Most compliance professionals are well aware that regulators can levy penalties not only when compliance programs fail but also when compliance measures are insufficient. As a result, obligated industries must implement a flawless risk-based approach to the Anti-Money Laundering (AML) program. For this reason, one of the most significant parts of an effective compliance program – PEP screening – should never be overlooked.

In this article, you will find out what a politically exposed person (PEP) screening is and how it can prevent financial crimes such as money laundering.

What is PEP Screening?

A politically exposed person is an individual that holds or has held a prominent public-sector role. Government officials, heads of state, high-ranking judges or military officers, and governors are common examples.

All high-ranking officials are considered to be higher risk due to their possible involvement in bribery, corruption, money laundering or other financial crimes. In order to prevent illicit activities, financial institutions and other industries must implement PEP screening processes. This process determines whether an individual is a PEP by screening official PEP lists.

How Does PEP Screening Work?

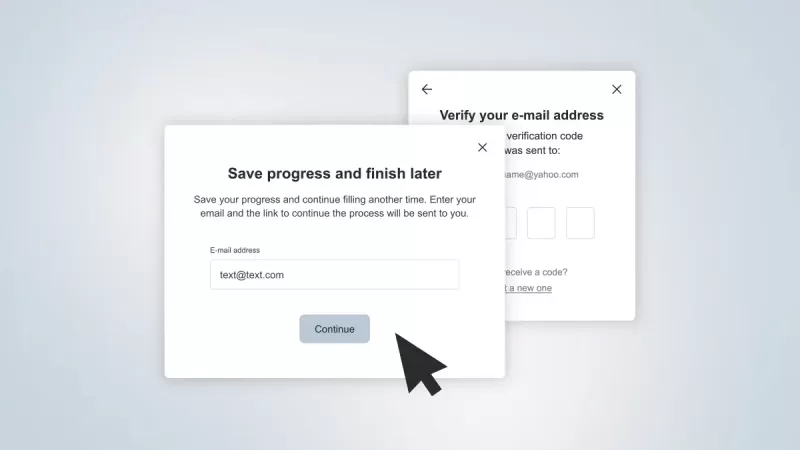

During the PEP screening process, a Know Your Customer (KYC) specialist or a screening service compares the client’s personal information against the PEP list database. An extensive PEPs check is an inherent part of a due diligence procedure that is performed during the customer onboarding process.

Since exposure to bribery and corruption is not limited to just politically exposed persons, their immediate family members and close associates can also be at risk if they attempt to take advantage of their association with the PEP in question. Other individuals who may fall under this designation include former PEPs and people who have been entrusted with handling money on behalf of a PEP – for example, an accountant or lawyer working for them. As a result, AML compliance laws require both PEPs and people associated with them to be treated as higher risk. It means that when a KYC specialist finds a client on PEP lists, they must begin an enhanced due diligence procedure.

Why is PEP Screening Important?

Just like sanctions screening, PEP screening is an essential component of a risk-based AML compliance program since it helps to mitigate potential customer risks. Individuals in prominent public positions are entrusted with important functions in a government or another organisation that could be abused for criminal purposes, such as fraud, bribery, or money laundering.

A PEP can also make decisions about large sums of money or critical infrastructure projects in their country. Effective politically exposed person checks can help financial institutions and law enforcement to prevent PEPs from abusing their positions of power.

It’s worth noting that failure to establish a client’s PEP status can result in hefty regulatory penalties. Businesses must monitor their customers and partners at the start of any business relationship and implement ongoing monitoring to avoid repercussions.

Why Should You Implement an Automated PEP Screening Service?

Unfortunately, there’s a lack of a single PEP list that consolidates all politically exposed person checks worldwide. This makes the due diligence process used to prevent financial crimes a complex and long procedure.

As a result, global companies spend a lot of resources checking all relevant lists when onboarding new clients and partners. The significant expenses related to labour and time spent on PEPs checks make manual screening inefficient.

With the market of effective KYC compliance software expanding, many companies have started abandoning manual processes and instead rely on KYC tools for PEP screening automatization. Minimising the need for human input boosts the speed of the screening process, lowers its cost, and allows companies to focus on their primary functions.

Automating the PEP Screening Process

Failing to notice a politically exposed person in time can damage any business relationship. That is why all financial institutions should invest in an efficient PEP screening process. This risk-based approach protects the company and avoids involvement of law enforcement agencies. Since the status can change anytime, regulators additionally require ongoing risk assessment and monitoring of any politically exposed person.

The best way to implement this for businesses is often investing in an automated PEP screening process. With Ondato, your company ensures PEP status is monitored in real time without additional resources or human error.