The importance of robust Know Your Customer (KYC) processes cannot be overstated. Though the norm for a long time, traditional KYC practices no longer cut it and often struggle to keep up with the dynamic nature of the modern financial landscape. Enter “Perpetual KYC” (pKYC), a modern concept that promises to redefine compliance through continuous and real-time customer verification.

What is Perpetual KYC?

Perpetual KYC is an automated, ongoing process that verifies and updates customer information in real time. Unlike traditional KYC methods, pKYC adopts a proactive approach, continuously monitoring and assessing customer data to ensure accuracy and compliance with regulatory standards.

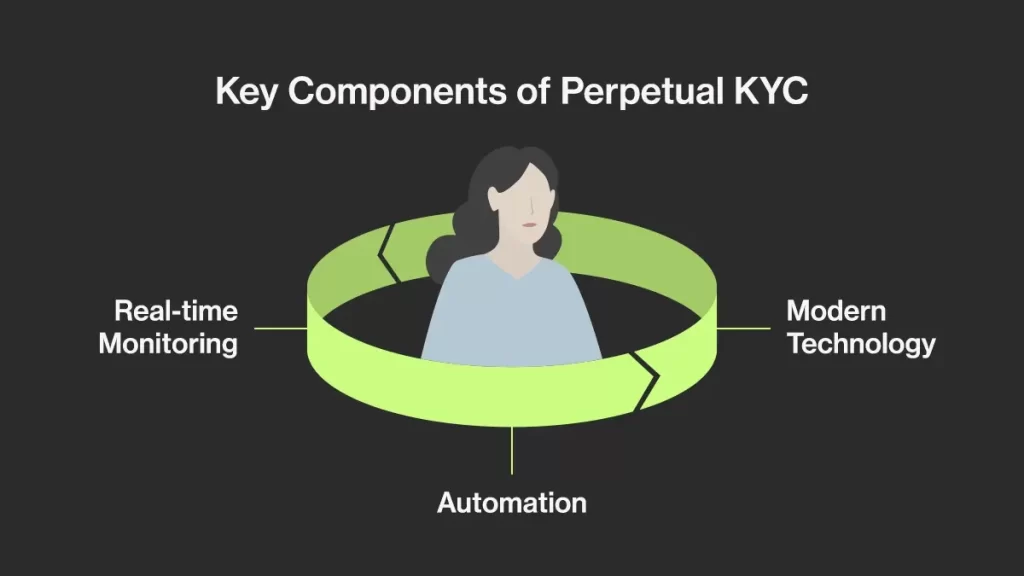

Key Components of Perpetual KYC

Real-time Monitoring

Perpetual KYC allows companies to update customer data in real time. This helps the financial services industry and other regulated companies to promptly identify and manage risk.

Automation

Automation streamlines the process, verifying customer information, detecting anomalies, flagging suspicious activities, and triggering immediate investigations. This reduces the manual workload for compliance teams.

Modern Technology

Perpetual KYC employs AI and machine learning to cut down on the resources typically needed for KYC. Additionally, this ensures higher levels of accuracy as it eliminates human error.

Perpetual vs. Traditional KYC

Generally, traditional KYC happens at set intervals in the customer relationship, whereas perpetual KYC is an ongoing approach to due diligence that occurs in real time.

As part of compliance and AML obligations, financial institutions must regularly review the information they hold on their customers. Traditional KYC happens at the customer onboarding stage and again every few years – usually after one, three, or five years, depending on perceived customer risk. This is commonly referred to as the ‘one and done’ KYC refresh process.

An obvious flaw with traditional KYC is that, in between these scheduled reviews, customer information may go out of date. The information would then stay inaccurate until the next KYC review took place. This means financial crime may go undetected for a significant period, risking reputational damage and regulatory fines.

Although a customer check can be brought forward if a risk is identified, manual checks require more time and resources than AI-powered solutions. Traditional KYC and manual processes are becoming outdated and no longer fit for the purpose, while perpetual KYC is enabling financial institutions to keep up with the times.

| Traditional KYC | Perpetual KYC | |

|---|---|---|

| Check frequency | Periodic | Ongoing |

| Process | Manual | Automated |

| Approach to risk | Reactive | Proactive |

| Information accuracy | Information may be years old | Up-to-date, accurate information |

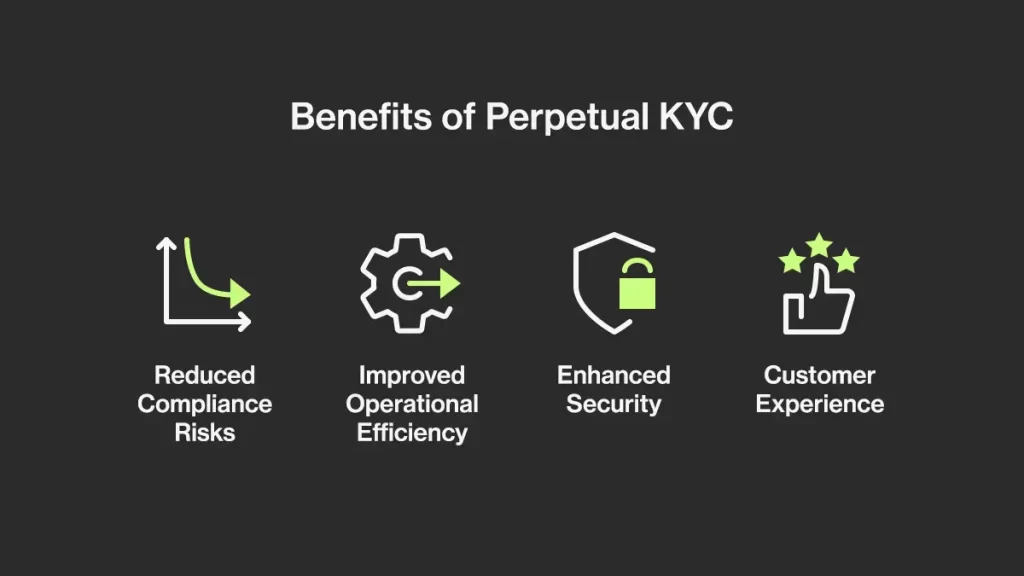

Benefits of Perpetual KYC

Perpetual KYC involves continuous enhancement of Anti-Money Laundering (AML) processes. This includes regularly updating customer profiles, verifying identity documents, and assessing the risk associated with each customer to meet regulatory requirements.

Reduced Compliance Risks

Continuous monitoring of customer data helps financial institutions stay ahead of potential compliance risks, allowing for proactive measures to be taken.

Improved Operational Efficiency

Automation and real-time monitoring reduce the burden on compliance teams, improving efficiency and reducing the likelihood of human error.

Enhanced Security

Utilising advanced technologies ensures the security and integrity of customer data, which is crucial in an age where cybersecurity threats are on the rise.

Customer Experience

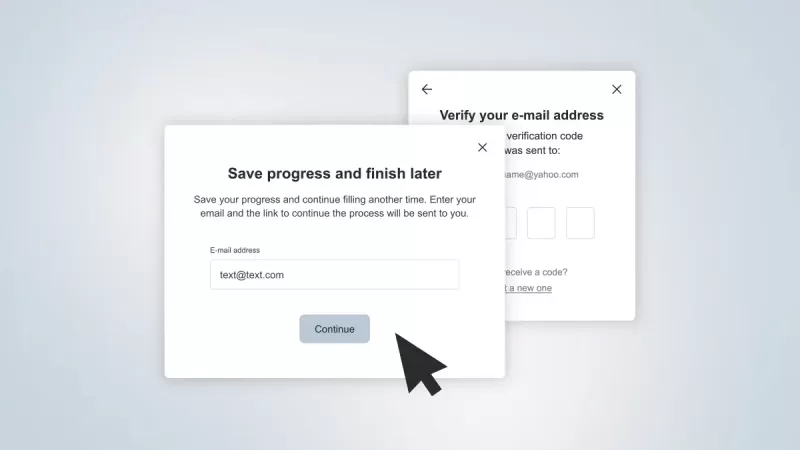

Perpetual KYC processes can be seamless for customers, reducing the need for lengthy identity verification procedures and enhancing the overall customer experience.

Last Thoughts

Perpetual KYC represents a significant leap forward in compliance, offering a proactive and real-time approach to digital onboarding. Despite challenges, the potential benefits, including reduced compliance risks, improved operational efficiency, and an enhanced customer experience, make it a compelling avenue for financial institutions looking to stay ahead in an increasingly complex regulatory environment. As technology advances, perpetual KYC is poised to play a pivotal role in shaping the future of financial compliance.

FAQ

Personal Information: Name, address, date of birth, and other demographic details.

Identification Documents: Valid government-issued identification documents like passports, driver's licences, or national ID cards.

Proof of Address: Documents that confirm the customer's residential address, such as utility bills or bank statements.

Photographs: Images of the customer for visual identification.

Biometric Information: In some cases, biometric data such as fingerprints or facial recognition may be collected.