Anti-Money Laundering (AML) regulations have become increasingly stringent in recent years, requiring businesses to implement robust AML screening solutions to detect and prevent illicit financial activities. Choosing the right AML screening solution is crucial for effective AML compliance and safeguarding your business against financial crime. In this article, we’ll explore key components to help you make an informed decision when choosing AML software.

Factors in Choosing an AML Screening Solution

Regulatory Compliance

Ensure that the AML screening solution complies with the latest AML regulations in your jurisdiction. Different regions may have varying requirements, and your chosen solution should be able to adapt to changes in regulatory frameworks.

Data Coverage and Quality

Verify the coverage and quality of the data that the AML screening solution uses. A comprehensive database with up-to-date information is essential for accurate risk assessments. The solution should cover a broad range of data sources, including sanctions lists, Politically Exposed Persons (PEPs) databases, and reputational risk media.

Screening Accuracy

Assess the solution’s screening accuracy, as false positives can lead to unnecessary delays and operational inefficiencies. Look for a solution that employs advanced algorithms and machine learning to reduce false positives and improve the overall efficiency of the screening process.

Scalability

Consider the scalability of the AML screening solution. Your business may grow, and the solution should be able to handle an increased volume of transactions without sacrificing performance. Scalability is crucial for adapting to changing business needs.

Integration Capabilities

Evaluate how easily the AML screening solution can integrate with your existing systems. Seamless integration is essential for a smooth implementation process and ensures that the solution becomes an integral part of your overall compliance framework.

User-Friendly Interface

A user-friendly interface is important for the efficient use of the AML screening solution. It should provide clear and actionable insights, making it easy for compliance teams to review and investigate flagged transactions.

Customisation Options

Every business is unique, and your AML screening solution should allow for customisation to align with your specific risk appetite and compliance policies. Look for a solution that can be tailored to your industry and business model.

Ongoing Monitoring and Updating

Financial landscapes and regulatory environments are dynamic. The AML screening solution should offer continuous monitoring capabilities and regular updates to stay ahead of emerging risks and regulatory changes.

Cost Considerations

Evaluate the total cost of ownership, including licensing fees, implementation costs, and ongoing maintenance. While cost is a factor, it’s crucial not to compromise on the effectiveness of the AML screening solution.

Deciding Between API Integration and Platform-Based Solutions

At Ondato, we understand how client needs may differ and offer two different methods of using AML screening solutions to ensure you can choose the option best suited for you.

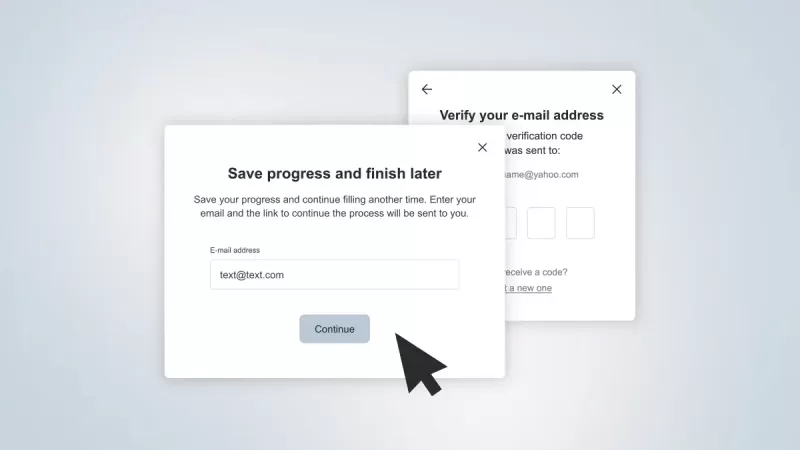

Ondato OS

Ondato OS is our platform-based solution that allows customers to use our system without needing any additional IT resources. In turn, it allows for instant integration. An all-in-one platform, Ondato OS enhances KYC and AML tools, saving you time and resources by automating the necessary processes.

It enables you to check over 15 million AML sources for information on PEPs, sanctions and reputational risk media, creating an easy one-stop-shop solution.

API Integration

The biggest advantage of API integration is the ability to customise your search parameters. While Ondato OS will look for a person in all databases at once, our API integration provides these search options:

- The PEP registry;

- PEP registry with only current PEPs;

- PEP registry only for people linked with PEPs;

- Sanctions lists;

- Sanctions lists with only current sanctioned persons;

- Sanctions lists with only former sanctioned persons;

- Reputational risk media;

- All databases at once.

| Ondato OS | API integration | |

|---|---|---|

| Compliance | Fully compliant | Fully compliant |

| AML sources | Over 15 million | Over 15 million |

| Data quality | Verified, quality data | Verified, quality data |

| Accuracy | Broader results | Narrower results |

| Integration | No IT resources needed | IT resources needed |

| Customisation | Some customisation options | Many customisation options |

| Interface | User-friendly, Ondato interface | Your own system interface |

| Monitoring and updating | Continuous | Continuous |

| Costs | Depends on the tools, same as API integration | Depends on the tools, same as Ondato OS |

Last Thoughts

Choosing the right AML screening solution is a critical decision for businesses operating in regulated environments. By carefully considering regulatory compliance, data coverage, screening accuracy, scalability, integration capabilities, user-friendliness, customisation options, continuous monitoring, audit trail features, and cost, you can make an informed choice that aligns with your business needs and helps mitigate the risks associated with money laundering and other financial crimes. Remember that an effective AML screening solution is an investment in the long-term integrity and security of your business.