For a while there, we lived in a world where all communication was digital. And although everyone craved human connection, it did bring a few good things. For example, companies were forced to step up their digital game and move their processes online while keeping them efficient. Though we’re back to seeing each other face to face, digital onboarding has remained a constant for many companies simply due to convenience. So let’s look at what it is, how it works and why it might be the right solution for your business.

What is Digital Onboarding?

In the grand scheme of things, the definition of digital onboarding doesn’t differ much from manual onboarding. It’s the customer identity verification process a new user needs to go through before opening a new account with a service, just online.

Many financial institutions or other businesses must perform the customer onboarding process as part of their Know-Your-Customer (KYC) compliance. Although the steps themselves differ from company to company, they often include filling out forms, providing biometric data and being subject to a background check. Implementing a digital onboarding process enables it to be much more efficient and convenient for both you and your customers.

How Does Digital Onboarding Work?

There are a few key factors that go into the digital onboarding processes:

1. A customer submits all relevant data

Depending on the company, the steps may vary. For example, digital onboarding in banking requires a stricter process than some other businesses. In general, new customers submit a picture of their documents while the system captures a face image of them for comparison.

2. The system confirms the data of the customer using the submission

The system then uses either AI, a KYC agent or both and compares the two submissions to confirm they match. This includes spoofing, liveness detection and other fraud prevention features.

3. The system checks that the data is valid and up to regulations

After the customer passes biometric verification, the system then checks for any further regulations and performs validity checks. For example, checks the document against sanctions or PEP lists to examine the customer’s risk level or lost and stolen registries to ensure the document is currently in the possession of the rightful owner.

4. The data is collected for storing

If government regulations ask for it (as is the case in the financial sector), your company can then collect and store the provided data for additional steps.

Types of Digital Onboarding

Digital customer onboarding has a few methods to choose from to ensure every company’s needs are met.

Automated digital onboarding process

A type of onboarding that’s as simple as taking a photo. Pictures of the user and their document are captured, and the system takes it from there for a customer experience that is quick and easy.

Assisted digital onboarding process

A remote method that keeps you connected to your customers. Let the system verify your client in a real-time video call with the assessment of a KYC agent. All the customer needs to do is show their document to the camera for capturing.

NFC-based digital onboarding process

An online onboarding process that uses the newest NFC technology to immediately confirm the validity of data. One of the safest currently available identity verification procedures that is accessible to anyone with an NFC compatible phone.

Manual digital onboarding process

Allows KYC agents and customers to perform the onboarding process on their own time. Clients submit the information online which can then be checked at a later date.

The Benefits of Digital Onboarding and Automation

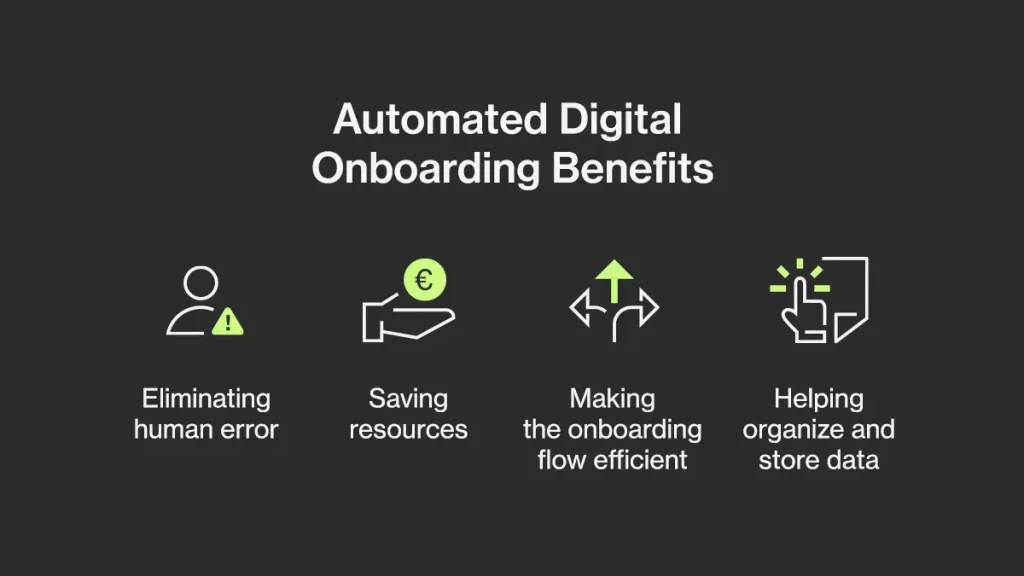

It’s estimated that the lockdown pushed online processes up by 7 years. It’s a significant number, but it also shows that procedures like automated digital onboarding are simply inevitable. So let’s see why that is and what benefits digital onboarding brings:

Eliminating human error

People are, well, people. So human error is bound to happen sometime. Luckily, AI can help. Long working hours, stress, and fatigue – these are all major factors in manual customer onboarding that do not affect automated processes, minimizing possible mistakes by a significant margin.

Saving resources

Possibly the most significant benefit provided by digital identity verification is avoiding unnecessary spending. All in all, human resources are less cost-efficient than an automated customer onboarding process. The money it takes to hire and train a KYC specialist team for on-site client onboarding can be cut in half by simply trusting the process to an automated system.

Making the onboarding flow efficient

Manual onboarding can require a lot of back and forth over multiple touchpoints, including filling out a series of forms, printing documents and verifying identities manually. Naturally, this takes up a good chunk of time and effort. Manually processing a single corporate client can take months, while automated processing can reduce this time to a few days or less, providing a frictionless onboarding experience.

Helping organize and store data

It’s simple: digitally stored data doesn’t take up space on your desk, your shelves, or your back room. When onboarding is done with physical documents, these documents can get lost, be destroyed, or just take hours to look through to find something you need. Investing in an automated system takes this data off your hands, literally.

Conclusion: the Best Way to Implement Digital Onboarding

At the end of the day, digital identity verification is the future for client onboarding. To avoid staying behind while your customers look for the most efficient way to get done with the process, you must invest in digital onboarding solutions. Ondato helps companies to figure out their needs, implement the process and adapt to the changes without major setbacks. Investing in an expert product helps make customer acquisition easier than ever.