Automated Identity Verification

A real-time identity verification method that’s as easy as snapping a picture. Simple for your users but extensive enough to prevent fraud and ensure regulatory compliance.

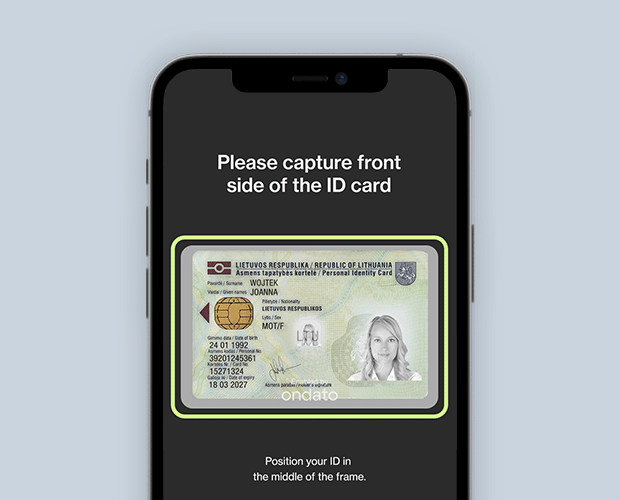

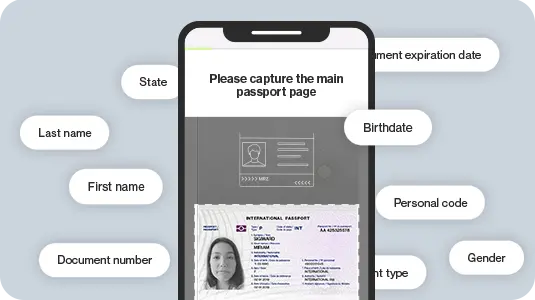

Identity Document Verification

Our AI will capture a picture of one of 10,000+ different types of ID documents worldwide, and will automatically pick up the necessary data to fill out the form. At the same time, the data will be checked against numerous ID registries to verify that it isn't stolen or altered in any way. Its authenticity is further assured by a final check provided by a human KYC specialist.

ID Spoofing Checks

Fake IDs aren't going to work. Ondato's checks include multiple alteration filters and cross-references against ID registries for the best fraud prevention.

Registry Confirmations

Quickly find out whether a document is valid and confirm if it hasn't been altered in any way with local and international registry checks.

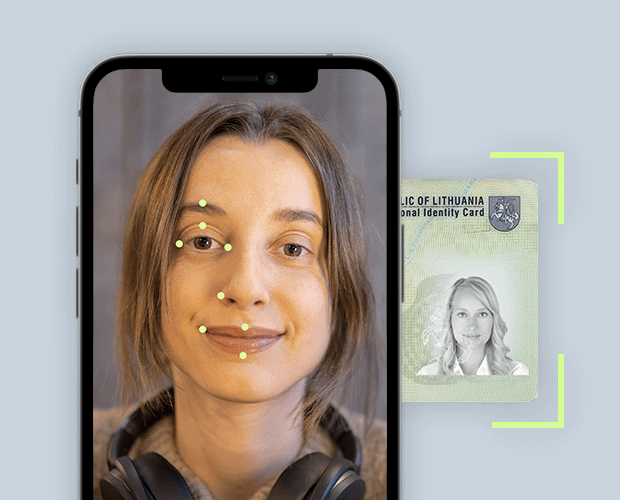

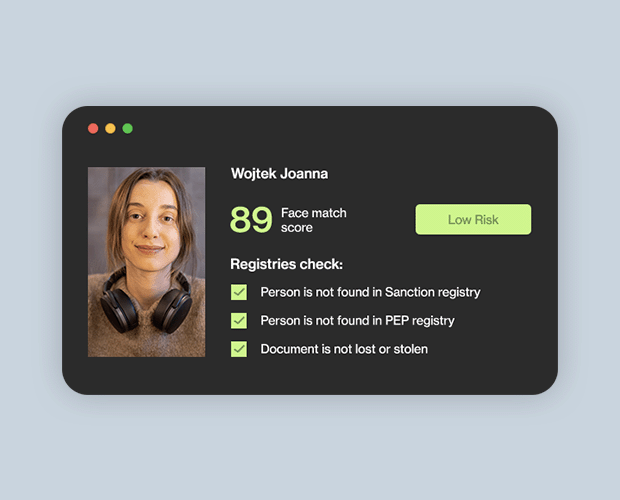

Face – A Universal ID

While faces are much more complex than documents, we're using technologies that make light work of recognition. Our AI automatically captures pictures of the document as well as the user's face. Then the system checks whether it's a real face or a mask. The checks can even include automated age verification and comparing that to the data provided in a document.

Biometric Security

Unconscious faces, screens with deepfake video feed, and masks will be flagged and won't bypass our checks.

Biometric Face Comparison

We have tech that accurately compares ID documents with faces, filtering out identical twins and lookalikes to ensure the highest degree of accuracy.

Benefits

Next-Gen KYC Compliance

Management

Build Your Own Process

Mix and match our modules to create the perfect solution for your problems. Adapt the software to your unique business case, not the other way around.

Integrate with Customer Data Platforms

All our modules can be seamlessly integrated into customer data platforms. There you can manage cases and monitor customer actions after they've onboarded.

Flexibility Meets Innovation

Process

Other Identification Options

Why Clients Trust Ondato

FAQ

Automated identity verification is a process designed to allow businesses to confirm user identity in real time. It's made up of various steps that allow it to stay secure, such as biometrics, spoofing checks, document verification, digital footprint analysis, etc.

The three most common methods used are photo-based IDV, video-based IDV, and NFC-based IDV.

Electronic identity verification uses remote processes to confirm identity without hassle. This removes in person branch visits for financial institutions and makes IDV much more convenient for your customers. Online ID verification usually takes a minute or two while in-branch visits might take a few hours.