If you are in the financial services industry or any other heavily regulated field, then you know that compliance is one of the most critical aspects of your business. Regulators enforce the Know Your Customer (KYC) procedure to ensure companies know who they are dealing with. KYC compliance requirements are strict and ever-changing. As a result, no organization should take it lightly. Otherwise, they risk getting penalized or ruining their reputation.

While many institutions continue to use manual processes to manage KYC data, others choose to collaborate with KYC service providers. The KYC service, powered by the latest technological advancements, can enhance the speed, efficiency, and cost-effectiveness of your compliance strategy. These advantages, however, are only guaranteed if you choose the right provider.

Who Needs KYC Service?

Any regulated business could benefit from the KYC service. It is especially useful for large-scale organizations with a large customer base, such as banks.

KYC is required for the following institutions:

- Banks and financial institutions

- Insurance companies

- Brokerages that offer investment advice and trade securities on behalf of others

- Online gaming and live streaming

- Gambling services

- Alcohol industry

- Travel sector

- Money transfer businesses

- Crypto industry

Many other industries, including new and emerging sectors, are subjected to compliance obligations.

What Is KYC Software and How Does It Aid in Regulatory Compliance?

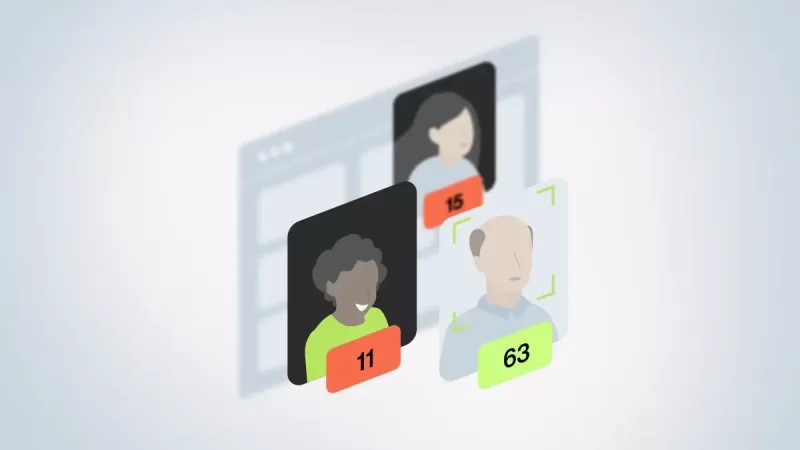

KYC software is a tool that aids in the onboarding process for businesses. It can help with the identification of customers, background checks, and other processes such as customer data management.

KYC software is designed to help with compliance and regulatory requirements, as well as to automate the onboarding of customers and clients.

How to Pick the Right KYC Service Provider?

Picking a KYC service provider is not an easy task. However, several steps make the process more efficient.

Establish Your Compliance Needs

To choose the right KYC service provider, first prepare your compliance strategy. A well-established strategy allows you to understand your precise compliance needs. If you already know what your compliance process should look like or if you have it in place, you can move on to evaluating providers.

However, a problem may arise if you have just started a regulated business and are working on the strategy from scratch. In this case, you can contact a professional compliance specialist to figure it out.

Many different platforms are available for use today, but not all of them work for every company. Some companies may have existing systems that need updating or upgrading; others may need something completely new.

The best place to start when finding out what kind of platform would be best suited for you is by talking with experts in the field who can give advice based on their experience with different types of companies and their unique needs.

Figure Out Your Options and Get to Know Who You Are Working With

When a compliance strategy is ready, it’s time to do market research. The compliance software market is booming. More and more new providers are joining the ranks with their services. For this reason, it may be challenging to pick the one that best fits your needs.

Getting to know their businesses is the best way to know which ones are worth your attention. Take the time to get to know who you are working with. Don’t hesitate to visit the provider’s website, social media accounts, and check the reviews of the company. You can also ask other customers for references. If you get the chance, don’t hesitate to schedule calls with the company’s representatives or chat them up at conferences.

Is the KYC Service Provider Certified?

Certification and accreditation are verification processes performed by an independent third party. The process determines whether the KYC service provider meets specific requirements for competence, experience, and integrity.

Many financial institutions will only work with accredited service providers because it gives them confidence that a company is providing the right expertise and credibility to its clients.

The following are some of the advantages of using an accredited KYC service provider:

- Risk of noncompliance with regulatory requirements is reduced.

- Greater assurance that all customer data is securely stored and easily accessible if regulators or law enforcement agencies require it.

- Application of cutting-edge technological innovations

Customer Support Availability

The availability of support staff is important for the success of your organization. Support teams with extensive knowledge and experience can help you avoid common mistakes and give you a better understanding of how to integrate compliance into your business model.

When choosing a KYC service provider, look at the number of support staff available to help with queries. Some companies may have separate departments for different types of queries, such as customer service or technical support, while others may only offer one line for all types of queries. This will depend on the company’s size and whether it has embraced a digital approach in its operations.

How Flexible Is the Provider’s System?

When choosing a KYC system, you’ll want to look at the service provider’s flexibility. You need to be sure that their system can adapt as your business grows and changes. This means that it must be able to scale and provide access to the data you need for onboarding purposes or when making decisions about risk management. For instance, if you’re planning to onboard both natural persons and legal entities, check if the provider offers a Know Your Business procedure.

Do They offer Coaching and Training?

In addition to providing access to the software, you want your KYC provider to be able to provide coaching and training. You may not only need assistance with how to use the software but also help with your compliance strategy as a whole. Finally, the provider should be able to provide support and training so that both parties are clear on expectations from each other.

At a minimum, they should be able to advise on key areas such as:

- The compliance landscape in your industry and how it applies to your business.

- How to identify and mitigate risk when providing services or products.

- The regulatory environment in which you operate (e.g., Anti-Money Laundering regulations, Know Your Customer requirements).

Conclusion

Picking a KYC service provider may seem like a daunting task. With a saturated compliance software market, it’s easy to overlook a great service. Start by setting up a great compliance strategy and assessing your needs to ensure you get exactly what you’re looking for. Then do your research and get to know the providers. Once you have your options, analyze each one’s platforms. Check certification, customer support availability, and flexibility. Don’t forget to evaluate relevant tools and look for coaching services. This way, you’ll pick the best provider for your business needs.