Before the pandemic started in 2020, many financial institutions were hesitant to step into the uncharted territory of digital onboarding. Some thought they would only be ready for digital transformation in 7 years’ time. But as lockdowns closed 22,500 physical banking and credit institution branches worldwide, organizations quickly had to implement digital identity verification methods. The crisis has sparked a rapid digitalization, which didn’t come without challenges.

Even though client trust in digital services has increased, their satisfaction remains low. Providers are still coming up short in a crucial part of their customer journey – onboarding. The frustrating signup process often leads to application abandonment, which in 2019 alone resulted in a $3.3 trillion loss for the global commercial and business banking market. To prevent financial loss, organizations trust the onboarding process to RegTech tools like Ondato. Let’s discuss how Ondato can help accelerate onboarding and not lose clients.

Efficient Customer Experience

According to the Digital Banking Report, the account abandonment rates correlate with the duration of the process. Apparently, the more time a client spends on the application, the higher the chances that they will quit the process. The abandonment rate increases by 40% if the process takes more than 10 minutes.

Companies should carefully consider the duration and complexity of their onboarding process. It’s important to understand that creating a streamlined and frictionless experience that aligns with strict KYC regulations is key to high success rates. The best way to do it is by making the user flow as short as possible.

Ondato’s identity verification tools are based on carefully researched and well-crafted user flows. While they depend on the regional compliance requirements, most flows require only a few steps, such as:

- The customer takes a selfie.

- The customer captures a photo of their ID or passport.

- The process is wrapped up after the customer signs the agreement documents.

How to Onboard Customers in Less than 90 Seconds?

Speed can make or break the onboarding process. To ensure fast service, you can enable OCR technology to capture the client’s details automatically, and they won’t have to manually fill in their name, birth date, and other information.

Additionally, implementing electronic signatures to sign documents without printing or downloading them will greatly improve customer experience and make the process faster.

The most important accelerator of KYC processes works in the background. As soon as the client provides their ID, their identity is automatically checked in various registries to prevent spoofing attempts, authenticate their identity, and evaluate a person’s risk score.

It’s important to think of small details that could derail the onboarding and implement solutions ahead of time. If a client starts a process in a device that doesn’t support camera function, implementing omnichannel technology can help quickly migrate the process to another device – without losing the progress.

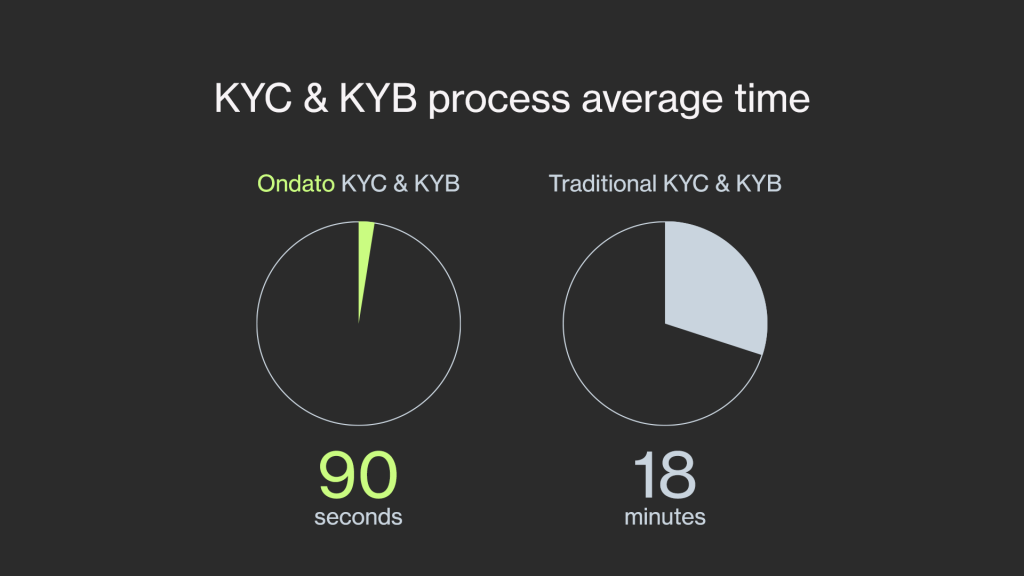

These technologies and functions allow Ondato clients, such as banks and other financial institutions, to onboard new clients in less than 90 seconds. In comparison, traditional banks take around 18 minutes to onboard clients digitally.

“Our focus is to provide a smooth and pleasing user experience so our users can perform their everyday tasks more efficiently,” says Ondato UX designer Tomas Gecevičius.

Customizable KYC Procedure

KYC may feel like solving a puzzle – you have to get all the pieces right. If the process is cumbersome and slow, you’ll lose clients right at the onboarding stage. If you miss something, you may be susceptible to hefty fines.

A centralized solution can simplify the KYC process by allowing you to build an effective KYC strategy based on local and international requirements.

You can customize the Ondato OS with these modules to check a customer’s background:

- IP and E-Mail Risk Scoring

- Sanctions Screening

- PEP Screening

- Negative Media Screening

- Registry Screening

- Proof Of Address

- Geolocation

- IP scoring

To verify documents, consider adding:

- OCR

- Spoofing Detection

Enable biometric confirmation such as:

- Facial Verification

- Biometric Face Comparison

Once you have your onboarding process ready, don’t forget that compliance doesn’t end with onboarding. To ensure that each client is in check with the latest KYB, KYC, AML, or CTF regulatory compliance requirements, you should monitor changes throughout the whole customer lifecycle.

Onboarding Clients with Safety in Mind

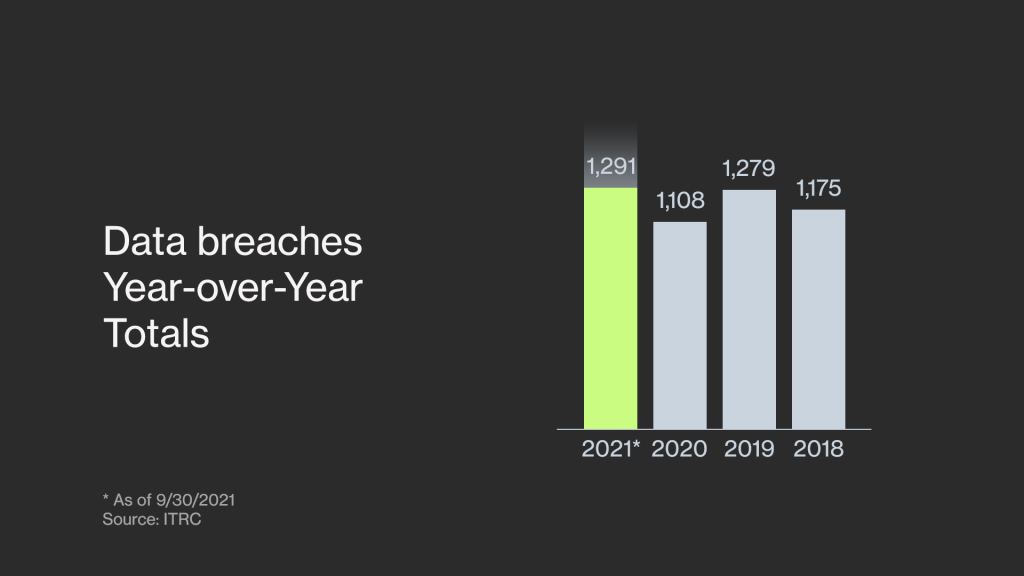

Safety has never been more important. According to ITRC, during the first three-quarters of 2021, businesses experiencing data breaches increased by 17%. You can make your clients feel confident that their sensitive data is safe by using a trustworthy third-party service.

We use only certified third-party technologies. Ondato facial recognition technology operates a $ 100,000 Spoof Bounty Program and passes NIST Level 1 & 2 PAD testing with 0% FAR, proving that it’s completely fraud-proof.

Our team of highly qualified professionals ensures the protection of our servers and information infrastructure. Our system is monitored around the clock every day. No security breach attempt slips through the cracks.

Furthermore, Ondato OS operates in compliance with international benchmarks. We are certified to the ISO/IEC 27001:2013 security standard that confirms that Ondato manages security holistically and comprehensively. We implemented efficient information security surveillance to address customer and architectural security risks.

Final Words on Customer Onboarding

Customers can get frustrated when they face a process that does not work. It has been estimated that as much as 33% of US consumers consider switching to another company after just one bad experience. That’s why organisations are losing millions during onboarding. Using trustworthy technology such as Ondato OS can increase your onboarding success rates.

“Ondato OS focuses on clients and their customers’ experience. We aim to become an essential day-to-day tool for compliance communities worldwide. With this in mind, we strive to provide a flexible, one-stop-shop solution to onboard customers quickly and efficiently,” says Ondato’s Product Owner Matas Bernotas. Learn more about our business verification platform here.