Document verification process is essential for document control, compliance, and risk management. Despite its importance, many businesses do not have an effective verification system in place. Neglecting the document verification process reduces safety, exposes businesses to misuse of service, financial crimes, and erodes user experience. More importantly, failing to implement adequate compliance measures may result in regulatory penalties.

This article discusses the most important aspects of document verification that you should be aware of in order to improve the effectiveness of your compliance program.

What is Document Verification?

Document verification process works by checking the authenticity of documents. It is used to verify the identity of the person submitting the document. KYC specialists can perform document verification both in person and online.

In the past, document verification was typically carried out in person, but as more businesses started transferring their services online, digital document verification became more common. The increase in digital services has sparked the growth of the compliance software market. Third-party services enable banks and other organizations to quickly verify their client’s identities and give them access to their services.

While some prefer to rely on human input, both in-person and online document verification are safe and trustworthy methods to verify someone’s identity. These methods serve as regulatory tools to prevent money laundering and identity theft.

How Does Document Verification Work?

Document verification is typically performed during the onboarding process. For example, during the in person verification, the KYC specialist or a trained bank employee thoroughly examines documents presented by the clients. They check the expiration date, ensure that the document is authentic and not forged, and compare the data provided on the document against various databases. Usually, this process is time consuming for both the bank and its clients.

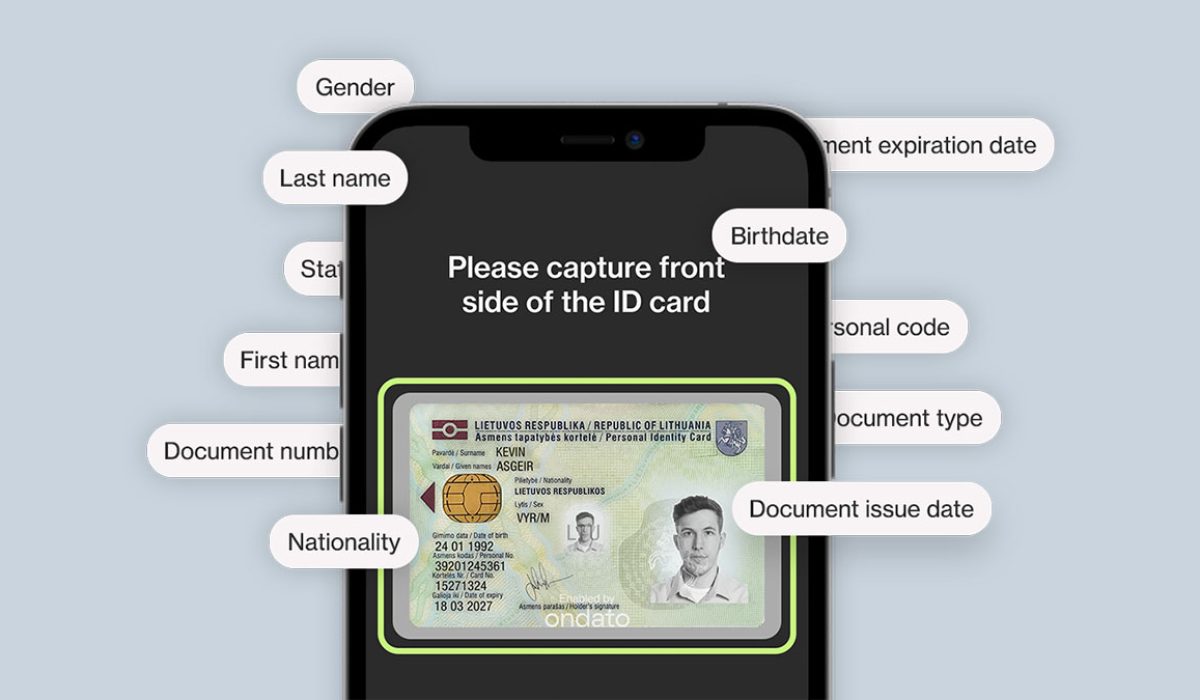

Meanwhile, digital document verification results in a much faster onboarding. The typical procedure requires a client to upload a photo of their document and take a selfie. The KYC software uses artificial intelligence and machine learning to verify the client’s identity online without requiring human intervention. It examines the document’s authenticity, ensuring that the document is not forged. Then, Optical Character Recognition (OCR) technology auto-fills the document data and compares it against various registries, such as lost and stolen documents and population registries. Machine learning technology speeds up the process from days to minutes. For example, Ondato IDV service, onboards new clients in under 60 seconds.

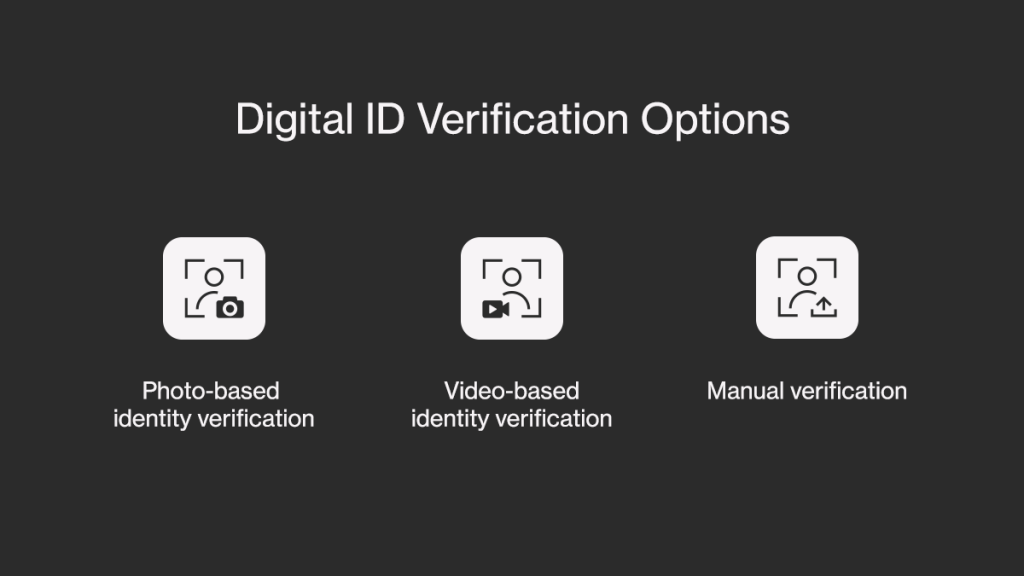

Since the digital ID verification process is a part of a broader identity verification (IDV) procedure, it can be performed in three most common ways:

- Photo-based identity verification. This type of verification requires a customer to take a photo of themselves and their document during the onboarding process.

- Video-based identity verification. Client documents can be verified via a virtual call with a compliance specialist.

- Manual verification. Clients can also submit copies of their documents for approval, and this method is most commonly used for documents such as proof of address.

What’s the difference between Document Verification and Digital Identity Verification

Document verification and digital identity verification may sound similar and are often used interchangeably, but they are two different procedures.

Document verification is an important part of the digital IDV process. During the process, a client submits a set of documents, such as a passport or driver’s license, which has to be verified by a company’s compliance specialist or KYC software. Document verification aims to ensure that a client’s documents are legitimate and not forged or stolen.

However, businesses must establish a full-scale identity verification procedure to ensure that a client is the rightful owner of the document. Identity verification falls under the broader procedure called customer due diligence.

During this process, important additional checks, such as proof of address, PEP, and others, are carried out. Most importantly, identity verification involves biometric checks, which means that the client’s biometric data matches the photo provided on the document. Regulators typically require identity verification, as document verification is insufficient to ensure adequate fraud prevention.

How Does Ondato Perform Document Verification?

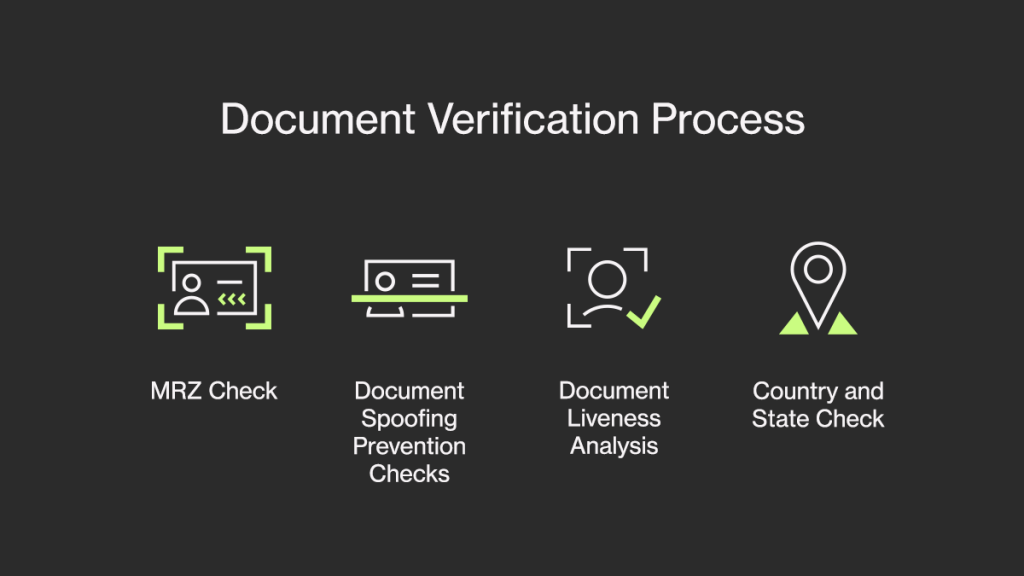

Document verification is a complex process that involves several different checks. There are several important steps that should be included in the document verification process.

MRZ Check

Machine Readable Zone (MRZ) is an area of an identity document that holds the document holder’s personal data. During the MRZ check, our system firstly decrypts the zone, then checks and crosschecks the checksums against the data printed on the document (Visual inspection zone).

Document Spoofing Prevention Checks

Ondato uses a deep learning engine for various checks, such as pixel distortion analysis, copy-replace detection, META detail analysis of identification media, and so on. This helps algorithms to detect any alterations made to the document and inspect for met description anomalies.

Additionally, Ondato has defined the natural and required color gradient percentage for each (international) document type. This helps the mechanisms detect if the media has the required color proportions.

Another important element of our document checks is the image depth analysis. Inspecting the depth of every media file received during identification helps to understand if an object in the media is 3D or 2D.

Document Liveness Analysis

The system checks if the presented document is legit by analyzing several factors:

- Replay detection (presentation attack) – system analyses if the document is presented as an original, not a replay from other device screens.

- Physical alteration – system analyses if the document was altered in any way physically (i.e., glued image on top, altered digits etc.).

- Reprint detection – system analyses if the document was printed on other material or if any unusual presence that is different than the original model needs to be.

- Pixel distortion analysis – system analyzes the received images for “broken “or duplicated pixels in order to detect digital manipulations of the document. This check also includes image META information analysis.

Country and State Check

The applicants’ documents are checked using the OCR method to ensure that they are not prohibited and are issued by recognized nations or states in accordance with the rules set by the company.

Benefits of Using Online Document Verification

The importance of document verification cannot be overstated. Let’s discuss its main benefits.

- Protection against identity fraud. Ensuring that a client is the rightful owner of a document can efficiently prevent identity fraud and prevent financial loss.

- Remote onboarding. Remote onboarding is only safe when businesses take adequate precautions. Document verification is one of the best measures to deter fraudsters, and illegitimate users businesses can take.

- Compliance with KYC and AML requirements. Document verification is part of regulatory compliance requirements. It assists in financial crime and fraud prevention.

- Age verification solution. Implementing document verification helps age-restricted service providers to confirm the age of their users. Paired with AI-based age checks, document verification is a simple and very effective way to deter from adult-only services and entertainment. For example, when a client provides theri selfie, Ondato’s Age verification tool can determine their age group with 95% confidence.

- Reduced inaccuracies and saved resources. Manual verification is prone to human error. Implementing digital document verification requires much fewer labor resources, saving money and time.

Conclusion

Document verification is a great tool to have in your arsenal when you need to prove your client’s identity or authenticity. It can be used in many different industries, from banking to healthcare, making it one of the most efficient methods to ensure that your clients documents are authentic.

While document verification can be performed manually, using a tool like Ondato serves as a much more reliable and secure alternative for both your company and your clients.