If you’re somewhat familiar with the ever-changing compliance regulations, you probably already know that obligated industries such as payment service providers must verify their customers’ identities. In most cases, this applies to both natural persons and legal entities. Thus, the obligated industry must know its way around effective Know Your Customer (KYC) and Know Your Business (KYB) strategies.

However, to ensure good business practices, identity verification and other relevant Anti-Money Laundering (AML) checks should be applied to merchant relationships too. Although less well known, the Know Your Merchant and merchant onboarding practices are just as important. Continue reading the article to find out more about KYM.

What Is Know Your Merchant (KYM)?

Know Your Merchant is a security measure that organisations undertake upon entering into a relationship with a merchant.

The main aim of KYM is to perform a due diligence process on a new partner or client to verify their identity, establish the legitimacy of their service or business, and evaluate possible risks involved. In other words, it aims to make the process of onboarding merchants as secure and compliant as possible.

What is the Difference between KYM, KYB, and KYC?

KYM, also known as merchant verification and merchant KYC, is a part of merchant onboarding. Since the procedure is closely related to KYC and KYB, these terms are often used interchangeably. However, the procedures may differ, which is why it’s important to understand the differences.

Know Your Customer

KYC is a standard practice for most obligated industries such as payment processors. While often used as an umbrella term for all kinds of clients, both legal and natural entities, KYC pertains to customers who are typically natural persons. Examples are a new bank customer who wants to open an account or a person who decides to start trading crypto. In both of these cases, the service provider must verify the identity of these customers.

Know Your Business

KYB was established by policymakers much later than KYC. The procedure appeared to be an attempt to fix a legal loophole that didn’t require organisations to verify information regarding their business clients and partners. Now, obligated industries, such as every financial institution, must ensure they are aware of a legal entity’s representatives and establish an ultimate beneficial owner — a person who directly benefits from the company’s profits.

Know Your Merchant

As the term suggests, KYM pertains to commerce and wholesale goods suppliers — merchants. It aims to make merchant risk management efficient and beneficial to any industry. While merchants are typically corporate entities, they can be natural persons as well. It means that the KYM procedure involves best practices from both the KYC and KYB procedures to ensure the merchant onboarding process is smooth and efficient.

Know Your Third Party

KY3P is a due diligence process used to assess and mitigate the risk associated with third-party vendors. Third-party relationships are necessary for many businesses, but they pose many potential threats, such as data breaches and non-compliance penalties. Thus, ensuring an effective KY3P procedure can mitigate these risks.

How does Merchant Onboarding Work?

The KYM process requires gathering a wide range of sensitive personal information and performing complex risk assessment procedures.

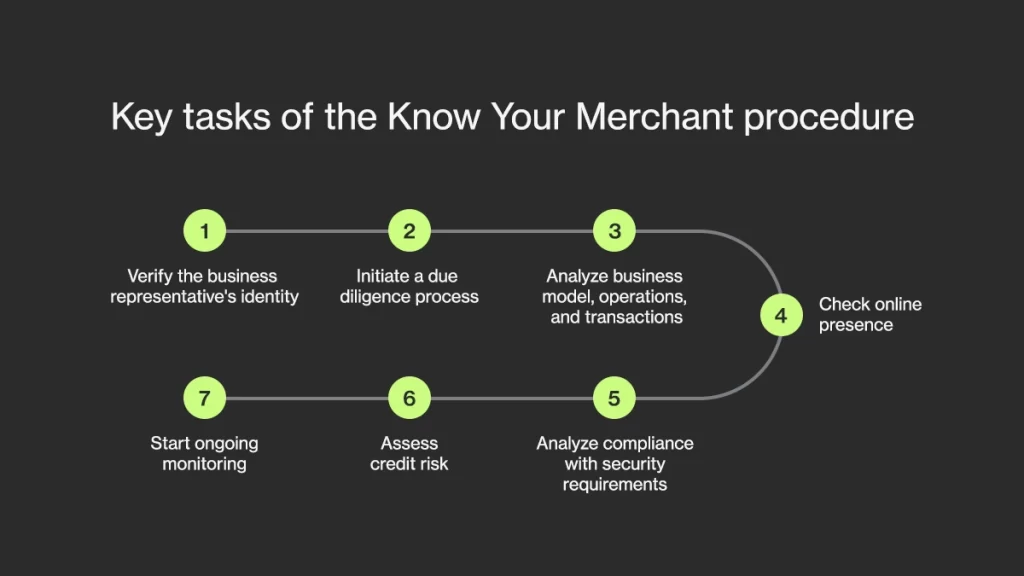

Here are the steps that you may be required to take during the merchant onboarding process:

- Identity verification for the representative and owners of the business.

- Running a due diligence process on the business and its owners. It involves PEP, adverse media, sanctions list checks, and a beneficial ownership search. During the due diligence process, you should also collect relevant information about the business, such as sales turnover, transaction history, business type, corporate registration documents, etc. The completed process should help establish a merchant’s risk score. If the resulting risk score is high, you may be required to complete an enhanced due diligence process.

- Business and operational model analysis paired with transaction analysis.

- Checking the merchant’s online presence. Often, fraudsters commit identity theft by posing as merchants in an attempt to receive payments without providing any services or goods.

- Analysing compliance with security requirements.

- Assessing risk with a merchant history check and analysing financial activity on the merchant account. These steps help implement stringent risk management procedures that fit the business

- Implementing an ongoing monitoring procedure for high risk merchants. Any information you gather throughout the onboarding process can swiftly change. Monitoring your merchant throughout the whole relationship will ensure compliance with regulation and effectively mitigate new risks as they arise.

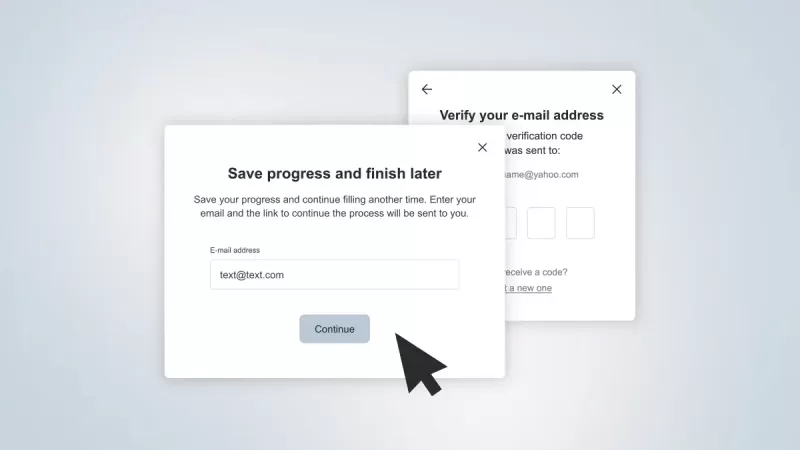

Know Your Merchant Process Automation

Traditional methods, such as asking a merchant to send you the relevant documents and manually performing checks, usually take weeks with no guarantee of data security. However, implementing automated merchant onboarding fixes this by making the process much faster and more efficient.

Regtech solutions, such as Ondato OS, can verify legal entities’ identities and perform various compliance checks with minimal supervision. It can easily adapt to each business’s goals and regulatory requirements, creating an individual, risk-based approach to KYM complaints and establishing a smooth merchant onboarding process.