Identity Verification (IDV) is a critical component in ensuring secure and seamless transactions. Over the years, the methods used to verify identities have evolved significantly, driven by the need to enhance security, make fraud detection easier, and provide a better user experience. This article explores the evolution of fintech identity verification, highlighting the transition from traditional methods to advanced, technology-driven solutions.

Traditional Identity Verification Methods

In the early days of fintech, identity verification was largely manual, relying on physical documents and In the early days of fintech, identity verification was largely manual, relying on physical documents and in-person verification during customer onboarding. Common methods included:

- Document Inspection: Customers were required to present government-issued identification documents, such as passports or driver’s licenses, for verification. Bank staff manually inspected these documents for authenticity.

- Face-to-Face Verification: Customers often had to visit a bank branch or financial institution to verify their identity in person. This process was time-consuming and inconvenient for both customers and businesses.

- Signature Matching: Comparing signatures on physical documents with those on file was a common practice. However, this method was susceptible to forgery and human error.

While these methods provided a basic level of security, they were not foolproof and often resulted in significant delays and inconvenience for customers.

The Shift to Digital Verification

With digital technology and the rise of online financial services, fintech companies began exploring new ways to verify identities remotely. This shift was driven by the need for faster, more convenient fintech identity verification solutions that could be conducted online. Key developments during this period included:

- Electronic document verification: Customers could upload scanned copies or photos of their identification documents, which were then verified using automated software. This reduced the need for in-person visits and sped up the verification process.

- Knowledge-based authentication (KBA): This method involved asking customers questions based on information from their credit history or public records. While more secure than manual checks, KBA was still vulnerable to fraud, especially with the rise of data breaches and identity theft.

- Two-factor authentication (2FA): By requiring a second form of verification, such as a code sent to a mobile device, 2FA added an extra layer of security to online transactions and account logins.

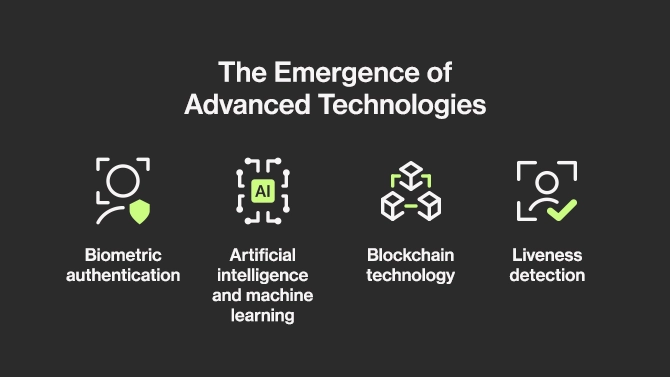

The Emergence of Advanced Technologies

As fintech continued to grow, so did the sophistication of identity verification methods. Today, cutting-edge technologies are transforming the way identities are verified, offering higher levels of security and user convenience as well as reducing the time it takes to complete identity verification. Some of the most notable advancements include:

- Biometric authentication: Biometric technologies, such as facial recognition, fingerprint scanning, and voice recognition, have become increasingly popular in fintech. These methods offer a high level of accuracy and security, as biometric data is unique to each individual and difficult to replicate.

- Artificial intelligence and machine learning: AI and machine learning algorithms analyze vast amounts of data to detect fraudulent activities and verify identities in real time. These technologies can identify patterns and anomalies that may indicate fraudulent behavior, enhancing security measures.

- Blockchain technology: Blockchain offers a decentralized and secure way to verify identities. It enables the creation of digital identities that can be used across multiple platforms, reducing the need for repeated verification processes and enhancing privacy.

- Liveness detection: To combat spoofing attempts, liveness detection technologies ensure that biometric data, such as a facial scan, is captured from a live person rather than a photograph or video. This adds an extra layer of security to biometric authentication.

The Future of Identity Verification in Fintech

As fintech continues to evolve, IDV methods will likely become even more sophisticated, focusing on improving security and user experience. Future trends may include:

- Decentralized identity solutions: Users will have greater control over their personal data, with the ability to share only the necessary information with service providers. This will enhance privacy and reduce the risk of data breaches.

- Integration of wearable technology: Wearable devices, such as smartwatches, may play a larger role in identity verification, offering convenient and secure authentication methods.

- Continuous authentication: Instead of relying solely on initial verification, continuous authentication methods will monitor user behavior and biometric data to ensure ongoing security throughout a session.

The Importance of Identity Verification in Fintech

Identity verification is essential for the fintech industry for several reasons:

Combatting fraud and financial crime: The rise the digital financial industry has brought with it an increase in identity fraud and financial crime. IDV plays a crucial role in fraud prevention by ensuring that users are who they claim to be. By implementing robust verification processes, fintech companies can prevent unauthorised access to accounts, reduce fraudulent transactions, and protect their customers’ assets.

Regulatory compliance: Fintech companies operate in a heavily regulated environment, with laws and regulations designed to prevent money laundering, terrorist financing, and other illicit activities. Compliance with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) is not only a legal obligation but also a business necessity. IDV helps fintech firms meet these regulatory requirements by accurately identifying customers and assessing potential risks. Failure to comply can result in hefty fines, reputational damage, and loss of customer trust.

Enhancing user trust and security: User trust is paramount in the fintech industry, where consumers entrust companies with sensitive personal and financial information. Implementing strong IDV measures enhances user confidence by demonstrating a commitment to security and privacy. Customers are more likely to engage with fintech platforms that prioritize their protection and take proactive steps to prevent identity theft and fraud.

Facilitating a seamless onboarding process: In a competitive market, fintech companies strive to offer a seamless and frictionless user experience. Effective IDV solutions enable quick and easy onboarding, allowing customers to access services without unnecessary delays. Modern verification technologies, such as biometric authentication and AI-driven identity checks, streamline the process, reducing user frustration and enhancing satisfaction. By optimising the onboarding experience, fintech firms can attract and retain more customers, driving growth and success.

Enabling financial inclusion: IDV plays a pivotal role in promoting financial inclusion by providing access to financial services for individuals who may lack traditional forms of identification. Many people worldwide remain unbanked or underbanked due to the inability to prove their identity through conventional means. Fintech companies can leverage innovative verification technologies, such as digital identities and mobile verification, to reach underserved populations and offer them the opportunity to participate in the formal financial system.

Building a sustainable business model: For fintech companies, a sustainable business model relies on maintaining a balance between innovation and risk management. Identity verification is a key component of risk mitigation, enabling companies to identify and manage potential threats effectively. By reducing the incidence of fraud and ensuring compliance with regulatory requirements, fintech firms can operate more efficiently and sustainably, ultimately enhancing their profitability and long-term success.

The Evolution of Identity Verification Laws

IDV laws have undergone significant transformations over the years, driven by the rapid advancement of technology, the increasing prevalence of online transactions, and the growing need to combat fraud and protect consumer privacy.

Early Identity Verification Regulations

In the early days of financial services, identity verification was primarily governed by traditional banking regulations designed to prevent fraud and money laundering. Key milestones in these early regulations included:

- Bank Secrecy Act (BSA) of 1970 (United States): The BSA was one of the first major laws requiring financial institutions to maintain records and report suspicious activity to combat money laundering and other financial crimes. It laid the foundation for IDV processes by mandating customer identification and record-keeping.

- Know Your Customer (KYC) Requirements: Originating from the BSA, KYC regulations required banks to verify the identity of their customers, understand the nature of their transactions, and assess potential risks. These early KYC measures involved manual processes, such as inspecting physical documents and conducting in-person interviews.

The Rise of Digital Identity Verification

As technology advanced and online financial services became more prevalent, the need for updated IDV laws emerged. Governments and regulatory bodies began to address the challenges posed by digital transactions and the increasing threat of cybercrime:

- Patriot Act of 2001 (United States): In response to the September 11 attacks, the Patriot Act expanded the scope of the BSA, introducing stricter identity verification requirements for financial institutions. It mandated enhanced KYC procedures, including the collection and verification of customer information through digital means.

- E-Sign Act of 2000 (United States): This law recognized electronic signatures and records as legally binding, paving the way for digital identity verification processes. It enabled financial institutions to verify identities using electronic documents and signatures, facilitating remote transactions.

- EU Data Protection Directive (1995): Although not specifically focused on identity verification, this directive laid the groundwork for data protection and privacy in Europe, influencing how personal information could be collected and used for IDV purposes.

The Emergence of Global Standards and Modern Regulations

With the growth of fintech and global financial transactions, international standards and modern regulations began to shape identity verification practices:

- General Data Protection Regulation (GDPR) of 2018 (European Union): The GDPR introduced stringent data protection and privacy requirements, impacting how personal data, including identity verification information, is collected and processed. It emphasized the need for informed consent, data minimization, and transparency in IDV processes.

- Anti-Money Laundering (AML) Directives (European Union): A series of directives aimed at preventing money laundering and terrorist financing introduced more robust IDV requirements for financial institutions. These directives emphasized the use of digital verification methods and the importance of ongoing customer due diligence.

- Financial Action Task Force (FATF) Recommendations: The FATF, an international body, issued guidelines for combating money laundering and terrorist financing. These recommendations encouraged the adoption of digital IDV technologies and the development of risk-based approaches to customer identification.

Modern Identity Verification Frameworks

Today, identity verification laws continue to evolve in response to emerging technologies and changing threats. Modern frameworks focus on striking a balance between robust identity verification and user convenience:

- Electronic Identification, Authentication and Trust Services (eIDAS) Regulation (European Union): This regulation provides a legal framework for electronic identification and trust services across the EU. It aims to ensure cross-border recognition of digital identities and promotes the use of electronic signatures and seals for secure online transactions.

- Digital Identity Guidelines (NIST SP 800-63, United States): Developed by the National Institute of Standards and Technology (NIST), these guidelines provide best practices for digital identity verification and authentication. They address various levels of assurance, from basic to high-security, and emphasize the use of multifactor authentication and risk-based approaches.

Last Thoughts

The evolution of IDV in fintech has been driven by the need to balance security, convenience, and compliance. As technology continues to advance, fintech companies will likely adopt even more sophisticated methods for verifying identities and fighting fraud. By leveraging these advancements, the industry can provide a secure and seamless experience for customers while meeting regulatory requirements and safeguarding sensitive information.