Many Anti-Money Laundering (AML) regulations employ a proactive approach to financial crime. This means that methods do not have to be exclusively used by criminals to be considered an offence. In this blog post, we will explore structuring in money laundering, how it is related to smurfing, why both practices are considered illegal and how companies can protect themselves.

The Consequences of Structuring

Money laundering practices such as structuring or smurfing are a serious crime under federal law. People found guilty of structuring can face up to five years in prison.

However, it’s important to note that the consequences of money laundering affect more than just the criminals. Financial institutions and any businesses dealing with AML processes run into several drawbacks when it comes to money laundering. Namely, money laundering:

- Undermines the legitimacy of the private sector

- Undermines the integrity of financial markets

- Causes economic distortion and instability

- Leads to a loss of revenue

- Causes huge amounts of reputational risk for businesses

On top of this, the failure to employ efficient anti-money laundering processes is punishable by harsh fines that often require more funds than the processes themselves.

It’s also worth noting that money laundering brings social consequences as well, including allowing drug traffickers, smugglers, and other criminals to expand operations. Additionally, it transfers economic power from the market, government, and citizens to criminals.

Are Structuring and Smurfing Illegal?

Yes, both structuring and smurfing are a form of money laundering. The goal of structuring is to make the illicit funds blend in with legitimate transactions, making it more challenging for law enforcement to detect and investigate money laundering activities. It’s important for financial institutions and authorities to be vigilant and identify patterns of suspicious transactions that may indicate structuring or other forms of money laundering.

Financial institutions are obligated to file a Suspicious Activity Report (SAR) if they believe a customer is manipulating transactions to evade reporting requirements. Almost any conduct that a bank deems suspicious can be covered by SARs.

The Financial Crimes Enforcement Network (FinCEN), which will look into the occurrence, must be informed. It is the duty of a financial institution to submit a report within 30 days, or, if more evidence needs to be gathered, an extension of up to 60 days may be requested. Importantly, the institution does not need to prove that a crime has been committed to submit SARs.

FinCEN requires that the SARs filed by financial institutions identify the following five elements:

- Who is conducting the suspicious activity?

- What instruments or mechanisms are being used?

- When did the suspicious activity take place?

- Where did it take place?

- Why does the filer think the activity is suspicious?

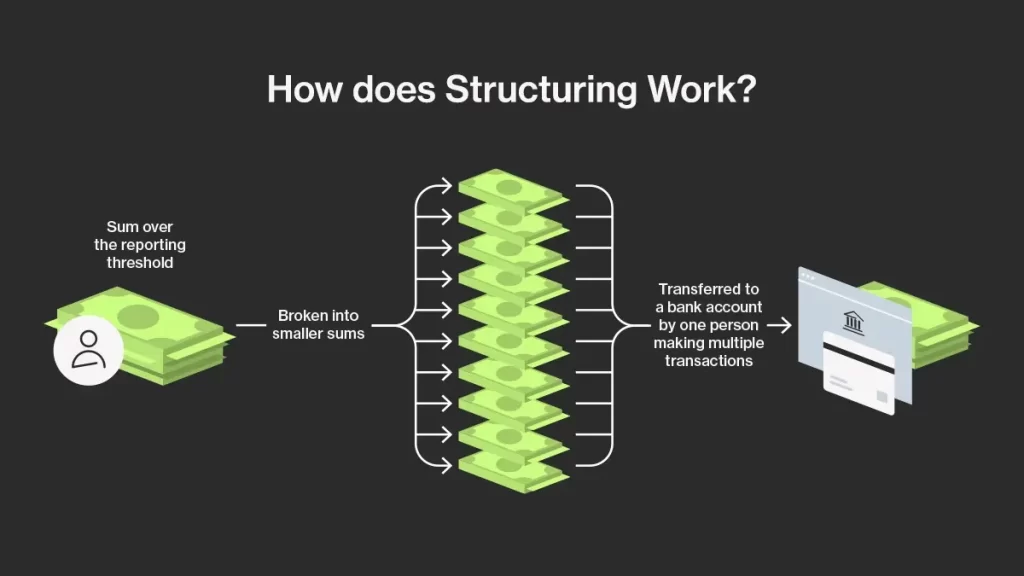

How does Structuring Work?

On the surface, structuring in money laundering is a simple method to trick financial institutions. It involves dividing money transfers into many smaller increments. The purpose of structuring is to stay below the reporting thresholds set by financial institutions and regulatory authorities. Transactions over $10,000 are often subject to reporting requirements, so by keeping each individual transaction below the reporting threshold, the money launderers aim to trick the financial institution and avoid detection.

In the case of structuring, instead of making one transaction of $80,000, a criminal would make ten smaller transactions of $8,000 instead. It is worth noting, however, that 10 transfers of $8,000 in a row are just as suspicious and likely to be caught by AML monitoring systems. That is why many fraudsters employ smurfing.

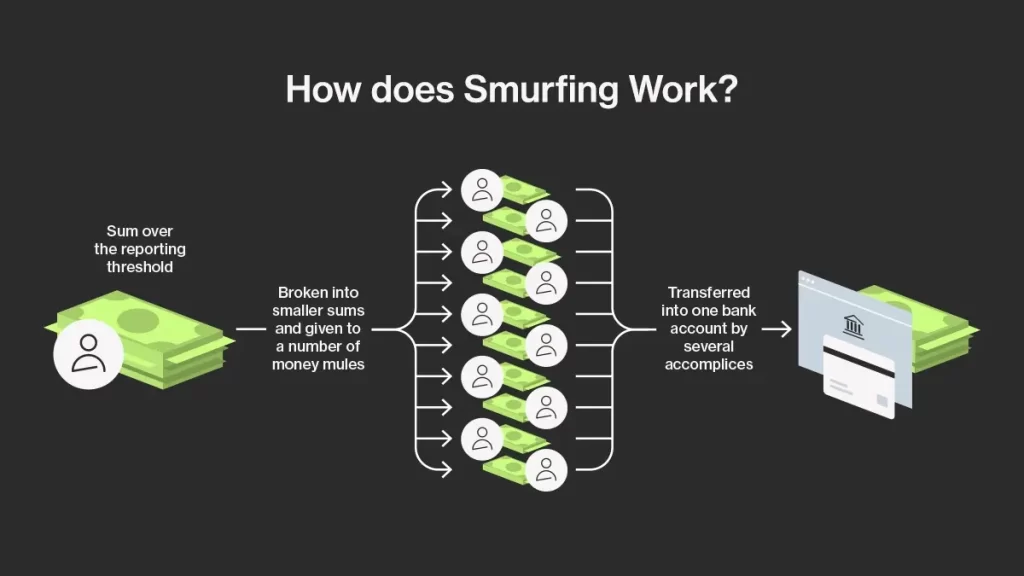

How does Smurfing Work?

Smurfing, similar to structuring, involves dividing larger transfers into smaller transactions. The main difference between smurfing and structuring is that smurfing employs the help of other people where instead of one person making multiple transfers of $8,000, ten different people make one transfer each. This method distributes the money across multiple transactions, accounts, or individuals to make them less conspicuous.

Much like structuring, the purpose of smurfing is to stay below the reporting thresholds set by financial institutions and regulatory authorities. Additionally, smurfing may involve a complex chain of transactions, with funds changing hands multiple times through multiple accounts and entities to further obscure the origin of the money.

How Ondato Can Help

Besides choosing the right Transaction Monitoring provider, The most important part of preventing financial crime, such as structuring and smurfing, includes taking measures before the crime actually takes place. That is why the best way to avoid structuring involves employing an efficient AML monitoring solution, which will help businesses ensure their clientele is trustworthy.

Ondato’s AML monitoring solution offers four tools to ensure your clients are who they say they are:

Global Sanctions

Utilise data that is updated every three hours to keep your client screenings current. This includes a worldwide sanctions list that includes information from all pertinent sanctioning authorities, such as the OFAC Sanctions List, UN Sanctions, and EU Consolidated List of Sanctions.

Politically Exposed Persons

Learn in-depth details on the pasts of those who play significant public roles. Get up-to-date information on a daily basis, gain an accurate understanding of risk scores, and access information on relatives and close associates (RCAs) with over 16 million PEP profiles.

Business Information Monitoring

Don’t miss any important details with 198 countries’ worth of business knowledge. Proactive risk management is made possible by our business information monitoring, which makes sure you’re always up to date on the most recent customer data and any potential changes.

Reputational Risk Media

With the help of this technology, organisations can identify risk-related news articles about their partners and clients promptly. Every day, our system scans 6.5 million articles to provide precise, high-quality information that enables you to respond appropriately.

Last Thoughts

Overall, smurfing and structuring are two money laundering techniques that, although simple on the surface, could land a financial institution in big trouble. And although important to AML processes, the ability to identify suspicious transactions isn’t enough to protect companies. Instead, preventative measures should be taken from the moment of customer onboarding.

FAQ

Placement:

The illicit funds are introduced into the financial system.

Layering:

The goal of this phase is to distance the illicit funds from their source.

Breaking Down Large Amounts:

The launderer breaks down the large sum of money into smaller, less conspicuous amounts.

Multiple Transactions:

The launderer conducts multiple cash deposits, each involving an amount that is below the reporting threshold.

Integration:

The final stage involves reintroducing the laundered funds into the economy in a way that makes them appear legitimate.