Since the inception of Anti-Money Laundering (AML) regulations, banks have had to perform a rigorous Know Your Customer (KYC) procedure. Through this process, policymakers ensured that financial institutions took part in effectively preventing financial crimes. However, they had missed an important loophole – a lack of beneficial ownership transparency.

Before law enforcement and policymakers discovered it, criminals had been devising complex AML schemes that went unnoticed due to anonymous shell company owners. This anonymity allowed them to conceal substantial amounts of suspicious transactions and avoid getting caught.

Years after the European Union introduced its first Anti-Money Laundering Directive (AMLD), regulators issued an amendment to fix the legal shortcoming. As a result, institutions now have to perform a procedure called Know Your Business (KYB), also known as Know Your Third Party (KY3P). The most important part of this process is establishing the ultimate beneficial owner (UBO).

Continue reading the article to unwrap everything you need about the ultimate beneficial ownership process.

What is an Ultimate Beneficial Owner (UBO)?

An ultimate beneficial owner (UBO) is a natural person (or persons) who owns or controls a legal entity and benefits from its profits. As per Know Your Business regulation, companies must provide the identities of their UBOs to respective registries. Meanwhile, an obligated organization should check these registries to identify the UBO before starting a relationship with a customer entity.

Following KYB regulation to the bone is necessary because customer-entities UBO may be anonymous or hidden by complex company structures. While it’s not illegal for the ultimate beneficial owner to not be a direct or well-known person, the situation poses an opportunity to hide financial fraud. For this reason, legal persons automatically pose a higher AML risk than natural persons and are subject to more rigid checks.

What is the difference between UBO and BO?

You’ll often notice that “ultimate beneficial owner” and “beneficial owner” are used interchangeably. While the definition is similar, there are important differences between these terms.

Both UBO and BO can be described as natural persons with some ownership privileges and shares in the company. Additionally, UBO and BO can gain profits and privileges related to the ownership of shares. However, the main difference is that the ultimate beneficial owner receives a much higher return and exercises significant control over the company.

What is the criteria for recognizing the ultimate beneficial owner?

Financial Action Task Force (FATF), the global money laundering and terrorist financing watchdog, has laid out specific criteria to identify beneficial owners of a legal entity:

- Individuals who own at least 25% of the capital or share capital.

- Individuals with at least 25% of the entity’s voting rights

- Persons with the power of attorney

- Legal guardians of minors

- Corporate directors specifically appointed to conceal the true owners

- Holder of anonymous shares, including bearer shares

Who is not considered an ultimate beneficial owner?

Sometimes, a person may hold shares in the company but doesn’t receive any benefits from them. This means a person is not a beneficial owner, no matter how many shares they own.

Shareholder’s benefits include:

- a right to the dividends

- company’s voting rights

- ability to benefit from the value of shares when the share is sold or transferred

When a natural person holds a share for somebody else, they are considered a non-beneficial owner. A non-beneficial owner can be a parent holding shares for their child who is a minor or a trustee who holds shares for the beneficiaries of a trust. It is important to note that using a non-beneficial ownership share-holding structure, such as a trust, allows holding shares anonymously.

Why Is Ultimate Beneficial Ownership Important?

Regulated entities need to know exactly who they are engaging with. Whether it’s their clients or business partners, validating the true identities of natural or legal persons is crucial to the regulatory compliance process. It also aids in preventing financial loss and protects the organization’s reputation.

According to the UN Office on Drugs and Crimes, global illicit proceeds total more than $2 trillion annually. Establishing the identity of a UBO prohibits a company from engaging in illegal activity, which may seek to avoid legal repercussions by concealing the beneficial owners’ identities. The anonymity allows for tax evasion, money laundering, corruption, embezzlement, terrorism financing, and other crimes. Bringing beneficial owners to light increases transparency and the security of the financial system.

UBO screening Regulations around the World

KYB regulations came into light after a serious tax evasion scandal exposed by the Panama Papers in 2016 demonstrated an enormous lack of transparency in the financial sphere. The 11.5 million leaked documents linked multi-millionaires, world leaders, politicians, and criminals to 214,448 offshore entities. Many of these entities became shell companies for various illicit activities, from bribery to money laundering.

The Panama Papers have prompted law enforcement around the world to take. As a result, numerous well-known public figures lost their jobs or were incarcerated, and dozens of countries have recovered $1.36 billion in unpaid taxes and fines.

The scandal had a tremendous impact, forcing legislators to fix gaping legal holes that allowed fraud to thrive. The European Commission was one of the first ones to react. In 2017, it included a requirement for beneficial ownership transparency in the 4th EU Anti-Money Laundering Directive (AML 4). The directive requires all member states to establish public registries for beneficial ownership. In turn, companies had to provide up-to-date ownership information on their beneficial owners. Meanwhile, regulated industries have to check this information once they start a relationship with a customer entity.

However, the United States, greatly involved in the Panama Papers scandal, still lags in beneficial ownership regulations. Its first AML regulation, which demands beneficial ownership transparency, may come into effect later in 2022 or early 2023. The Corporate Transparency Act (CTA) will require small legal entities, both domestic and foreign, to file information about themselves and the individuals who formed, own, and control them with a division of the US Treasury Department. Violations of the act could result in civil and criminal liability with up to five years in prison and civil and criminal fines of up to $250,000.

The demand to investigate ultimate beneficial owners of customer entities has become increasingly prevalent and is now required in 51% of high-income economies. In 2020, a total of 64 countries had this requirement imposed. However, it still needs to be implemented more often in low-income economies. Only 14% of developing countries have a regulation concerning the UBO establishment.

How to Establish an Ultimate Beneficial Owner?

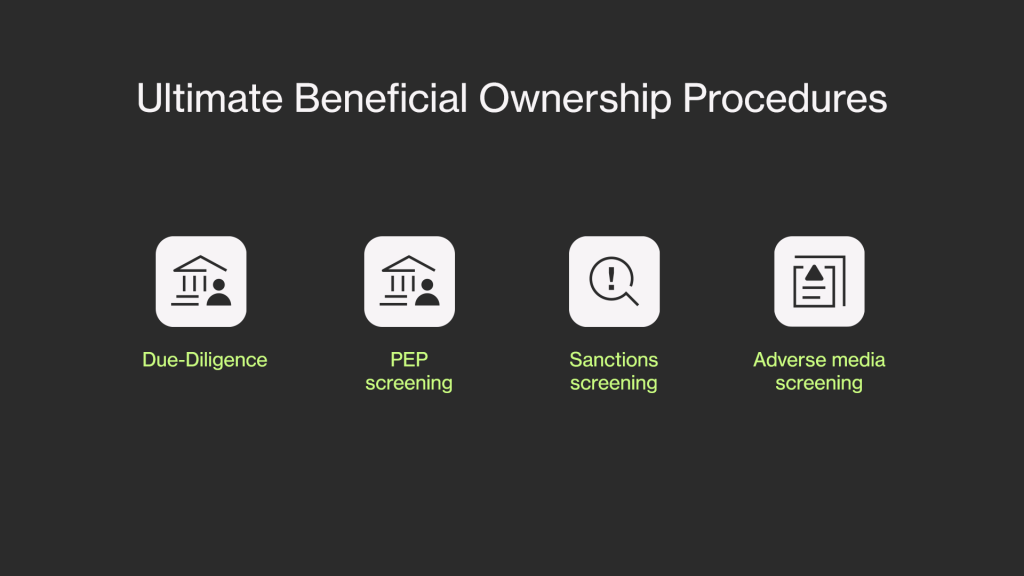

For the UBO check to be efficient, a regulated organization should implement an efficient KYB strategy as part of its AML compliance. The strategy should involve the following procedures: due diligence, PEP, sanctions and adverse screening, as well as ongoing monitoring.

Due-Diligence

Organizations should collect identifying information about their customer entity, such as the names and addresses of company directors. By checking ultimate beneficial ownership information, an organization can establish a company’s ultimate beneficial owners. In case the UBO check results in a high risk score, an organization might need to perform enhanced due diligence before proceeding with business relationships or implementing ongoing monitoring.

PEP screening

As the Panama Papers demonstrated, politically exposed persons may use shell companies to hide their illicit activities. They are also considered to be at greater risk of bribery and other financial crimes. Thus, organizations should screen their clients to establish their PEP status.

Sanctions screening

Sanctioned individuals are more susceptible to the use of shell companies as a way to illegally obtain access to financial services, requiring the organization to screen their clients against sanctions lists.

Adverse media screening

A customer entity’s reputation can be assessed by monitoring adverse news pieces written about it. Media stories can quickly demonstrate a person’s risk status when involvement with criminal activities is uncovered.

Ongoing monitoring

The regulations require performing these procedures not only at the beginning of the relationship with a client but also throughout the whole customer lifecycle. Thus, it’s very important to continue checking relevant registrars for up-to-date ultimate beneficial ownership information.

How Ondato can help you trace the ultimate beneficial owner

Identifying who benefits from a company’s profits is a complex and resource-intense process. Financial institutions and other obligated organizations to establish ultimate beneficial owners of their customer entities can minimize the burden by automating the compliance process. Any industry can quickly improve its compliance process by implementing Ondato OS into its daily operations.

Ondato OS is a complete compliance solution that streamlines KYC, KYB, and AML processes. By delegating the heavy lifting to our system, you will be able to save time and money while improving the performance of your compliance strategy.

From due diligence to adverse media screening, Ondato helps speed up all KYB and AML processes. Our system provides a comprehensive overview of each client and assesses their risk score. It enables you to manage the data of your clients throughout their lifecycle and automatically check relevant registries for up-to-date information.

Ondato can detect any UBO by quickly reviewing a significant amount of data. Here is a complete list of the information that our system may acquire on the company of interest:

- Basic registration

- Share Capital

- Official and calculated beneficiaries

- Shareholding and shareholders

- Directorship and managers

- Activity field

- Amount of employees

- Export and import

- Real estate

- Movable assets

- Subsidiaries

- Pledges

- Litigations

- Debts to third parties

- Tax debts

Conclusion

Establishing ultimate beneficial ownership is required by KYB regulations. This procedure is important to bring transparency to your business relationship and prevent money laundering, terrorist financing, and other financial crimes. The process is complex and resource intensive but can be easily streamlined with the help of regtech solutions such as Ondato.