What is Digital Verification? How It Works, Key Technologies, and Benefits

From banking to grocery shopping, these days we do almost everything online. The digital footprints that we leave each day are as significant as our physical ones. Therefore, with digital identity fraud and cybercrime on the rise, the main verification question today is no longer “Who are you?” but “How can you prove it’s you online?”

The quick (and best) solution is digital verification, a technology that ensures identities, transactions, and documents are authentic, secure, and valid in a virtual environment. This article will analyze digital verification, explore the core processes and technologies that make it work, and highlight the significant benefits it brings to businesses and consumers alike.

What Is Digital Verification?

Digital verification is the process of confirming the authenticity of a person, document, or transaction in the digital space, by using a combination of secure, automated tools and advanced technologies to establish that the digital identity or information provided is legitimate, accurate, and trustworthy.

Simply put, it’s a way to prove “you are who you say you are” or “this document/data is real” when operating online. Unlike traditional in-person ID checks, digital verification uses technology to validate identities and information remotely.

The global identity verification market is projected to grow from $13.75 billion in 2025 to nearly $40 billion by 2032. Source

For example, to open a bank account online, instead of visiting a branch with your passport, you can download a banking app, take a photo of your ID, and record a short video selfie. The system instantly verifies your identity and liveness against the document. Or, you can sign a legal contract electronically, through a digital verification process, by using an electronic signature and certificate, which confirms that your signature is valid and the document hasn’t been altered.

How Does Digital Verification Work?

Digital verification is a multi-step security approach that uses diverse data points to create a bulletproof layer of trust. In contrast to the good-old manual, in-person verification that could last for days or even weeks, the digital verification process is highly automated, allowing modern systems to perform complex checks in a matter of seconds.

Let’s break down the core components of the digital verification mechanism:

Digital Identity Verification Process

The first step is to confirm that the person accessing a service is the real-world individual they claim to be. It consists of the following actions:

Users upload images of a government-issued ID (like a passport or driver’s license). AI-powered systems scan the document to check for authenticity features (watermarks, holograms, fonts), and read the data via OCR (Optical Character Recognition) or MRZ (Machine Readable Zone).

Practically speaking, document verification helps catch fake or tampered IDs and is crucial for the Know Your Customer (KYC) regulations. On a more general level, verifying identity documents ensures the person isn’t using a forged or stolen ID, which helps prevent identity fraud and keeps businesses compliant with customer identification laws.

The next step for many digital verification flows is biometrics, i.e., asking the user to take a selfie or scan their fingerprint/face. Then, the biometric data is compared to the photo on the ID document to ensure they match, confirming that the person presenting the ID is the actual owner. Technologies like facial recognition with liveness detection (making sure it’s a live person and not a photo or a deepfake) can verify someone’s identity within seconds.

Since biometric factors are hard to fake, over 57% of companies now use biometric authentication as part of their security measures. All in all, biometrics provide a high-confidence factor, which dramatically reduces the risk of impersonation and meets compliance guidelines for strong customer authentication.

Two-factor authentication (2FA)

A simple but essential layer where the user provides an additional code, typically sent to a verified phone number or email, on top of their primary credentials. This ensures that the user has access to the claimed phone/email and acts as an extra hurdle for attackers.

Accounts that use multi-factor authentication are 99.9% less likely to be compromised than those relying on password alone. Source

The two-factor authentication step adds an extra layer of defense; even if a password is stolen, a fraudster can’t get in without that second factor, which reduces the chances of account takeover.

Address Verification

This step confirms that an individual lives at the physical location they claim. At this stage, the user might be asked to submit a proof of address document, such as a utility bill or bank statement, or the system may cross-check the provided address against databases.

Address verification is important for compliance with KYC and Anti-Money Laundering (AML) rules: regulators often require financial institutions to have a verified address for each customer. It also helps detect fraud patterns, such as multiple identities using the same address, or fraudsters using fictitious or stolen addresses.

Email and Phone Verification

This step confirms a user’s ability to receive communications at a given digital endpoint. A verification link or a one-time passcode (OTP) is sent to the provided email address and/or phone number (SMS), and the user must interact with the link or enter the code into the application. A simple and effective method, email/phone verification offers a decent defense against bot attacks and ensures a valid communication channel for account recovery and other critical security alerts.

Digital Signature Verification

Digital signatures have become commonplace for signing contracts, agreements, and forms online. This method helps ensure the integrity and non-repudiation of electronic documents.

A digital signature is a cryptographic code generated using the signer’s private key, called Public Key Infrastructure (PKI). When someone signs a document digitally, by using platforms like DocuSign, Adobe Sign, etc., the system creates a unique, encrypted fingerprint of the document and the signer’s identity. Digital signature verification provides legal certainty and confidence for digital contracts and agreements, ensuring compliance with the e-signature regulations globally.

KYC and AML Compliance

Digital verification solutions are often designed to meet stringent regulatory KYC and AML mandates. KYC requires businesses, especially financial institutions, to verify the identity of their clients. AML involves screening a client’s verified data against global sanctions lists, Politically Exposed Persons (PEPs) lists, and adverse media databases. Therefore, digital verification ensures that a business is not facilitating financial crime, fraud, terrorism financing, or money laundering, protecting both the company’s reputation and its legal standing.

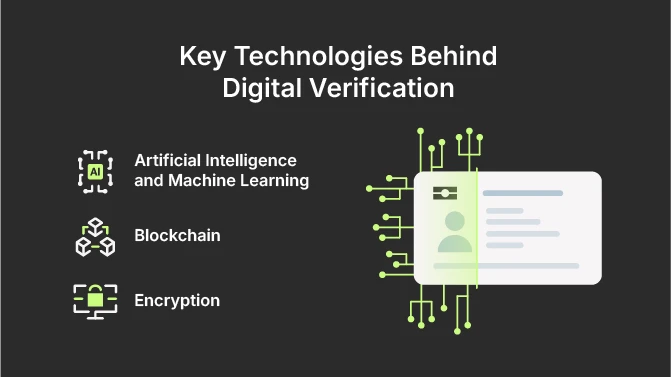

Key Technologies Behind Digital Verification

The speed, accuracy, and security of modern digital verification wouldn’t be possible without three cutting-edge technologies.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML power modern digital verification by training models to recognize document forgeries, detect ID tampering, perform facial recognition, and flag anomalies. ML algorithms quickly and accurately examine IDs for signs of fraud: mismatched fonts, altered numbers, or invalid issuer information. Also, AI enables liveness detection in biometrics, prompting users to blink or turn their head to verify they’re real people, not photos or deepfakes. Beyond onboarding, AI monitors user behavior over time to catch fraud after account creation.

Example: Banks use AI to verify IDs at scale. So, when a bank needs to onboard 10,000 new customers after launching a digital account, they can employ AI models to validate each document’s authenticity and match selfies automatically, instead of a long manual review of 10k passports.

Overall, AI/ML provide the intelligence behind digital verification, continuously learning from new fraud patterns to detect suspicious activity while allowing legitimate users through smoothly.

AI-based identity verification can eliminate up to 90% of human errors in the process. Source

Blockchain

While most known for cryptocurrency, blockchain offers a revolutionary approach to storing and sharing verified digital identities and credentials in a decentralized and tamper-proof manner. Instead of a company holding your sensitive ID documents (which is a single point of failure), the verification result (for example, your age and place of residence) can be stored as a verifiable credential on a decentralized ledger to which only the user has the private key that allows them to share this verifiable proof.

Example: A customer completes their KYC process with Bank A. But if they decide to open an account with Fintech B, they don’t have to submit their ID again. They simply use their cryptographic key to grant Fintech B access to the verified credential from Bank A – a process often referred to as Reusable Identity or Self-Sovereign Identity (SSI).

Encryption

Encryption is the ultimate method of keeping data secure by ensuring that sensitive information remains unreadable to unauthorized parties. Each time you scan an ID or take a selfie through a verification app, the encryption protocol is activated to store and transmit your sensitive personal data securely.

Overall, digital verification relies heavily on end-to-end encryption and strong hashing functions to protect data both “in transit”, i.e. while being sent from your phone to the verification server, and “at rest” – while being stored. This process involves converting plain text (your name, ID number) into an unreadable cipher text. Basically, encryption assures that even if hackers tap into the communication or cloud storage, they can’t steal usable identity data.

Example: When you submit your driver’s license photo during a bank account signup, encryption scrambles that image into unreadable code before it travels over the internet to the company’s servers. This prevents hackers from intercepting and stealing your ID if they breach the network.

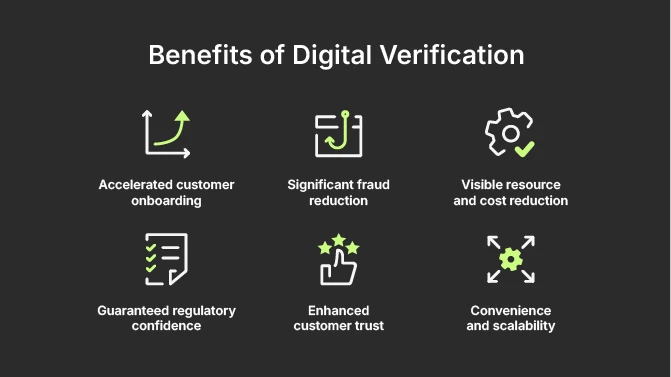

Benefits of Digital Verification

The shift towards automated digital verification offers tangible benefits for both businesses and users. Let’s review the main ones.

- Accelerated customer onboarding

Digital verification eliminates time-consuming in-person visits and manual data entry, providing a frictionless user experience. When powered by AI, the digital onboarding process can be 80% faster, thus shortening manual processes that used to take weeks to mere minutes, and, as a result, significantly reducing customer drop-off rates. - Significant fraud reduction

Automated, multi-layered checks (biometrics, AI, 2FA, document analysis) are highly effective at detecting sophisticated fraud, including deepfakes and synthetic identities. For example, incorporating biometric face matching with liveness checks helped one bank cut onboarding fraud by 50%. Implementing a combined identity verification solution with a risk-based approach can drastically reduce ID fraud. - Visible resource and cost reduction

Replacing manual review teams with automation frees up staff and significantly lowers the cost per verification. In general, digital KYC onboarding helps businesses save significant amounts of time and money compared to manual procedures, which lowers the cost of compliance. Research shows that AI-driven verification can lead to 70% lower KYC/AML compliance costs. - Guaranteed regulatory confidence

Many industries, such as finance, healthcare, gambling, and others, are legally required to verify age, identity, or credentials before offering services. And digital verification is a great way to have an auditable, verifiable digital trail that proves compliance with global regulations like KYC, AML, and GDPR. Conveniently, digital verification systems come with built-in compliance checks, like automatically screening against sanction lists and providing audit logs of every verification. - Enhanced customer trust

Digital verification is a fast, secure, and transparent process that builds long-term loyalty and improves customer satisfaction. Not surprising that 73% of global consumers say they would feel positive about their bank if it identified a payment scam and stopped it, highlighting the value of strong fraud protection. - Convenience and scalability

Users can conveniently verify their identity remotely from home at any time, while businesses benefit from scalable automated systems that can handle growing volumes without proportional cost increases. More so, companies can rapidly onboard large numbers of users, while maintaining quick processing times and security standards, adhering to growth plans, and handling sudden surges in demand.

Future of Digital Verification: Key Trends and Challenges

It’s a fact: digital verification is becoming commonplace, quickly replacing traditional methods of verification. As it spreads, it also evolves. And even though the future holds new possibilities that will elevate the way we verify identities and data online, there are still a few challenges that stand in the way.

Challenges

- Fraud sophistication. Generative AI makes it easier than ever for bad actors to create convincing deepfakes and launch highly automated, scalable attacks, known as “injection attacks”, making liveness and anti-spoofing detection a continuous arms race.

- Privacy concerns. As more sensitive data is digitized, consumers rightly worry about how their personal information is collected, stored, and shared. That’s why it’s very important to keep on looking for the right balance between robust security and data privacy.

- Accessibility. Digital verification must be inclusive and accessible to everyone. Systems need to work for all people, regardless of their device, internet connectivity, or physical ability, ensuring they don’t create new barriers to accessing essential services.

Emerging Trends

- Privacy trends. Technologies like zero-knowledge verification (proving something without revealing the data) and reusable identity (completing verification once and sharing the certified result across multiple providers) will become the standard, shifting data control back to the user.

- AI regulation. Governments are rapidly moving to regulate AI, particularly for high-risk applications like digital identity. Regulations, such as the EU AI Act, will enforce strict standards for transparency, data quality, and human oversight in verification systems.

- Decentralised systems and reusable identities. Users will have more control over their data, and AI-driven anomaly detection will become increasingly sophisticated. User-controlled digital identity wallets will soon let you store verified credentials and reuse them across multiple services, rather than repeatedly uploading your ID to every company. You’d be able to verify once with a trusted authority, and then seamlessly use that verification across banks, airlines, employers, and more.

- Market outlook. The market itself is booming, underscoring its strategic importance. The Global Digital Identity Market size is predicted to reach approximately $280.8 billion by 2034, growing at an estimated CAGR of 20.87%. Furthermore, it is forecasted that the total global digital identity revenue will reach $80.5 billion by 2030.

Final Thoughts

Given that billions are lost today to fraud and sensitive data is increasingly at risk, strong verification has become a strategic imperative. Organizations that embrace modern verification gain security, compliance, and user satisfaction, while those lagging behind face higher fraud losses, customer drop-off, and regulatory trouble.

For users, digital verification means greater control and convenience. One-click verification instead of tedious paperwork wins every time. Technologies will continue maturing, incorporating AI models, cryptography, and global networks, while trying to balance security and privacy. One thing is clear: the world is moving toward faster, safer, and smarter ways to verify trust online.