Vendors play a crucial role in business operations by providing essential services like cloud servers and consulting, but they are also common fraud targets. Over time, managing third parties has become closely linked to risk management, requiring companies to evaluate vendors carefully to protect their assets, a process known as Know Your Third Party (KY3P or KYTP). This due diligence procedure, often mandated by regulations, assesses third-party risks and implements measures to mitigate them. It involves verifying a vendor’s identity, analyzing its activities, and addressing money laundering risks to ensure transparency and safeguard business interests.

What is KY3P?

Know Your Third Party (KY3P or KYTP) is a third party risk management due diligence process that organisations perform at the beginning of a relationship with a vendor or any other third party. The purpose of KY3P is to determine the risk of third-party relationships and implement relevant procedures to mitigate the risk. Regulations require businesses to verify the identity of a third party, analyse its activities, and access money laundering risks.

What Risks Does a Third Party Pose?

Implementing an effective KY3P framework is not just a mere regulatory requirement. It is a widely accepted method to protect companies’ interests. Lack of transparency in a business relationship can have devastating consequences. If anything goes wrong, the organization may lose clientele, profits, and the trust of its investors. Thus, it’s important to be aware of the common risk factors third parties may present. The most common are reputational damage, non-compliance risk, and information security breaches.

Reputational Damage

Third-party relationships can cause customer dissatisfaction and diminish your reputation due to poor security, sensitive data breaches, violations of laws, or poor service. It could have terrible consequences for your business if you start a business relationship with a vendor who has pending litigation or bankruptcy.

Non-Compliance Risk

If a third party’s product or service is inconsistent with regulatory requirements and policies, this may hurt your company too. Non-compliance may disrupt business operations and bring regulatory penalties. That’s why it is important to run your third parties against PEP and sanctions registries and take appropriate risk mitigation activities if your vendor falls into these lists.

Information Security Breaches

Often, third-party vendors need to get access to sensitive company data. To ensure data security, you need to assess how the vendor stores and processes the collected data. It would be best to verify whether the vendor has any third or fourth-party involved. Failing these checks can leave your data available to unauthorized parties.

What Is the Difference between KY3P, KYC, KYB, and KYM?

KY3P is sometimes called third-party KYC or third-party due diligence. But as you may be aware, there are also KYC, KYB, and KYM procedures. While these processes are very similar, their goals and level of due diligence differ. Let’s take a closer look at the most important AML compliance procedures.

Know Your Customer (KYC) KYC has been around since the inception of anti-money laundering regulations and has become a standard practice for obligated industries. This verification procedure pertains to every client an obligated industry deals with. However, it usually refers to natural persons, for example, a new customer applying for a credit card. In this case, a bank would have to verify the client’s identity, perform due diligence to assess the money laundering risks, understand the source of the client’s funds and evaluate its legitimacy.

Know Your Business (KYB)For years after KYC was established, most obligated industries were not mandated to verify business partners and clients. The regulatory loophole posed significant AML risks and was fixed by mandating the KYB process. Now, obligated industries must verify the identity of a legal entity’s representatives and establish an ultimate beneficial owner — a person who directly benefits from the company’s profits.

Know Your Merchant (KYM): If you’re planning to start a relationship with a supplier rather than a client or business partner, you should implement a KYM procedure. The KYM process uses best practices from both the KYC and KYB procedures since the merchants can be both natural and corporate entities.

Know Your Third Party: KY3P is a due diligence process used for third party risk management. It is closely related to both KYB and KYM procedures and shares a similar due diligence process.

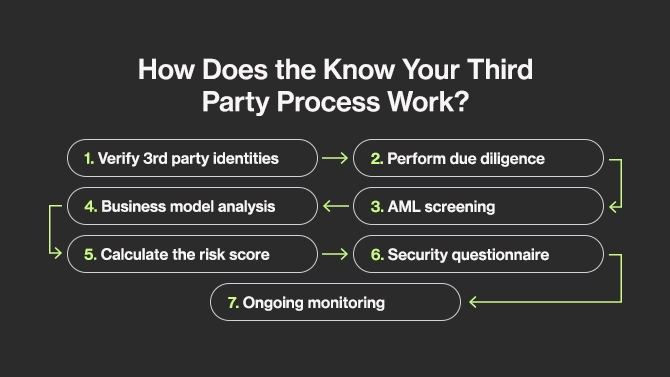

How Does the Know Your Third Party Process Work?

Getting to the bottom of who you work with is not easy. KY3P is an expensive and time-consuming process. Businesses must open compliance departments with suitable numbers of staff with up-to-date knowledge of ever-changing regulations.

Here are typical steps a KY3P compliance specialist should take.

- Verify the identity of the third party. The process includes business representatives and owners and can be made swift with technological solutions.

- Perform due diligence. During this step, you need to gather business registration information, names, addresses, and other relevant information. You may also need details on the business industry, managing directors, status, and incorporation date. After collecting relevant data, you should validate its accuracy against independent, trustworthy sources, such as government registries.

- Additionally, regulations require checking PEP (politically exposed persons) and sanction lists. Adverse media screening can also help assess the vendor’s reputation.

- Lastly, analyse the vendor’s business model, operations, and transactions.

- When you complete the due diligence process, you will have enough data to calculate the third party’s inherent risk score. This score will determine whether you need to take additional actions to mitigate third party risks and decide if a vendor matches your risk appetite.

- Don’t forget to send the vendor security questionnaire to gather data on the business’s compliance with security requirements.

- If the onboarding is successful, you need to implement ongoing monitoring. This procedure involves periodic checks on any changes in the provided information. For instance, implementing ongoing adverse media checks will immediately inform you about relevant media pieces. Monitoring the vendor throughout the relationship will ensure regulatory compliance and effectively mitigate new risks as they arise.

To mitigate the potential losses arising from manual processes, many companies, such as financial institutions, dedicate identity verification, due diligence procedures, and ongoing monitoring to regtech solutions, such as Ondato. Powered by the latest technology solutions, Ondato’s third party risk management program can swiftly verify and onboard vendors as well as improve operational efficiency. Our effective solution automatically assesses the risk score of your vendors and lets you know if there are any additional actions to take. The ongoing monitoring feature will not let you miss document expiration dates or other changes.

Last Thoughts

Know Your Third Party is a complex and resource-intensive procedure. However, it is an important step to ensure the business’s security and compliance with regulations when they cannot provide end to end services. Implementing an effective KY3P procedure can protect a company’s reputation, assets, and data security. While the process is expensive, many companies mitigate the costs by integrating a working regtech solution, such as Ondato.