Selecting the appropriate Know Your Customer (KYC) and Anti-Money Laundering (AML) solutions is crucial for putting into place effective procedures that aid in preventing fraud and safeguarding your business. Based on G2 review data and a number of other considerations, we will contrast Ondato vs. Persona in this post.

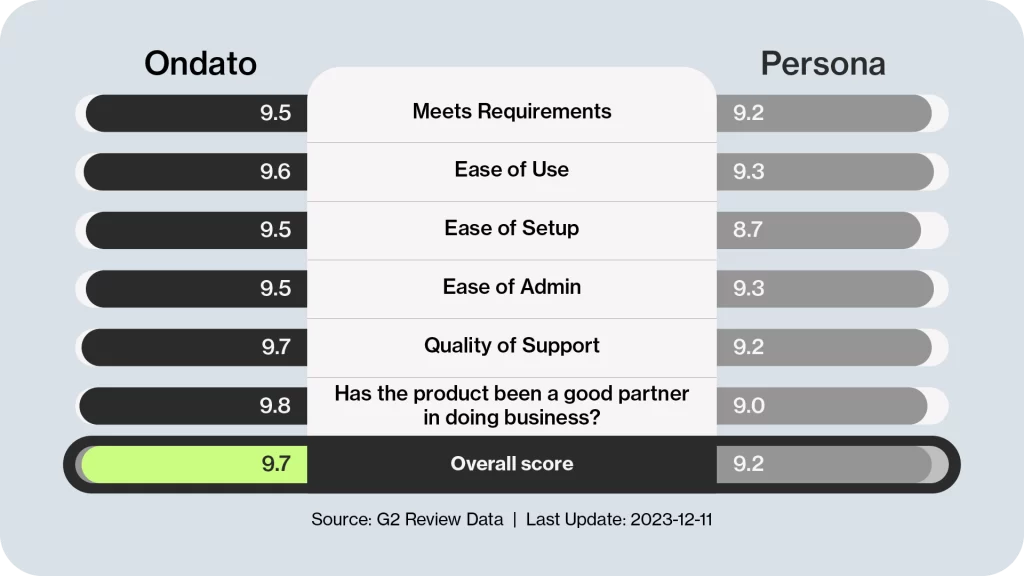

As evident in the table above, Ondato is considered a better KYC and AML solution provider due to how easy it is to set up and use, and how satisfying it is to work with Ondato.

Technological and Coverage Factors

Global Presence

In the sphere of technology and coverage, Ondato distinguishes itself with its worldwide impact and cutting-edge capabilities. Ondato provides services globally, excelling in identity verification, business onboarding, and AML screening for diverse businesses and users across numerous countries and regions. Ondato’s reach spans 192 countries, offering extensive scanning capabilities for over 10,000 diverse document templates.

Compliance Standards

Ondato sets a high standard in regulatory compliance, particularly in KYC and AML adherence. Its solutions and technologies empower businesses to adapt processes to meet the regulatory standards of any country. This includes flexible options such as photo-based identity verification with liveness checks and video-based verification with agents. Ondato remains at the forefront of technological advancements, leveraging artificial intelligence and machine learning for precise and efficient identity verification. The company has developed its OCR technology rooted in ML and AI, specifically designed for scanning personal documents and preventing forgery.

OCR Excellence

Ondato’s AI-powered OCR technology excels in accuracy, swiftly extracting relevant data from identity documents during onboarding. Capable of reading over 10,000 document templates in less than a second with up to 99.8% accuracy, it significantly enhances KYC and AML compliance processes globally. Ondato’s OCR is language-flexible, effective across various scripts, alphabets, and 186 countries. With a rapid learning curve, it can adapt to new documents or characters within two weeks, making it a dynamic and best-in-class solution. Additionally, it ensures compliance with data protection regulations, offering secure and audit-friendly data storage options.

Holistic Risk Assessment

Ondato’s unified AML software platform enables a comprehensive and holistic risk assessment. By consolidating data and insights, organizations can gain a broader view of customer activities, improving the ability to identify potential risks and suspicious patterns that may not be apparent with fragmented systems.

AML Data Sources

In AML compliance, Ondato stands out with due diligence measures by aggregating data from over 15 thousand global sources, including constantly updated sanctions lists, politically exposed persons information from over 16 million PEP profiles, and scrutiny of 6.5 million reputational risk media (also referred to as adverse media) articles daily.

Customization and Security

Ondato is a beacon of customization and integration, allowing businesses to seamlessly adapt identity verification processes to their unique needs. The platform offers various tools, including video-based identity verification and NFC-based identity verification for modern compliance and maximum security. Security is paramount for Ondato, with robust features protecting sensitive user data. The platform is GDPR compliant, adheres to the eIDAS regulation, meets ETSI technical standards, and is ISO 27001:2013 certified, showcasing a systematic evaluation of information security risks. Ondato employs unshareable and un-phishable biometric technology that successfully passes NIST Level 1 and 2 PAD testing.

Scalability

Ondato’s scalability accommodates the needs of businesses, offering flexibility as requirements evolve. Service prices are competitively set, with plans tailored for both small businesses and large corporations.

User-Centric Approach

User experience takes centre stage in Ondato’s identity verification process, prioritising a smooth and convenient journey for end-users, minimising friction, and optimising overall satisfaction. Ondato’s commitment extends to exemplary customer support, with a 24/7 assistance team ready to address implementation and troubleshooting concerns promptly, solidifying the platform’s dedication to customer satisfaction. Persona, on the other hand, does not currently offer 24/7 support.

Learn what we did for our clients – Ondato case studies

What Sets Ondato Apart?

| Ondato | Persona | |

|---|---|---|

| Client Dashboard | Yes | Yes |

| KYB information prefilling | Yes | No |

| Sanctions lists updated | Updated every 3 hours, 24/7 | – |

| Support 24/7 | Yes | No |

| Video call verification | Yes | Yes |

| KYC form filing | Yes | No |

| OCR technology | Yes | No |

| NFC Identity Verification | Yes | Yes |

| Supported languages | Most of the languages | – |

| Document templates | 10,000+ | – |