Accuracy, speed, and compliance are essential to efficient Identity Verification (IDV) processes. With this in mind, Ondato has introduced a game-changing solution: the highly advanced Optical Character Recognition (OCR) technology. This will allow companies to streamline Anti-Money Laundering (AML) and Know Your Customer (KYC) processes.

What is OCR?

OCR is a technology that automatically extracts data from documents or images containing text. It upgrades the way companies handle paperwork, eliminating the need for manual data entry and significantly expediting processes such as onboarding and verification. With the application of Artificial Intelligence (AI), OCR has evolved into a powerful tool capable of reading and digitising various document types with unprecedented accuracy and speed.

Ondato’s Cutting-Edge OCR Solution

Ondato’s OCR technology is a testament to innovation and precision. Initially integrated into their own identity verification and business onboarding solutions, Ondato now offers it as a standalone API integration for third-party use. This technology boasts remarkable capabilities, reading and digitising over 10,000 document templates in less than a second with an astonishing accuracy rate of up to 99.8%.

Global Accessibility and Multilingual Support

One of the standout features of Ondato’s OCR is its global accessibility. Effective across 186 countries and compatible with nearly all languages and alphabets, including non-Latin scripts and ideograms like those found in Chinese, Ondato’s OCR transcends linguistic barriers. Even documents of poor quality are no match for its prowess, as it ensures legibility and accuracy in all scenarios.

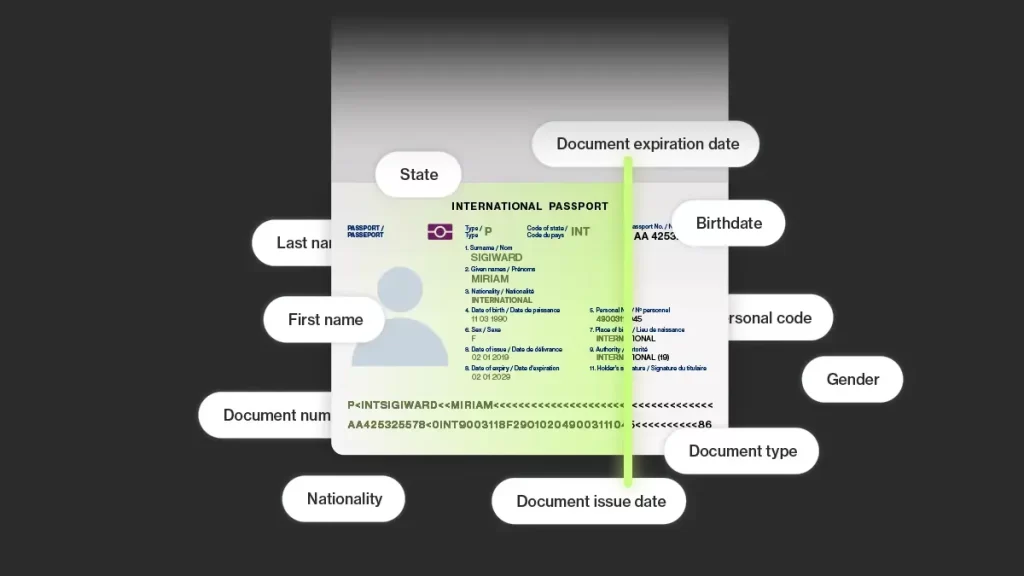

Understanding MRZ and VIZ

In the realm of passport verification, Ondato’s OCR excels. It seamlessly deciphers Machine Readable Zones (MRZs), the standardised zones on passports and visas containing crucial personal information. Additionally, it effortlessly navigates Visual Inspection Zones (VIZs), where human-readable information such as names, dates of birth, and nationalities are printed, facilitating manual inspection by immigration officers.

Compliance and Security

In an era of stringent data protection regulations, Ondato prioritises compliance and security. Data extracted through OCR is securely transmitted and stored on clients’ servers, ensuring adherence to regulations such as the European Union’s GDPR legislation. Furthermore, additional security measures, fraud detection, and spoofing checks can be integrated as needed, offering comprehensive protection against fraudulent activities.

Empowering Businesses Across Industries

Ondato’s OCR technology caters to any organisation that requires robust identity verification processes. Whether it’s KYC providers, financial institutions, or online platforms, Ondato’s OCR changes the way businesses operate, enabling swift and accurate onboarding processes while mitigating risks associated with human error and fraudulent activities.

Last Thoughts

Ondato’s AI-powered OCR technology emerges as a beacon of innovation in identity verification processes. By harnessing the power of AI and OCR, businesses can streamline their operations, enhance compliance, and deliver unparalleled customer experiences. With Ondato’s OCR, the future of identity verification is not just efficient—it’s transformative.