We are living in the age of digital transformation. Many financial institutions and other organizations are shifting towards offering services in a way that many users now prefer—online. Thus, the need for digital and automated Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures is growing.

What does this mean for any business unwilling to embrace the digital mode just yet? Unfortunately, the competitive market requires focusing on consumer needs instead of wasting time setting up Excel sheets for KYC data. Manual processes have long been a setback for many organizations. They leech their resources and stand in the way of effective risk assessment and customer data protection.

Fortunately, there is a simple solution: regtech. The latest compliance technology delivers streamlined and frictionless onboarding and monitoring for customers of all risk levels.

Let’s take a comprehensive look at the benefits of KYC compliance platforms.

What Are the KYC Compliance Platforms?

Know Your Customer compliance platforms are tools used by obligated industries that need to learn who their customers truly are. It enables organizations to meet regulatory requirements by automatically implementing a risk-based approach when accepting new clients.

The KYC itself is a part of Anti-Money Laundering regulations. Policymakers impose AML compliance obligations on various industries to prevent money laundering, terrorist financing, and other financial crime. Obligated organizations are required to perform a Know Your Customer procedure on each client at the beginning of the business relationship and regularly after that.

What Is a KYC Procedure?

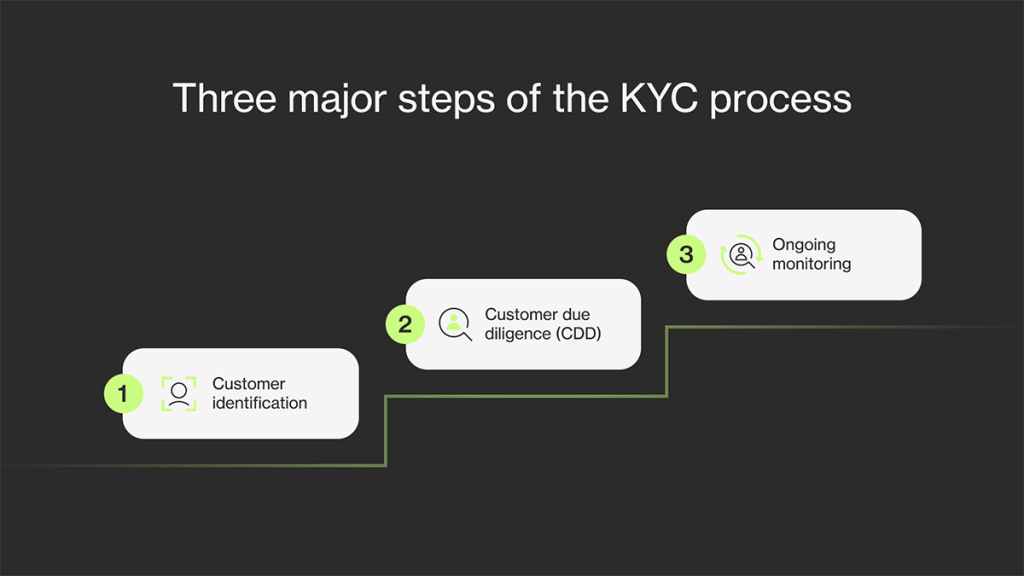

Usually, the digital KYC procedure involves several steps, such as:

- Identity verification.

- Due diligence

- Ongoing monitoring

As per regulatory compliance requirements, identity verification should be the first step of a KYC process. The client provides their identity documents and a selfie to verify their identity. If the delivered data is legitimate, then a service provider can continue with the due diligence procedure.

The due diligence process is an important part of comprehensive risk assessment. The client’s risk is estimated with sanctions screening, politically exposed persons, and adverse media checks. When completed, a due diligence process delivers a full picture of who the client truly is. Additionally, it ensures that a client matches the organization’s risk appetite and fits the KYC compliance requirements.

However, organizations should undertake an enhanced due diligence process if the due diligence process reveals a high-risk client. It serves as an added security measure and comes with other compliance operations.

Lastly, the Know Your Customer process doesn’t end when the business onboards a new client. Regulations mandate ongoing monitoring. It ensures comprehensive case management to stay ahead of any AML risk that may appear throughout the relationship. The process also includes transaction monitoring and suspicious behavior reporting duties.

Manual KYC versus a Digital KYC Process

For many years, obligated institutions have been collecting the relevant KYC data manually. Often, specialists store sensitive client data, such as the client’s name and date of birth, in Excel sheets for quick data management and navigation.

The main problems with the manual method are obvious. Lack of data protection and the risk of human error has made banks vulnerable to financial crime, AML penalties, and wasted resources. However, companies are learning that they can avoid the major pitfalls of compliance by using KYC compliance platforms. Regtech services automate all KYC procedures, from identity verification to adverse media checks, while saving time and resources.

Why Do Businesses Choose Ondato OS as Their Primary KYC and AML Platform?

Ondato OS is a pioneering compliance platform incorporating all the necessary KYC and AML tools and services for safe client onboarding and lifecycle management.

Ondato OS pays special attention to onboarding speed. Depending on the KYC data process you implement, the OS can complete it in under 90 seconds. The process is as simple as it can be.

In the background, Ondato performs relevant checks, and if no KYC risks are determined, the client is onboarded immediately.

By the way, Ondato increases the number of verifications per hour. While banks that don’t use regtech onboard around three clients per hour, Ondato greatly increases this number to 50 users.

Safety is at the core of the platform. Powered by the most advanced machine learning technology, Ondato OS implements liveness checks to handle spoofing attempts, altered IDs, and other fraud activity. The technology delivers a 99.8% KYC success rate when verifying clients.

We know that KYC is a never ending process. That’s why Ondato is putting an end to manual processes. As long as a person is your client, the system will routinely check relevant data to see if they still fit your risk appetite throughout the relationship. The KYC operational system will notify you about specific client behavior changes and risk assessment changes. Try out Ondato OS by booking a demo here.

Benefits of KYC Compliance Platform

Businesses that forgo manual KYC compliance processes and implement a trustworthy compliance platform reap major benefits. Let’s take a closer look at what those are.

Cost-effectiveness

The manual KYC process requires much more labor, office space, technology, training, and other expenses. The cost of highly trained KYC specialists alone tops the price of any compliance solution. Thus, implementing an automated compliance service can reduce overall AML compliance costs by half or even more, depending on the particular business case.

For example, most Ondato customers pay less than €1 to verify the identity of one person. The price can even be lower depending on how many verifications a business needs to perform. Meanwhile, manual compliance processes cost businesses around €12.58 per verification.

Improved Customer Experience

Digital identity verification enables a frictionless user experience. Regtech has made it possible to collect sensitive KYC data and documents from users in a simple and effortless manner. By eliminating the face-to-face process, a customer can become a bank’s or crypto trader’s client in the comfort of their home. The pandemic has proven that customers prefer digital services over in-person onboarding.

Lower KYC Processing Time

It’s no secret that application speed correlates with customer satisfaction, so KYC and AML processes should be as short as possible. Otherwise, an organization risks losing clients.

On average, banks spend 18 minutes verifying a client’s identity and completing KYC and AML checks. Often, this results in customer frustration. According to research, if onboarding lasts 10 minutes or more, 40% of the clients abandon the process.

Regtech solutions such as Ondato can greatly cut processing time and reduce customers’ frustration.

Increased KYC Success Rate

Human error in the manual Know Your Customer processes is unavoidable. From time to time, a specialist can overlook an important piece of KYC data that hints toward a client’s high-risk status. Implementing an AI-based regtech solution can greatly increase the success rate of the verification process. By effectively spotting document alteration and spoofing attempts, the regtech solution minimizes any potential risk.

In Short

Banks and other regulated institutions can easily win over new customers and reduce regulatory costs with KYC compliance platforms. KYC data solutions are feature-packed to adhere to recent regulations, boost customer experience, decrease onboarding time, and save precious resources. They make businesses more secure and trustworthy.