Many businesses strive to stay competitive by entering new markets, forming partnerships, and conducting cross-border transactions. However, with this increased global activity comes the risk of dealing with entities that may not always be what they seem. One of the most concerning types of entities is the “shell company.” Shell corporations can be used for legitimate purposes, but are also commonly associated with illegal activities like money laundering, tax evasion, and fraud. In this article, we will explain what shell companies are, how they work, why they are dangerous, and how companies can use KYB (Know Your Business) processes to identify and avoid them.

What Is a Shell Company?

A shell company or a shell corporation is a business entity that exist primarily on paper and have no active business operations, no or nominal assets, and no employees. These companies are often registered in jurisdictions with minimal regulations or oversight, making them an ideal vehicle for various illicit activities. A Shell corporation can be set up in tax havens where regulations around ownership disclosure are lax, allowing the actual owners to remain hidden.

However, not all shell companies are inherently illegal. Some are set up for legitimate reasons, such as:

- Holding assets for estate planning

- Structuring business operations for future expansion

- Facilitating mergers or acquisitions

The line between legitimate and illegitimate use of shell companies can be blurry, but the lack of transparency surrounding their ownership and operations makes them particularly attractive to bad actors.

Are Shell Companies Legal?

The legality of shell companies depends largely on their purpose and how they are used. At their core, shell companies are not illegal. Many jurisdictions around the world allow businesses to set up legal entities with minimal operational requirements. In fact, shell corporations can serve legitimate purposes, such as holding intellectual property, facilitating mergers and acquisitions, or managing tax obligations in a lawful manner.

However, it is the intent behind the use of a shell corporation that determines whether it crosses into illegality. When shell companies are used to conceal true ownership, evade taxes, launder money, or facilitate corruption, they often violate national and international laws. These illicit uses can expose the companies setting them up and any partners or banks involved to significant legal risks, including regulatory penalties, reputational damage, and even criminal charges.

In many jurisdictions, regulators are tightening oversight on shell companies, especially those operating in high-risk sectors or secrecy jurisdictions. Laws such as the U.S. Corporate Transparency Act and the EU’s Anti-Money Laundering Directives require more transparency around ownership structures, making it increasingly difficult for illicit shell corporations to remain hidden.

For businesses, the key takeaway is this: while shell companies themselves may be legal, their misuse is not. Proper due diligence and compliance processes are essential to ensure that your company is not inadvertently engaging with entities that use shell structures for illegal activities.

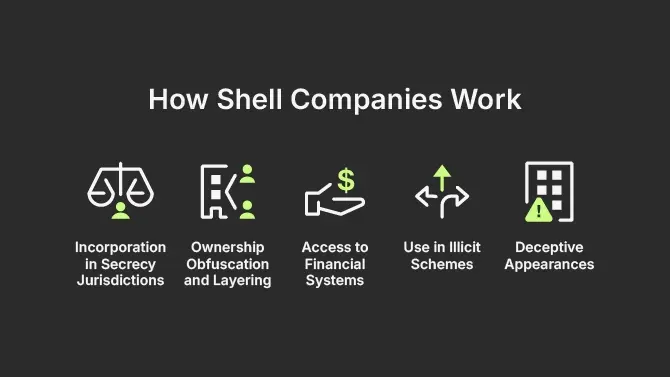

How Shell Companies Work

Shell companies operate by leveraging legal and regulatory loopholes to obscure ownership, disguise financial flows, and evade scrutiny. While not inherently illegal, their structure and function often make them attractive vehicles for illicit activity.

Incorporation in Secrecy Jurisdictions

Shell companies are frequently established in offshore financial centers—also known as secrecy jurisdictions—such as the British Virgin Islands, Cayman Islands, or Panama. These jurisdictions are known for limited disclosure requirements, low or no taxation, and minimal enforcement of beneficial ownership transparency.

According to the OECD and Financial Action Task Force (FATF), such jurisdictions contribute significantly to the opacity that enables global money laundering and tax evasion.

Ownership Obfuscation and Layering

A hallmark of shell corporation abuse is the use of multi-layered ownership structures, where one shell company owns another in a chain that crosses multiple jurisdictions. This technique, known as layering, makes it nearly impossible to identify the ultimate beneficial owner (UBO) without advanced forensic financial analysis.

Investigative reports such as the Panama Papers and Pandora Papers, published by the International Consortium of Investigative Journalists (ICIJ), exposed how networks of shell companies were used to hide billions in assets by politicians, criminals, and corporate leaders alike.

Access to Financial Systems

Once incorporated, a shell corporation can easily open bank accounts, sign contracts, and conduct cross-border financial transactions. Because many financial institutions struggle with effective UBO verification, these entities can move substantial amounts of money with little scrutiny.

A 2016 Global Shell Games study by the University of Texas and Griffith University showed that even in countries with strict AML laws, shell companies could be formed without verifying beneficial ownership in most cases.

Use in Illicit Schemes

Shell companies are frequently used in money laundering schemes, acting as intermediaries to “clean” illicit funds. They also play a role in fraud, bribery, sanctions evasion, and terrorist financing by masking the source and destination of funds.

The United Nations Office on Drugs and Crime (UNODC) estimates that global money laundering amounts to 2–5% of global GDP, and shell companies are often central to these operations.

Deceptive Appearances

To further their legitimacy, some shell companies go as far as creating fake financial statements, websites, and staff directories. These facades can deceive regulators, banks, and business partners—undermining trust and enabling fraudulent activity.

Shell Companies and Financial Crime

| Financial Crime Type | Description | Example |

| Money Laundering | Shell companies are used to disguise the origins of illicit funds through layering across multiple jurisdictions. | Russian Laundromat: Over $20 billion in illicit funds funneled through shell companies. |

| Tax Evasion | Corporations and wealthy individuals shift profits to low/no-tax jurisdictions using shell companies, avoiding home-country taxes. | LuxLeaks: Multinational companies used Luxembourg shell companies for secret tax rulings. |

| Corruption and Bribery | Shell companies conceal corrupt payments, such as bribes and kickbacks, and launder proceeds of corruption. | Petrobras scandal: Shell companies distributed bribes tied to inflated construction contracts. |

| Sanctions Evasion | Entities under sanctions hide ownership through shell companies to bypass restrictions and continue business. | North Korean shell companies used to evade UN sanctions and finance weapons programs. |

| Fraud and Deceptive Practices | Fraudulent businesses create fake clients, transactions, and inflated revenues through shell companies to deceive stakeholders. | Wirecard scandal: Shell companies fabricated revenues, contributing to one of the largest frauds. |

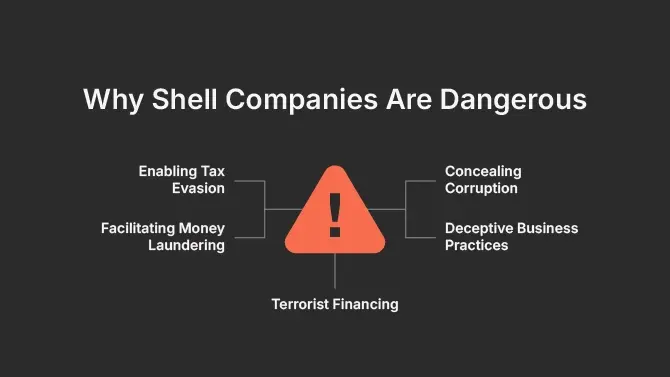

Why Shell Companies Are Dangerous

While not inherently illegal, shell companies are dangerous because they are frequently used for fraudulent and criminal purposes. Below are some of the key risks associated with shell companies:

Facilitating Money Laundering: One of the most common uses of shell companies is to launder illicit funds. Criminals use them to conceal the origins of their money, making it difficult for regulators to track where the funds came from and who controls them.

Enabling Tax Evasion: Shell corporations help individuals and corporations shift profits to low-tax jurisdictions, depriving governments of tax revenue. This results in billions of dollars in lost taxes every year, undermining public services and economic stability.

Concealing Corruption: Corrupt officials and businesses can use shell companies to hide bribes, kickbacks, and other corrupt payments. This lack of transparency in ownership allows bad actors to siphon public funds without detection.

Deceptive Business Practices: Shell companies can mislead investors, partners, or clients by masking their true financial health. They can be used to inflate stock prices, engage in fraud, or participate in other deceptive practices that harm legitimate businesses.

Terrorist Financing: Shell corporations are also known to be exploited by terrorist organizations to transfer and launder funds that finance illegal activities and violence.

Given these risks, it’s crucial for legitimate businesses to identify and avoid engaging with shell companies.

Shell Companies in the Context of KYC and KYB

Identifying and avoiding shell companies is vital in both KYC (Know Your Customer) and KYB (Know Your Business) compliance, helping prevent financial crime and ensure transparency in business relationships.

Due Diligence: KYC and KYB involve verifying company registration, ownership structures to uncover Ultimate Beneficial Owners (UBOs), financial activity, and jurisdiction of incorporation, especially in high-risk areas.

Unmasking UBOs: Shell companies often hide real owners through complex layers. Using registries, databases, and forensic tools, KYC and KYB processes help trace ownership and flag risks.

Risk Assessment and Monitoring: Businesses create risk profiles based on factors like jurisdiction and ownership complexity. High-risk entities require closer scrutiny and continuous monitoring for suspicious changes.

Sanctions and Watchlists: Screening entities and owners against sanctions lists, watchlists, and politically exposed person (PEP) databases is crucial to avoid shell companies linked to illegal activities.

Technology Integration: Modern solutions use AI, machine learning, and big data to automate due diligence and cross-check data in real-time, improving efficiency and accuracy.

Holistic Compliance: KYC and KYB should work together as part of a comprehensive compliance strategy, protecting businesses from legal and reputational risks while promoting global financial transparency.

How Businesses Can Detect and Avoid Risky Shell Companies

Companies must be proactive in preventing exposure to shell corporations. Know Your Business (KYB) processes are essential compliance tools designed to uncover hidden risks and maintain transparency. Let’s explore how KYB works in detail:

In-depth Due Diligence

KYB processes begin with comprehensive due diligence on any company a business intends to engage with. This includes a multi-layered verification process:

- Corporate registration documents: Confirming the legal status and registration of the company.

- Ownership structure: Identifying the chain of ownership to uncover the Ultimate Beneficial Owners (UBOs).

- Financial health and activity: Reviewing financial records and recent transactions to detect red flags.

- Jurisdiction of incorporation: Assessing the regulatory environment of the company’s home jurisdiction, especially if it’s a known secrecy or tax haven.

By conducting this thorough investigation, companies reduce the risk of dealing with shell companies that may conceal illicit operations.

Identifying Ultimate Beneficial Owners (UBOs)

Shell companies often use complex ownership chains to hide the identity of their real owners. KYB processes are designed to uncover these UBOs, who are the individuals with ultimate control over the company. Businesses leverage tools such as:

- Company registries and government databases

- Blockchain technology to trace ownership trails

- Third-party verification services and global watchlists

By making UBO verification a standard part of onboarding, KYB helps organizations spot suspicious structures early and avoid entanglement with hidden bad actors.

Risk Profiling and Continuous Monitoring

KYB isn’t just a one-time check, it’s an ongoing process. Companies must establish risk profiles for each entity based on factors such as:

- The industry the company operates in.

- The jurisdiction of registration, especially if it’s a known tax haven or secrecy jurisdiction.

- The ownership structure, including connections to high-risk individuals like politically exposed persons (PEPs).

Ongoing monitoring ensures that businesses detect any changes in ownership, business activity, or regulatory standing that could signal emerging risks. This vigilance is crucial in preventing financial crime.

Screening Against Sanctions and Watchlists

Shell corporations are often linked to sanctioned individuals, criminal networks, or entities involved in illicit activities. KYB processes incorporate screening against global sanctions lists, watchlists, and PEP databases. This helps businesses avoid inadvertently engaging with blacklisted entities or becoming a conduit for prohibited transactions. Regular updates to these watchlists ensure real-time protection against evolving threats.

Automating KYB for Efficiency and Scalability

Manual KYB processes can be slow and resource-intensive. Advanced KYB solutions now integrate automation, AI, machine learning, and big data analytics to streamline and enhance due diligence. These technologies can:

- Cross-reference multiple data points in real-time to identify inconsistencies and suspicious patterns.

- Flag potential shell companies that might otherwise go unnoticed.

- Scale compliance efforts, making it feasible for businesses to monitor thousands of third-party entities without sacrificing accuracy.

Automation not only boosts efficiency but also improves the effectiveness of KYB, ensuring businesses stay ahead of emerging financial crime risks.

Last Thoughts

Shell companies pose a serious risk to businesses and the global financial system, enabling money laundering, tax evasion, and fraud. Understanding how they operate is essential for any company in international trade or finance.

Robust Know Your Business processes help uncover ultimate beneficial owners, ensure compliance with global standards, and minimize risks. Ondato provides advanced KYB solutions that simplify compliance and protect businesses from hidden threats.