Explaining Ongoing Monitoring Practices in AML

As regulators tighten their grip and criminals get smarter, strong Anti-Money Laundering (AML) has become essential. At the heart of AML safeguards is ongoing monitoring – the cornerstone of due diligence. Today, regulators expect organizations to maintain an up-to-date understanding of their customers, their behavior, and their risk levels.

That’s why ongoing monitoring plays a critical role in enabling perpetual KYC (pKYC) and continuous risk assessment – the areas where many companies still struggle to keep up and where competitors are quick to point out gaps. In this article, we explore why ongoing monitoring matters, how to build an effective strategy, and what forward-thinking teams are doing to stay ahead of emerging trends.

What is Ongoing Monitoring?

Ongoing monitoring is all about staying in tune with who your customers are right now, not just who they were at onboarding. It’s the continuous check-in that keeps Customer Due Diligence (CDD) alive throughout the entire client lifecycle, helping teams make smarter, faster decisions as risks shift and new information comes to light.

By keeping customer data fresh and behavior in focus, ongoing monitoring helps organizations spot early signs of trouble, such as money laundering, terrorism financing, sanctions violations, and other financial crime risks. Ongoing monitoring also plays a big role in third-party risk management, giving companies the visibility they need to stay compliant, avoid unnecessary surprises, and protect their reputation.

And when something changes? Ongoing monitoring triggers reviews, whether that’s a sudden ownership shift, unusual transactions, or any anomaly that raises an eyebrow and requires a closer look. Future-oriented teams don’t see ongoing monitoring as another regulatory chore, but rather as a living, strategic practice that keeps their risk picture sharp and their defenses one step ahead.

The Significance of Ongoing Monitoring Processes

Ongoing monitoring matters because it helps you understand the current customer risk, spot suspicious patterns early, catch changes in customer behavior, and stay aligned with changing regulatory expectations, without slowing your operations down.

Non-compliance can be really costly, as global enforcement actions from bodies like the FATF, FCA, and FinCEN, impose massive fines for failing to continuously reassess customer risks. Recently, regulators have made it clear that the “set-and-forget” approach is no longer acceptable.

Instead, today supervisors expect automated, auditable processes that prove you’re monitoring customers consistently, documenting decisions, and acting on red flags in real time. In other words, an effective ongoing monitoring process is the operational backbone of a modern, fraud-resilient AML program.

Strategies for Effective Ongoing Monitoring

Risk-Based Approach

A risk-based approach means focusing your ongoing monitoring efforts where they matter most. For example, high-risk customers and transactions naturally call for deeper, more frequent checks, while low-risk profiles can be monitored with a lighter touch. It’s a smarter, more efficient way to allocate resources without compromising protection.

What’s changing today is how that risk is measured. With dynamic risk scoring, a customer’s risk level gets automatically updated as new data, behaviors, or events come in, eliminating manual recalculations or stale profiles. This real-time adjustment ensures your monitoring strategy stays aligned with today’s actual risk, not yesterday’s assumptions, giving teams a clearer and more responsive view of potential threats.

Advanced Analytics

Advanced analytics turns ongoing monitoring into a faster and more reliable process. By tapping into powerful data models, institutions can sift through massive volumes of information in real time and spot unusual behaviors long before they become real threats.

And AI and ML-driven anomaly detection takes this even further, identifying subtle patterns humans might miss and dramatically reducing false positives. Instead of being overwhelmed by constant alerts, teams get clearer signals, better context, and a more accurate view of what truly requires attention. Simply put, it’s a smart way to strengthen AML defenses while keeping operations efficient and focused.

Scenario-Based Monitoring

Scenario-based ongoing monitoring process gives teams a structured way to spot red flags quickly. Financial institutions can automatically flag activity that falls outside normal behavior by setting predefined rules and thresholds. Triggers, like sudden spikes in transaction volume, unusual payment patterns, or activity linked to high-risk regions, are activated.

For example, a customer sending multiple transfers just below a reporting threshold, or a first-time transaction routed through a high-risk jurisdiction, would immediately trigger a closer look. These simple, case-based scenarios help teams visualize real risks and respond with confidence, ensuring nothing suspicious slips through the cracks.

Customer Due Diligence (CDD)

Customer Due Diligence is one of the strongest foundations for effective ongoing monitoring because it gives you a clear, verified starting point for understanding who your customers are and what “normal” looks like for them. When you know their expected behavior, activity patterns, ownership structure, and risk profile, it becomes much easier to spot when something changes or when something doesn’t add up.

But CDD can’t stay static. A risk profile created at onboarding quickly becomes outdated if it isn’t revisited. That’s why modern teams are shifting toward perpetual KYC (pKYC) – a dynamic, always-on approach where customer information and risk levels update continuously based on new data, behavioral changes, or external triggers.

Therefore, CDD is not a one-off activity, but rather a process that grows with the customer, ensuring a proactive approach to managing risk across the entire customer lifecycle.

Collaboration and Information Sharing

A financial organization can’t see the full picture of a financial crime on its own. That’s why collaboration is such a powerful part of modern AML, when institutions share intelligence and insights to gain a clearer, more complete understanding of emerging risks and suspicious patterns.

Industry forums, information-sharing platforms, and public-private partnerships all help teams stay ahead of threats, rather than reacting to them after the fact. Cross-border data-sharing and global industry consortia make this even stronger, enabling organizations to spot shared risks that span regions, sectors, and jurisdictions.

Regulatory Requirements for Ongoing Monitoring

Global AML frameworks like FATF, the EU 6AMLD, FinCEN, and FCA, all share one core expectation: ongoing monitoring isn’t optional. Each regulatory compliance framework requires institutions to keep customer information current, track behavioral changes, and continuously reassess risk, not just rely on digital onboarding checks.

Most regulators also emphasize event-driven monitoring, meaning you must take another look whenever something meaningful changes, such as a shift in Ultimate Beneficial Ownership (UBO), new adverse media, unusual transactions, or any newly surfaced risk indicators.

And the consequences of getting it wrong are serious: non-compliance can lead to harsh penalties, including financial sanctions, license restrictions or suspension, enforcement actions, and long-term reputational damage that’s often harder to recover from than the fines themselves.

In short, ongoing monitoring is baked into every major AML framework because it’s the only way to stay genuinely aligned with evolving risk and stay on the right side of regulators.

Emerging Trends in Ongoing Monitoring

Ongoing monitoring is evolving fast, driven by smarter technology, tighter regulation, and a push for more adaptive, real-time risk management. Here’s what’s likely to be shaping the future:

Smarter Technologies

AI, machine learning, blockchain insights, and big data analytics are becoming the backbone of modern AML programs. Predictive analytics, network analysis, and advanced entity resolution are helping teams spot hidden connections and detect suspicious behavior with far more accuracy.

Automation and Perpetual KYC

Manual reviews are giving way to automated ongoing monitoring. With pKYC, customer risk profiles update continuously as new data, behaviors, or triggers emerge – meaning that organizations don’t just react to risks, they stay ahead of them, with fresher insights and fewer operational bottlenecks.

AI-Enhanced Alert Systems

While traditional rules-based alerts often flood teams with noise, AI-driven alerts prioritize what matters, learning from historical data and reducing false positives. As a result, you get a more focused workflow where analysts spend their time on real threats, not sifting through false alerts.

Behavioral Analytics

Institutions are moving beyond static rules and embracing behavioral analytics to understand what “normal” looks like for each customer. By mapping patterns, anomalies, and shifts in transactional behavior, organizations can quickly identify more sophisticated laundering tactics that traditional monitoring would miss.

Privacy-First Monitoring Practices

With data privacy regulations strengthening worldwide, the challenge is to monitor effectively while respecting customer rights. Organizations are adopting privacy-enhancing technologies and stronger data governance frameworks to keep sensitive information protected without losing monitoring precision.

Cloud-Based AML Ecosystems & APIs

Cloud-based AML platforms are making it easier to handle growing data volumes, global operations, and faster updates. API integrations connect different tools, databases, and workflows, creating a seamless ecosystem that strengthens monitoring, accelerates decision-making, and adapts quickly to new demands.

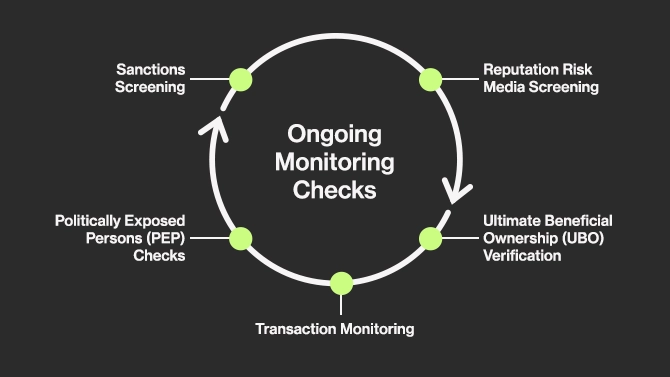

Ongoing Monitoring Checks

Ongoing monitoring helps businesses stay aligned with regulatory expectations, protect themselves from financial crime, and react quickly when something changes. Key checks incorporated into this ongoing monitoring framework include:

Sanctions Screening

Sanctions lists shift constantly as geopolitical events unfold, which means a one-time check isn’t enough. Regular sanctions screening ensures your customers aren’t linked to restricted individuals or entities. Modern RegTech tools make this easier by automatically tracking client names across sanctions lists and news sources, giving teams real-time visibility and reducing the risk of accidental violations.

Politically Exposed Persons (PEP) Checks

PEP status isn’t static. People get elected, retire, connect with other influential people. That’s why ongoing PEP monitoring is so important. By reassessing customer status regularly and applying Enhanced Due Diligence (EDD) when needed, businesses can stay ahead of potential corruption or bribery risks tied to high-profile individuals and their networks.

Adverse Media Screening

Adverse media monitoring helps you catch early warning signs that a customer’s risk profile might be changing. If a client appears in negative global news, that information can signal an increased AML risk. Keeping an eye on public sentiment and reputation shifts helps protect both your compliance standing and your brand.

Ultimate Beneficial Ownership (UBO) Verification

Criminals often hide behind layered ownership structures, making UBO verification essential. Ongoing monitoring helps uncover changes in ownership and identify individuals who may pose higher risks. With timely insight into who truly owns or controls an entity, businesses can take fast, informed action.

Transaction Monitoring

Transaction monitoring gives you real-time visibility into your customers’ behavior. By spotting unusual patterns, unexpected transaction sizes, or activity that doesn’t fit a customer’s profile, institutions can quickly flag and investigate suspicious behavior. It’s one of the most powerful tools for detecting potential transaction fraud or money laundering as it happens, not after the damage is done.

Examples of Ongoing Monitoring

Ongoing monitoring comes to life when you see how it works day-to-day. It’s a process that helps teams notice what’s changing, what’s unusual, and what needs a closer look.

EXAMPLE 1: Spotting unusual international transfers

A customer who typically sends small domestic payments suddenly initiates a series of large international transfers to high-risk jurisdictions. Automated monitoring immediately flags this shift in behavior, prompting a review before potential money laundering activity can occur.

EXAMPLE 2: Identifying a new PEP after a political change

A longtime customer wins a local election and steps into a politically exposed position. Ongoing monitoring catches this change through updated public records and news sources, reclassifying the customer as a PEP and triggering enhanced due diligence to reassess their risk.

EXAMPLE 3: Catching suspicious UBO patterns in layered ownership

A business client updates its corporate structure, and new beneficial ownership data reveals a complex chain leading back to an offshore shell entity. Ongoing monitoring surfaces this pattern, allowing analysts to dig deeper and verify whether the structure is legitimate or designed to conceal illicit activity.

EXAMPLE 4: Adjusting monitoring based on customer risk

Financial institutions and FinTechs don’t treat every customer the same, nor should they. Low-risk customers might be reviewed periodically, while high-risk profiles receive more frequent or real-time checks. This dynamic cadence ensures resources go where the risks are highest, without overwhelming compliance teams or slowing down the customer experience.

Final thoughts

Ongoing monitoring gives companies the tools to stay one step ahead of financial crime while protecting their reputation and meeting global regulatory expectations. And with cloud-based ecosystems, AI-driven alerts, and API-first architectures becoming the norm, the future of monitoring is only getting faster, more connected, and more proactive.

In the world where risk never stands still, ongoing monitoring empowers businesses to make better decisions, respond to risks as they emerge, and create a compliance framework that grows with them. Those organizations hat monitor continuously, adapt quickly, and build AML programs designed for the future, will ultimately thrive.