In today’s digital landscape, regulatory compliance is an extremely important concern for businesses, particularly those like financial institutions or other industries operating with high financial and security risks. Know Your Customer (KYC) procedures play a crucial role in verifying the identities of individuals and businesses, mitigating the potential for fraud and illegal activities. To effectively manage KYC requirements, many organizations turn to identity verification services. In this article, we delve into the significance of KYC providers and how they assist businesses in achieving seamless KYC and AML compliance.

The Role of KYC Providers

KYC providers specialize in offering comprehensive solutions to streamline and optimize the KYC process for businesses across various industries. Here are some key roles they play:

Technology and Infrastructure:

A customer identification program can leverage advanced technology and robust infrastructure to facilitate the collection, verification, and analysis of customer data. Automated processes, artificial intelligence, and machine learning algorithms enhance the efficiency and accuracy of KYC checks, minimizing the need for manual intervention. KYC providers will create the infrastructure of the entire verification process. They will be the ones to employ various checks from different data sources as well as create solutions catered to your business. A well-rounded KYC provider will ensure that every step can be completed with their help and your business is not required to rely on several different providers.

Data Aggregation and Verification:

KYC providers have access to vast databases and information sources, which makes document verification and gathering efficient and secure. They employ multiple data points, such as government-issued IDs and biometric data, to establish the authenticity of customer identities.

Compliance Expertise:

Staying up-to-date with evolving regulations and compliance requirements can be a daunting task. KYC providers possess extensive knowledge and expertise in regulatory frameworks, ensuring businesses remain compliant. They continuously monitor changes in global AML and CTF standards and update their processes accordingly, alleviating the compliance burden for businesses.

Risk Management:

KYC providers conduct thorough risk assessments to identify suspicious activities, unusual patterns, and potential red flags. By applying sophisticated risk scoring models and data analytics, they help businesses make informed decisions and prioritize resources based on the level of risk associated with customers or transactions.

Enhanced User Experience:

KYC providers aim to streamline the onboarding process for customers, minimizing friction and ensuring a seamless user experience. By implementing user-friendly interfaces and intuitive workflows, they simplify the KYC process while maintaining stringent security measures.

Choosing the Right KYC Verification Provider

Selecting the appropriate KYC provider is crucial to achieving effective compliance. Consider the following factors when evaluating potential providers:

- Regulatory Compliance: Ensure the provider adheres to relevant regulatory standards, such as the General Data Protection Regulation (GDPR) and industry-specific guidelines.

- Technology Capabilities: Assess the provider’s technological infrastructure, including their data collection, verification, and analysis tools. Look for advanced automation, AI capabilities, and scalability to meet your organization’s needs.

- Modern solutions: In the current market, automating identity verification might be the smartest decision a business can make. It allows the process to be quicker, minimizes users that abandon onboarding and saves on resources.

- Data Security: Verify the provider’s data security protocols and measures, such as encryption, secure storage, and access controls. Compliance with data privacy regulations is critical to protecting customer information.

- Reputation and Experience: Research the provider’s track record, reputation, and industry experience. Client testimonials and case studies can offer insights into their performance and reliability.

- Pass rate: It’s important to note the pass rate of verifications with any service. A pass rate that is too high might mean that fraudulent cases can get past, while a pass rate that is too low might mean that clients are more likely to abandon the process.

Why Choose Ondato?

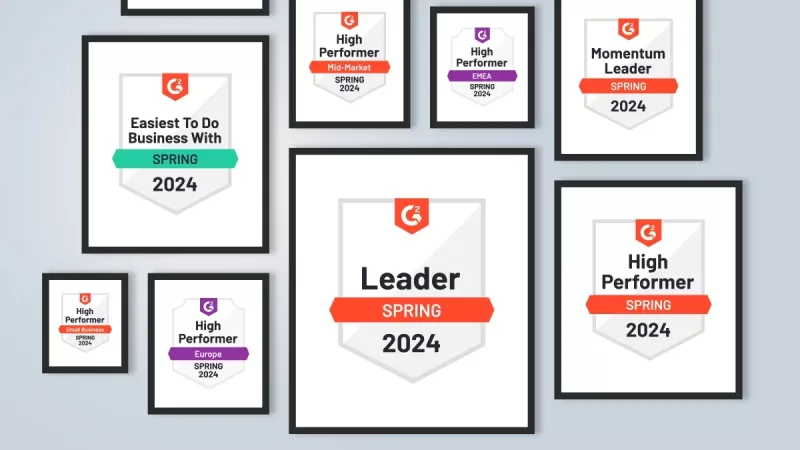

Ondato offers a compelling choice for companies seeking a reliable and efficient KYC provider. With advanced technology and comprehensive solutions, we streamline the customer onboarding process while ensuring compliance with regulatory requirements.

Our robust identity verification system utilizes AI-powered algorithms, biometric authentication, and data analytics, enabling companies to authenticate customer identities quickly and accurately, making client onboarding efficient. Our user-friendly interface and customizable workflows make it easy for businesses to integrate the KYC processes seamlessly. Additionally, we prioritize data security, implementing stringent measures to safeguard sensitive information.

We offer global coverage and multi-language support that further enhance your experience, enabling you to expand your operations while maintaining compliance across different regions. Choosing Ondato as a KYC provider not only minimizes the risk of fraud and identity theft but also saves time and resources, allowing you to focus on your core objectives with confidence.

Outro

In the complex landscape of regulatory compliance, KYC tools play a pivotal role in helping businesses meet their obligations efficiently and effectively. By leveraging advanced technology, expertise in compliance, and data-driven risk assessment, these providers enable organizations to enhance their security measures, prevent financial crime, and protect their reputation. When selecting a KYC provider, it is crucial to consider factors such as regulatory compliance, technology capabilities, data security, and industry experience. Partnering with the right KYC software provider can ensure a seamless and robust compliance process, allowing businesses to focus on their core operations while mitigating risks.