Best Sanctions Screening Software 2026

Why is it important to choose the right sanctions screening solution for your business? The short answer is: one missed sanction can cost you a lot! We’re talking millions in fines, frozen accounts, and regulators who won’t forget your name. And it’s not going to get easier in 2026: regulations are getting tighter, criminals are becoming smarter, and your software might be lagging behind.

The best sanctions screening tools combine supreme data accuracy with intelligent automation, plugging seamlessly into your existing systems and helping your team work faster. But here’s what most buyers miss: the software that looks perfect on paper can be a nightmare in production.

So, which platforms will actually deliver in 2026? We’ve broken down the top sanctions screening providers on the market, highlighting their features, capabilities, coverage, and integration methods to help you choose the best provider for your business needs:

- Ondato

- AML Ranger

- Acuris Risk Intelligence

- Dow Jones Risk & Compliance

- Sanctions.io

- ComplyAdvantage

- LexisNexis Risk Solutions

- FircoSoft

- NICE Actimize

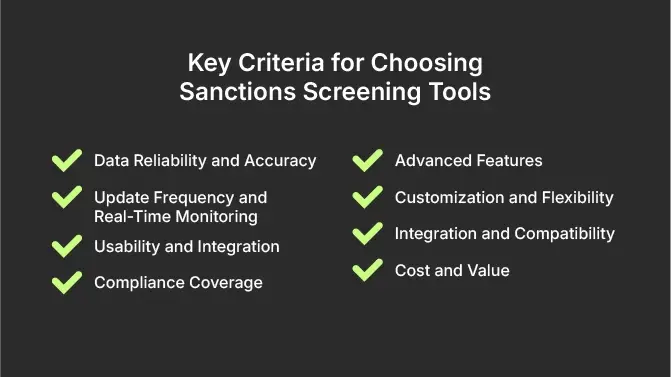

Evaluation Criteria for Sanctions Screening Tools

When you’re evaluating sanctions screening solutions, you’re really asking one question: will this tool catch what matters without wasting my team’s time?

Here are the key factors to consider when selecting a sanctions screening software provider:

- Data Reliability and Accuracy

The best platforms pull from comprehensive, verified global sanctions lists. Having reliable and precise data from global sanctions lists means that you will flag sanctioned individuals or entities correctly to avoid regulatory breaches. - Update Frequency and Real-Time Monitoring

Sanctions don’t wait for your software’s weekly refresh cycle. Look for the solutions that offer continuous and real-time updates to sanctions lists. It will help your business to respond quickly to emerging risks and regulatory changes without any delays. - Usability and Integration

If your new screening tool requires a complete workflow overhaul or doesn’t talk to your existing Anti-Money Laundering (AML) systems, you’ve just bought yourself a headache. The right solution should fit your tech stack seamlessly and make false positive management actually manageable. That’s why look for a solution that will be easy to use and integrate into your existing systems and workflows. - Compliance Coverage

If you have comprehensive coverage, there will be fewer gaps in your risk assessment. An effective screening process spans global sanctions lists, Politically Exposed Persons (PEP) databases, and adverse media monitoring. - Advanced Features

The sanctions screening best tools use AI, Machine Learning (ML), fuzzy matching, configurable rules, and intelligent automation to boost accuracy while cutting down on the manual busy work that bogs teams down. - Customization and Flexibility

Your business doesn’t operate like everyone else’s, so why should your compliance tools? Look for providers who offer customizable solutions, allowing you to tailor screening parameters, workflows, and reporting to match how you actually work, not force you into their rigid framework. Look for maximum flexibility to accommodate unique business processes and compliance objectives. - Integration and Compatibility

Choose a vendor who can clearly explain how their tool connects to your current systems. You need APIs and SDKs that seamlessly integrate with your existing software, databases, and platforms. Bonus points if it supports mobile and cloud access for teams that aren’t chained to a desk. Compatibility with mobile devices and cloud-based solutions is also important, especially if you have remote and distributed teams. - Cost and Value

Evaluate the provider’s pricing structure and overall value proposition. Make sure the price tag still looks good six months in. Smart buyers look past the initial cost and consider the long-term ROI and potential cost savings. So, it’s best to factor in the time saved, the risks avoided, the fines you won’t pay, and the reputation hits you’ll dodge.

Overview: Comparing Sanctions Screening Providers

| Core Sanctions Screening Features | Core Technology | Target Market | |

| Ondato | Integrated KYC & Screening: Provides sanctions checks (UN, EU, OFAC, etc.) as part of a broader, end-to-end digital onboarding suite. | AI/ML-powered matching designed for user-friendliness. Frequent data updates advertised as frequent.Strong API for integrating screening with ID verification. | FinTechs, online businesses, SMEs, banks, and companies seeking a single, seamless digital onboarding and compliance solution. |

| AML Ranger | Sanctions Screening AI Ranger: Real-time screening of individuals and entities against global lists, PEPs and adverse media | AI-powered context analysis to filter out irrelevant results and reduce false positives. Shared core technology with Ondato. | Law firms, mid-sized financial institutions, Compliance Officers, and businesses needing a focused, efficient, and AI-assisted AML/sanctions tool. |

| Acuris Risk Intelligence | Data and Research-Driven Screening: Provides sanctions data, specifically specializing in Enhanced Due Diligence (EDD) on individuals, PEPs, and adverse media. | Focus is on human-curated, investigative-grade data and detailed profiles, to achieve high-confidence match confirmation and false positive reduction. | Investigative firms, law firms, investment banks, and institutions requiring in-depth, human-vetted EDD for high-risk cases. |

| Dow Jones Risk & Compliance | Industry-Leading Data Feeds: Offers Sanctions Data Feeds & APIs, Watchlist Screening, and specialized data like Sanctions Control & Ownership (SCO) to identify controlled entities. | Focus is on data quality, coverage, and integrity. Data is often integrated into third-party screening platforms for the matching logic/workflow. | Large banks, global financial institutions, and enterprises that prioritize data quality and need a trusted, auditable data source. |

| Sanctions.io | API-First Sanctions Screening: Offers 75+ sanctions lists updated with high frequency. Includes PEP and criminal watchlists. | Smart-matching technology using NLP/ML for false positive reduction. Designed for simple, flexible API integration into custom applications. | FinTech startups, developers, SaaS platforms, and businesses prioritizing ease of integration, scalability, and usage-based pricing. |

| ComplyAdvantage | Real-Time Data and Watchlists: Provides screening against global sanctions, PEPs, and adverse media. Strong focus on real-time risk detection across the customer lifecycle. | A cloud-native platform an with AI-driven approach, using data science and ML to process data faster (minutes vs. months) and significantly reduce false positives. | FinTechs, challenger banks, and mid-market financial institutions that need modern, real-time, and scalable risk intelligence via API. |

| LexisNexis Risk Solutions | Integrated Risk Screening: Offers sanctions screening combined with solutions for identity verification, fraud, and KYC/AML workflow management. | Employs advanced entity resolution technology to link data across billions of records for comprehensive, accurate risk profiles and lower false positives. | Large, global institutions and corporations needing a holistic solution that ties screening, KYC, and fraud prevention together. |

| FircoSoft (Part of the LexisNexis/Finastra ecosystem) | High-Volume Transaction/Payment Screening: Historically focused on specialized real-time screening of payment messages, like SWIFT, and trade finance. | High-performance, low-latency filtering engine for processing massive transaction volumes quickly, with accurate fuzzy logic matching. | Banks, payment processors, and institutions with critical, high-speed transactional screening needs. |

| NICE Actimize | Enterprise Financial Crime Platform (WL-X): Offers sophisticated, centralized watchlist filtering (sanctions, PEP, etc.) as a module within a full-suite AML/fraud solution. | Advanced analytics and AI/ML for entity-centric risk scoring and reduction of false positives. Provides end-to-end investigation and case management tools. | Tier 1 global banks and very large, complex financial institutions requiring an enterprise-grade, highly scalable platform. |

Best Sanctions Screening Providers

To help you choose the right sanctions screening provider this year, let’s compare the 8 best sanctions screening software providers, and overview the key categories, such as: core features, coverage, integration methods, scalability, and customization options.

#1 Ondato

Ondato is a trusted name in the world of sanctions screening, known for its innovative approach and cutting-edge technology. Sanctions screening is a part of our broader business verification services offering that helps organizations maintain compliance with AML and KYB requirements.

Offering real-time watchlist updates, Ondato consolidates global sanctions lists (UN, EU, OFAC, etc.) refreshed every 3 hours, while its advanced algorithms and AI-powered tools reduce false positives for faster and more accurate screening.

- PEP data: 16+ million Politically Exposed Persons profiles with risk scoring.

- Adverse media: International negative news monitoring updated daily.

- SaaS platform: Cloud-based interface, just plug-and-play with minimal IT effort.

- Cloud-native scale: Processes large volumes in seconds, as AI tools maintain speed at high throughput.

- Flexible scaling: Handles from tens to thousands of screenings as business grows.

- Configurable checks: Adjustable screening parameters and risk scoring to fit compliance teams’ policies.

- Custom sources: API supports selecting specific lists or data sources as needed.

On top of this, Ondato offers a comprehensive pricing model that can adapt to the needs of both smaller and bigger companies. So, if you’re looking for a modern, intuitive, and reliable solution that delivers a balanced blend of accuracy, intelligence, and usability, Ondato is the best choice for 2026.

#2 AML Ranger

The newest AML compliance tool, designed by Ondato, offers dedicated sanctions, PEP and adverse media AI Rangers who scan global databases, process local and international news, and deliver real-time reports in just 30 seconds.

- Global watchlists: Access to international sanctions, watchlists, PEP and adverse media databases in 100+ languages, including local-language sources, for comprehensive coverage.

- Continuously updated: Uses Ondato’s constantly refreshed data sources for up-to-date screening.

- Web portal: Cloud-based tool available to use immediately with free monthly credits.

- API integration: Can be embedded into existing workflows, designed to integrate with banks’ systems via API.

- High-volume readiness: Assists teams in managing large data volumes efficiently through automation.

- Autonomous operation: Pre-configured AI models require minimal manual tuning with the focus on automated decision-making.

#3 Acuris Risk Intelligence

Acuris is a global data and analytical tools provider that offers sanctions screening solutions designed to help with compliance efforts. Their toolset allows companies to comply with regulations and mitigate the risk of engaging with sanctioned entities or individuals.

- Coverage: Focuses on sanctions, PEPs, global watchlists, and adverse media (over 30,000 global news feeds in 45+ languages), often used for strengthening EDD.

- Integration methods: Designed for real-time integration into existing KYC/AML and onboarding systems via API. Integrates directly into compliance workflows for initial screening, ongoing monitoring, and risk scoring.

- Scalability: Built to handle daily and real-time screening volumes and to scale with businesses operating across multiple jurisdictions.

- Customization: Uses AI/ML for intelligent matching to reduce false positives.

#4 Dow Jones Risk & Compliance

Dow Jones Risk & Compliance provides comprehensive sanctions screening solutions that enable organizations to identify and mitigate compliance risks effectively. With the help of an extensive database of global sanctions lists and regulatory data, their platform offers real-time screening, customizable risk scoring, and ongoing monitoring capabilities.

- Coverage: Access to high-quality data to screen for sanctions, PEPs, and adverse media, including Sanctions Control & Ownership (SCO) data to help organizations comply with the OFAC’s „50% rule” globally.

- Flexible Data Delivery: Primarily acts as a data provider, offering multiple delivery methods, such as Data Feeds, APIs, and integration within their RiskCenter applications.

- Partner-Dependent: Often requires integration into third-party screening platforms or proprietary systems for full AML workflow orchestration.

- Scalability: Highly scalable for banks and corporations needing to screen large, high-volume customer and counterparty data globally in real-time.

- Customization Options: Offers granular, specialized data content sets and customizable data feeds to build tailored, efficient compliance workflows.

#5 Sanctions.io

Sanctions.io provides comprehensive sanctions screening solutions that help businesses mitigate risk by screening individuals and entities against global sanctions lists and watchlists. Their platform offers smart matching technology, powered by NLP and ML, that reduces the number of false positives, with continuous monitoring and instant alerts available.

- Coverage: Provides global coverage of 75+ sanctions and watchlists from 30+ jurisdictions, 1M+ PEP profiles, and criminal watchlists, like Interpol, FBI.

- Integration: Offers a low-latency real-time Screening API and a batch Screening API endpoint. Simple, out-of-the-box integrations for common platforms like Salesforce and HubSpot.

- Scalability: Designed for automation and scale, capable of handling high-volume bulk operations.

- Customization Options: Allows users to customize screening logic, set triggers, and tailor the review workflow to match internal compliance policies. Supports screening against custom lists defined by the user.

#6 ComplyAdvantage

ComplyAdvantage offers a modern and dynamic sanctions screening solution powered by artificial intelligence and machine learning. Their platform provides real-time monitoring of individuals and entities against global sanctions and adverse media sources, helping businesses to efficiently manage compliance risks and reduce false positives.

- Coverage: Focuses on using data science and machine learning for fast data updates across global sanctions, PEPs, and adverse media. Includes crucial ownership data for compliance with the OFAC 50% rule and similar regulations.

- API-First & Modular: Utilizes a comprehensive, modular JSON REST API for integration, supporting real-time (synchronous) and bulk (batch/SFTP) processing.

- Scalability: Features an „API-first” architecture built for enterprise-scale and reliability across high-frequency and multi-format checks.

- Cloud native: Cloud-native architecture supports high availability and fast performance for mission-critical use cases.

- Customization: Every platform feature is accessible via the robust API, allowing developers to fully customize the screening stack. Offers flexibility in workflow design and the ability to define whitelisting via the API.

#7 LexisNexis Risk Solutions

This sanctions screening software is a full watchlist screening solution focusing on initial screening and ongoing monitoring. Offering access to 1,700+ global watchlists and sanctions sources, with advanced analytics to minimize false positives, LexisNexis incorporates AI/analytics to automatically resolve matches and cut down false alerts.

- Coverage: Using over 7 million profiles from the WorldCompliance™ Data across sanctions, PEPs, and adverse media.

- Integration: Integrates screening, intelligent decisioning, and case management tools in one solution to blend screening and monitoring into core banking and operational systems via APIs and workflow automation.

- Scalability: Offers robust batch and high-volume processing capabilities that scale to meet large transactional loads. Hosting options are flexible.

- Customization: Features a fully configurable interface allowing organizations to tailor screening thresholds and risk rules based on their risk appetite.

#8 FircoSoft

FircoSoft performs automated checks for sanctions, PEPs, adverse media, and dual-use goods (export control) as per organizational needs. It’s a part of LexisNexis/Accuity’s Firco line, integrating payment filtering, customer screening, and trade compliance capabilities, with a built-in workflow automation tool and advanced risk detection analytics.

- Coverage: A leader in watchlist filtering, as well as transaction and customer screening. They specialize in trade compliance screening, including checks for dual-use/controlled goods, vessels, and ports.

- Integration: The core filtering engine performs real-time transaction screening in milliseconds. And the Firco Compliance Link platform centralizes screening across customer, transaction, and trade activities, reducing silos through API connectivity.

- Scalability: Able to handle high-volume processing in global financial businesses. Provides options to configure infrastructure and hosting to meet specific high-volume workload needs.

- Customization: Offers customizable match logic and scoring to reduce false positives and improve operational efficiency. Allows configuration of screening logic and business rules across customer, payment, and trade activities.

#9 NICE Actimize

This sanctions screening software provider is an enterprise-grade platform helping businesses fight financial crime. It offers watchlist filtering and AI/ML analytics to screen customers and payments against sanctions and PEP databases, by incorporating fuzzy matching and facial biometrics for precise name matching and fewer false positives.

- Coverage: A broad, enterprise-grade solution covering fraud, AML, trade surveillance, and case management. The coverage spans from Customer Due Diligence (CDD) and KYC to transaction monitoring and real-time payment screening.

- Integration: Provides open APIs and standard connectors for integrating with core banking systems and third-party solutions. Offers enterprise-focused cloud platforms that support rapid deployment and reduced overhead.

- Scalability: Preferred by large global financial institutions for its ability to handle millions of daily transactions and complex multi-jurisdictional compliance requirements. Optimized for both on-premises and cloud-based deployments.

- Customization Options: Known for high customization potential, suitable for institutions with dedicated compliance and modeling teams to tailor rule sets and risk profiles.

What is Sanctions Screening and Why it Matters in 2026?

Sanctions screening is the process of checking customers, partners, transactions, and other counterparties against global watchlists to ensure an organization isn’t doing business with individuals or entities involved in financial crime, terrorism, corruption, or other prohibited activities.

In 2026, sanctions screening remains a very important compliance activity for financial organizations. Today’s geopolitical tensions, rapid policy shifts, and increased regulatory pressure have broadened global sanctions regimes even further, expecting FinTechs, crypto, logistics, telecom, and other financial businesses to know exactly who they’re dealing with at all times.

In other words, missing a high-risk match nowadays is a pretty serious matter that can result in reputational damage, heavy fines, and broken customer trust.

One of the ways to stay on top of sanctions and be compliant is AI-driven automation. Today’s AI systems can interpret context, understand linguistic variations, detect hidden associations, and adapt to changing sanctions conditions. AI helps compliance teams better prioritize what truly matters, focus on high-value decisions, and avoid mistakes and threats.

Therefore, the organizations that will be leading the way in 2026 are those that embrace smart, scalable screening technologies and tools that make compliance feel less like an annoying and costly obligation and more like a strategic advantage.

Final Verdict: The Right Sanctions Screening Provider for Your Business

Finding the right sanctions screening software solution for your business is an important undertaking: it has to fit your size, business complexity levels, and regulatory exposure. If you’re a startup that handles a few hundred sanctions checks a month, you don’t need the same power and feature range as a multinational bank managing millions of transactions daily to avoid financial crime risks.

What you need is to find a balance between accuracy, automation, speed, and cost-efficiency. And that’s exactly why Ondato stands out as the most balanced choice for 2026!

It delivers enterprise-grade precision without overwhelming smaller teams, and its smart automation makes compliance feel manageable rather than overwhelming. At the same time, AML Ranger shines as a focused, dedicated AI-powered solution for teams who need fast, intelligent, standalone screening.

Why Ondato is the best all-around choice:

- Real-time sanctions updates every 3 hours for always-fresh data

- AI/ML-powered matching that significantly reduces manual reviews

- End-to-end onboarding + screening in one seamless platform

- Flexible pricing and scalability for both SMEs and large institutions

- Highly configurable screening rules tailored to your risk appetite

- Cloud-native speed for high-volume screening without slowdown

Why AML Ranger is a strong, focused alternative:

- Dedicated AI Rangers for sanctions, PEPs, and adverse media

- 30-second risk reports with context-rich analysis

- Uses Ondato’s constantly refreshed data sources

- Plug-and-play web portal plus developer-friendly API

- Ideal for teams wanting a standalone, high-efficiency screening engine

In the end, the right provider is the one that meets you where you are and grows with you.