Know Your Customer (KYC) processes are the backbone of regulatory compliance and risk management in financial services. Initially, these procedures focused on verifying the identity of new customers during onboarding, but as financial crime tactics evolve, companies have recognized the need to go further. Customer reverification—reassessing customer identity at periodic intervals after the initial identity verification process—has become an essential practice for maintaining up-to-date, secure, and compliant customer data.

In this article, we’ll explore why the customer reverification process is growing in importance, how it works, the challenges it presents, and its future.

What Is Reverification?

Customer reverification is the process of re-checking a user’s identity after their initial onboarding or identity verification. Unlike one-time verification that happens when a user first registers or engages with a service, reverification ensures that identity data remains accurate and trustworthy over time, minimizing risk of identity theft.

It’s a core component of ongoing compliance in regulated industries like finance, insurance, and telecommunications—especially where KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations are in place. Without reverification, businesses risk relying on outdated or incorrect identity data, which can open the door to fraud or regulatory violations.

Why Reverification is Critical

KYC compliance is designed to prevent illegal activities like money laundering, terrorist financing, and fraud. The process typically involves collecting customer data, such as personal identification, financial details, and other risk factors, during onboarding. However, customer information doesn’t stay static—people move, change jobs, or update their financial profiles, all of which can affect their risk levels.

Here’s why customer reverification is so important:

Combating Financial Crime

Criminals often use outdated or fraudulent information to mask their illegal activities. By regularly updating and verifying customer data, a financial institution can identify red flags sooner and prevent identity theft, financial fraud, and other crimes. Criminals may also alter their behavior over time, making it essential for companies to reassess the risk profiles of their customers.

Maintaining Regulatory Compliance

Financial regulators globally, including the Financial Action Task Force (FATF), European Union, and U.S. Financial Crimes Enforcement Network (FinCEN), require institutions to maintain accurate and up-to-date records. Non-compliance can result in significant fines, reputational damage, and even the suspension of operations. Regular repeat identity verification helps ensure compliance with these stringent regulations.

Reducing Risk Exposure

As markets and economies change, so do the financial behaviors of customers. If a previously low-risk customer begins engaging in high-risk activities, such as transacting in large sums of money or interacting with politically exposed persons (PEPs), reverification helps catch these changes. This dynamic approach helps institutions stay ahead of risks before they materialize into actual threats.

How Reverification Works

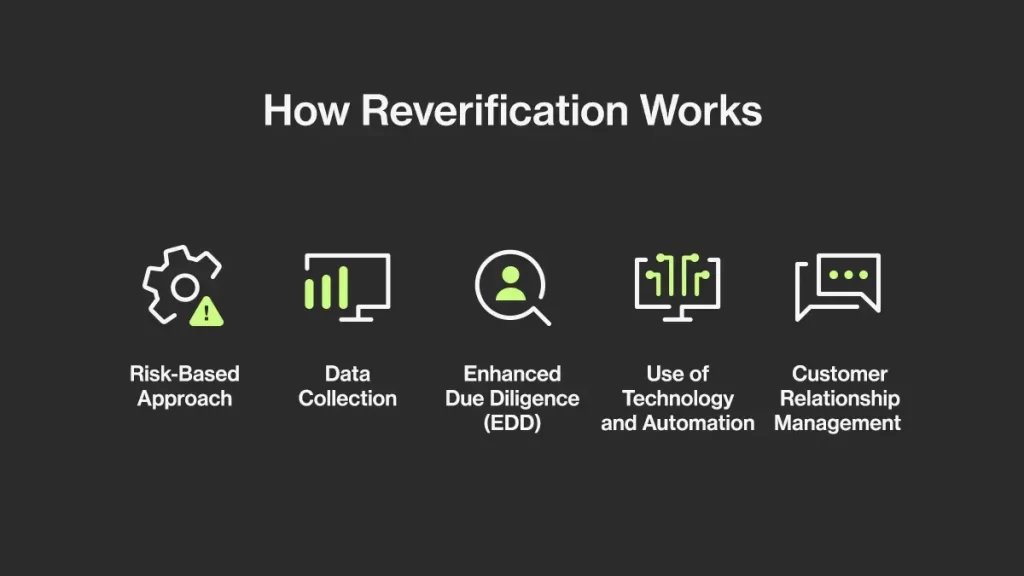

Reverification is often part of the ongoing monitoring process and deals with more than just checking customer details periodically—it’s about using data intelligently to maintain an accurate understanding of customer risk. The process typically involves several key steps:

Risk-Based Approach

Financial institutions often adopt a risk-based approach to KYC, where customers are segmented into categories based on their perceived risk level. Higher-risk customers—like PEPs, businesses involved in high-risk industries, or those transacting large amounts internationally—are more likely to undergo frequent identity verification, while low-risk customers might be checked less often.

Data Collection

During reverification, financial institutions re-collect key customer data points, such as updated addresses, employment status, and financial information, maintaining data integrity. Additionally, they check for any new risk factors, such as negative news reports, changes in their transaction behavior, or shifts in their corporate structure (in the case of business customers).

Enhanced Due Diligence (EDD)

For high-risk customers, enhanced due diligence is often required. This involves more rigorous identity verification, such as requesting additional documents, conducting in-depth background checks, and closely monitoring transactions for suspicious activity.

Use of Technology and Automation

The volume of data and frequency of reverifications can be overwhelming for institutions, especially large banks with millions of customers. To streamline the process, many companies are turning to automation, machine learning (ML), and artificial intelligence (AI) tools. These technologies can automatically flag when a customer’s profile needs updating and conduct checks across a wide range of public and private databases.

Customer Relationship Management

Reverification also involves contacting customers directly to update their information. While this might seem like a mundane task, it can be challenging to balance compliance needs with customer experience. Companies need to make the process as seamless as possible to avoid customer frustration or churn.

Benefits of Reverification for Businesses

Reduced Risk of Fraud

Reverification significantly strengthens your fraud prevention framework. By continuously validating customer identities and monitoring for behavioral anomalies, businesses can catch discrepancies early—before they escalate into serious incidents. Whether it’s identifying compromised accounts or spotting identity fraud, reverification helps protect both your platform and your customers.

Improved Data Quality

Customer data doesn’t stay accurate forever. People move, change names, update documents, or even change their nationality. Without a system for checking and updating that data, businesses end up relying on outdated or incorrect information. Reverification ensures that your customer records remain current, complete, and usable across departments—from compliance to customer support.

Regulatory Compliance

In many industries, compliance isn’t just important—it’s mandatory. Reverification helps businesses meet the ongoing KYC and AML obligations required by regulators. By scheduling periodic checks or responding to key risk triggers, companies demonstrate due diligence and reduce the likelihood of audits, penalties, or license risks.

Strengthened Customer Trust

Customers are increasingly aware of security and privacy risks. When businesses take proactive steps to verify their identity data and protect their accounts, it sends a clear signal: you care about their security. This kind of transparency and vigilance builds long-term trust, turning reverification into a customer loyalty driver—not just a compliance checkbox.

Proactive Risk Management

Reverification allows businesses to take control of risk before problems arise. Instead of reacting to breaches or regulatory flags after the fact, organizations with reverification protocols in place are positioned to spot issues early and act quickly. It’s a shift from reactive firefighting to proactive oversight—one that can save time, money, and reputation.

Challenges of Reverification

While reverification is critical for maintaining compliance and mitigating risks, it also comes with its own set of challenges:

Customer Fatigue

One of the most significant challenges is managing customer relations. Requiring customers to repeatedly submit the same documents or answer questions can cause “KYC fatigue,” where they become frustrated with the process. Striking a balance between security and convenience is essential, and institutions must work to streamline this interaction through user-friendly digital processes.

Data Management and Accuracy

Handling vast amounts of customer data efficiently is a major challenge. Institutions must ensure they are not only collecting the right data but also keeping it secure and accurate. This requires robust data governance policies and regular audits to ensure compliance.

Cost and Resource Intensive

Reverification, especially for large institutions, is both time-consuming and resource-intensive. Manual processes are not scalable, and while automation helps reduce costs, implementing and maintaining such systems can be expensive and technically complex.

Regulatory Variability

Financial institutions often operate across multiple jurisdictions, each with its own regulatory requirements for KYC and reverification. This regulatory patchwork makes it difficult to implement a uniform reverification process. Companies must navigate different rules and timelines, creating operational inefficiencies and increasing compliance risks.

Cybersecurity Threats

Every reverification cycle increases the amount of personal data collected and stored by financial institutions, which in turn makes them targets for cybercriminals. A breach of sensitive data could have catastrophic consequences for both the customer and the institution. Therefore, strong cybersecurity protocols must be in place to protect this sensitive information.

The Future of Reverification in KYC

The future of reverification in KYC processes will likely be shaped by continued advancements in technology and evolving regulatory demands. Several key trends are expected to shape the industry:

Increased Use of AI and Machine Learning

AI and machine learning tools are already playing a pivotal role in enhancing reverification processes, and this trend will only grow. Predictive analytics will allow financial institutions to anticipate changes in a customer’s risk profile before they happen, enabling proactive reverification efforts. These technologies can also help institutions prioritize which customers need immediate attention.

Ongoing Monitoring

Traditional reverification relies on periodic checks, but ongoing monitoring is becoming more feasible thanks to big data analytics and AI. Instead of waiting for an annual review, financial institutions can continuously monitor customers’ activities and instantly trigger reverification when they detect suspicious behavior or risk changes.

Improved Customer Experience

Companies are increasingly focusing on balancing compliance with customer satisfaction. In the future, expect to see more seamless digital KYC experiences, where customers can update their information with just a few clicks, using biometric identification or automated document submission processes.

Regulatory Evolution

Regulatory frameworks for KYC and reverification are likely to evolve to keep pace with technological advancements. Governments and regulators are already considering how blockchain technology, decentralized finance (DeFi), and digital identities could impact KYC processes, potentially leading to more standardized and secure methods of customer verification.

Reverification at Ondato: How We Support Clients

At Ondato, we know that reverification needs to be accurate, efficient, and low-friction—for both businesses and users. That’s why we’ve built our platform to support reverification as an integrated, flexible feature.

Clients can define specific triggers for reverification, such as document expiry dates, suspicious activity alerts, or changes in risk scoring. These automated rules ensure that reverification happens at the right time, without manual oversight.

Our user journey automation ensures reverification flows are smooth and intuitive, with options like one-click document uploads, biometric checks, and smart reminders to encourage fast user completion.

To meet compliance requirements, our platform supports local, regional, and international regulations, all configurable through the dashboard. Clients operating in multiple jurisdictions can customize reverification strategies without needing separate systems.We also offer deep integrations through our API, allowing reverification to become a seamless part of any app, platform, or workflow. Whether you’re running a neobank, insurance portal, or crypto exchange, Ondato can make reverification both effortless and reliable.

Last Thoughts

Reverification is no longer a secondary consideration in KYC processes—it is a core component of ongoing compliance and risk management strategies for financial institutions. As the regulatory landscape tightens and financial crime grows more sophisticated, regularly updating customer data and reassessing their risk profiles is crucial for protecting both institutions and their customers.

While reverification poses challenges in terms of cost, customer satisfaction, and data management, advances in AI, machine learning, and real-time monitoring offer solutions that can help companies manage these complexities effectively. As we look ahead, the financial industry will need to continue innovating to keep pace with regulatory requirements while delivering a streamlined, secure customer experience.