Compensa Life Vienna Insurance Group SE is a member of Vienna Insurance Group (VIG), the leading insurance group in Central and Eastern Europe. With a long tradition, strong brands and close customer relationships, the group comprises about 50 insurance companies in 30 countries. In the Baltic states, Compensa Life has been around since 1993. By developing insurance solutions in line with personal and local needs, the company is currently a leader in Lithuania’s life and health insurance sector.

Why Compensa Life Chose Ondato

Compensa Life came to us for the same reason many financial institutions do: Identity Verification (IDV) is a necessary but resource-consuming process. Manual IDV has several shortcomings. For example, a human employee having to check that all information matches is likely to take several minutes. Humans are also prone to fatigue, human error and even carelessness. Digital IDV helps fight financial crime, improve accessibility and streamline the customer experience.

So what Compensa Life needed was an accurate and efficient online process that would help them improve their user experience and allow the process to move to the digital space.

How Our IDV Solution Helped

Our IDV solution uses AI technology to streamline the onboarding process. Verifications take less than 60 seconds to complete with 99.8% accuracy. This means potential users do not have to wait to be verified and are less likely to abandon the onboarding process. We also ensure the highest standards of AML compliance with the latest KYC, GDPR and AML guidelines.

On top of that, our IDV uses registry checks to increase the accuracy of verifications. For their Lithuanian branch, we are able to check users with the Lithuanian Civic Registry to ensure fraud prevention.

How does Ondato’s IDV Work?

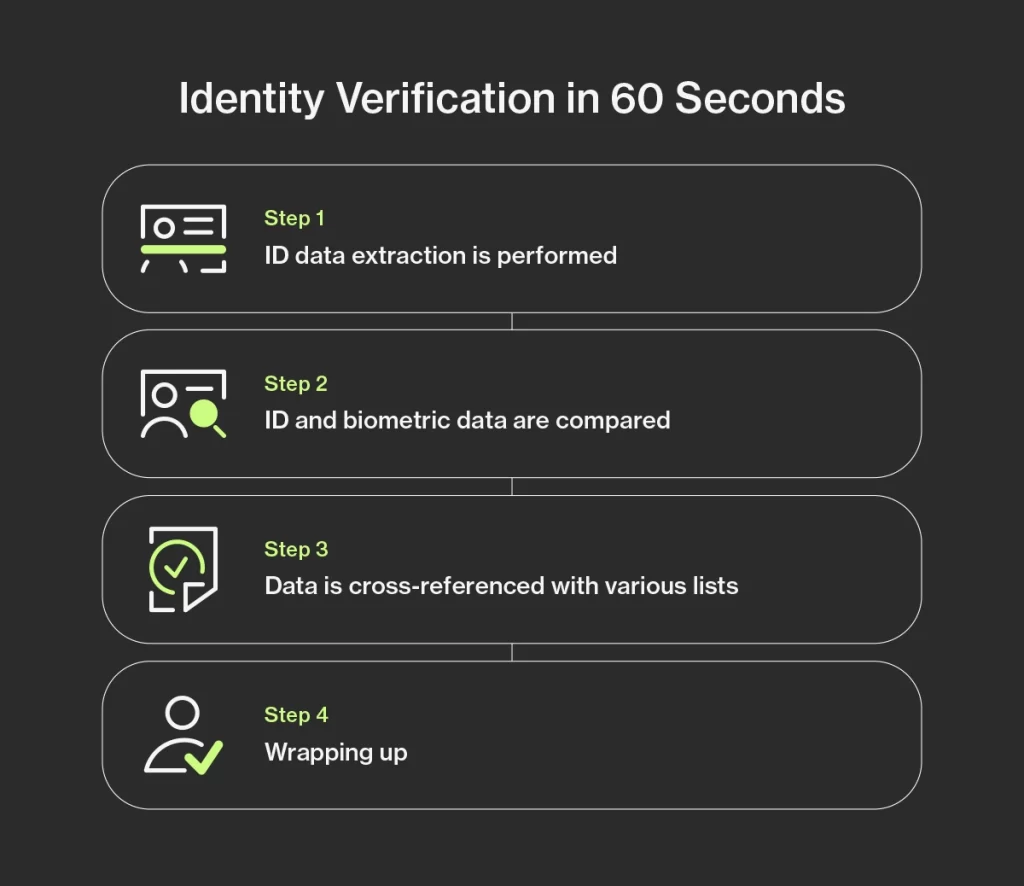

Ondato’s IDV includes 4 simple steps:

Data extraction

The user takes a selfie and snaps a picture of their ID document. Our AI then uses optical character recognition and various spoofing detection tools to check the validity of that data. This can be done with over 10 thousand different document types.

Triple matching

Once our AI confirms that the picture and the document are both legitimate, the biometric data of both pictures is compared to ensure they match.

Background analysis

The data is then cross-referenced with sanctions, adverse media and politically exposed persons lists. We currently work with over 15 thousand AML sources to ensure nothing can slip past the system.

Wrapping up

Once all of that is done, the user can continue with creating an account.

Last Thoughts

We have been working with Compensa Life since August 2020 and are very happy they continue to trust us with the delicate process of IDV. Here’s what they had to say about us:

“We take our clients’ experience and privacy very seriously, which is why we chose and continue to work with Ondato. We wanted an efficient identity verification solution, and that is exactly what we got. The client onboarding process we now employ is quick, accurate and easy to understand.”

Compensa Life