Biometric Authentication

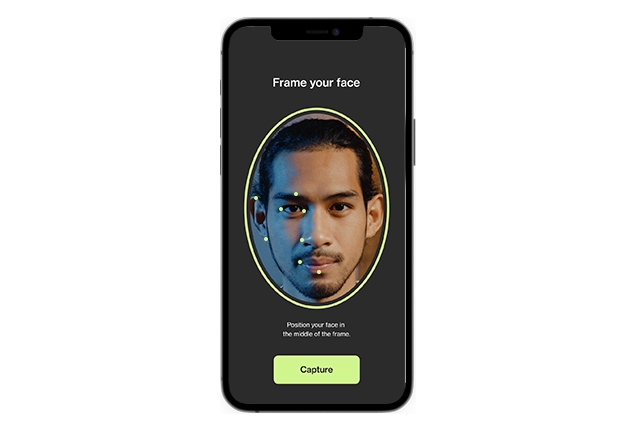

Replace old-fashioned authentication methods with biometrics. Quickly and securely verify users and allow them to access your product or service.

Build Trust with Biometrics

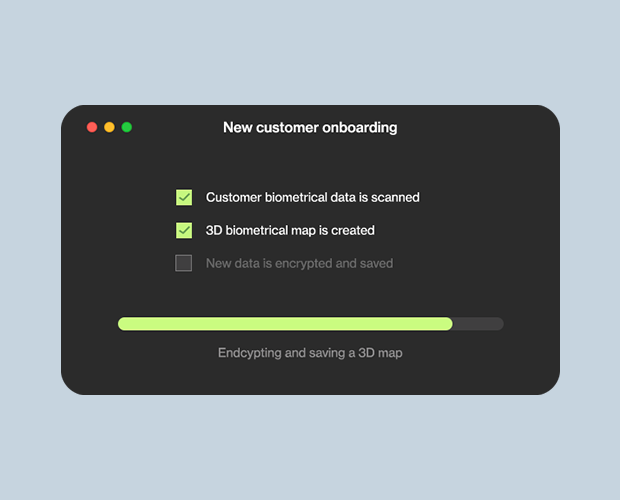

The customer’s face is scanned during authentication, creating its 3D map. In milliseconds this data is then compared to already stored information, checking for spoofing methods and other alterations. Quickly telling if the returning user is genuine and keeping accuracy of 1 in 12,800,000 at less than 1% FRR.