+ countries.

Yes. We meet global data protection regulations including GDPR, CCPA, and local AML laws.

The cost of identity verification varies depending on the method, and volume, with Ondato’s fee ranging from €1,40 to €0.50,

Ondato’s identity document verification takes around 30 seconds.

Identity verification helps confirm customer identities, protecting your business from identity fraud and financial crime. It allows you to distinguish legitimate customers from bad actors, and minimize fraud risk, enabling safe, compliant, and efficient onboarding.